|

| By Gavin Magor |

The market is gyrating wildly back and forth over economic reports, earnings and Fed announcements.

That is something I try to avoid like the plague.

Typically, I just consider these reports and knee-jerk reactions to them as noise.

Our traditional Weiss trading models allow us to be proactive, objective and always looking forward.

Numbers don’t lie. Two plus two equals four. It’s not up for debate. Unfortunately, though, numbers also tell a story and are always open to interpretation.

Which leads me to Fed Chairman Jerome Powell, who seems to hold the key to investors’ content or discontent. He spoke last Wednesday, and I’d like to say Wall Street listened.

Investors Only Hear

What They Want to Hear

However, as has become the norm, investors listened and then heard what they wanted to hear. It already took a whole lot of Powell-isms to convince the masses that rate cuts were off the board for the near future.

This time around, he tiptoed around the possibility of more rate hikes. Powell hedged, using phrases like “not likely,” and “not being considered at this time.” To me, that means a potential rate hike is back on the table. If he stopped at “no,” he could’ve eliminated any guesswork on the part of investors.

But that’s what investors heard, and everything seems to be just peachy for the time being — until they misinterpret the next economic report or Powell’s rhetoric.

So, I’m sitting here this week watching the markets go up and down, depending on the economic or earnings report of the day. Thus far, investors shouldn’t be disappointed with Q1 earnings, unless they find reasons to be.

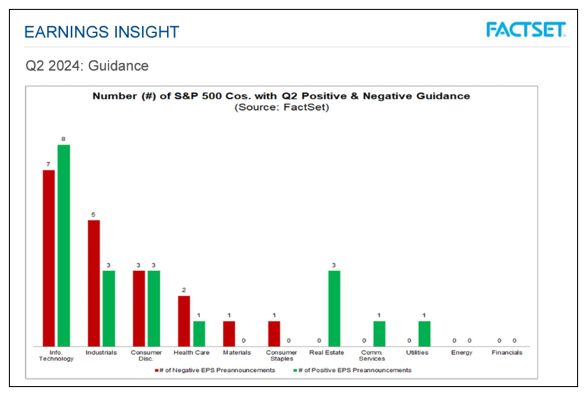

Thus far, 50% of the companies in the S&P 500 have reported. Some 81% of those beat estimates (versus the 74% norm) by a very vibrant 7.8%, topping the usual 6.5%.

Collectively, Q1 earnings are now expected to increase 4% year over year, instead of the projected flat estimates.

Sector-wise, eight of the 11 have reported year-over-year earnings growth, led by the communication services, utilities, information technology and consumer discretionary sectors. On the other hand, three sectors showed year-over-year decline in earnings: health care, energy and materials sectors.

Our Weiss Stock Ratings page is the perfect place to stay up to date on stocks you currently own.

While what I’m about to share might raise a few eyebrows or blood pressures, it’s merely meant to introduce a possibility.

This is not a scare tactic by any means, and I’m not the only one saying it out loud. It’s only meant to keep your eyes focused on the future and challenge mainstream expectations.

Because if there’s one thing we’ve learned since the pandemic four years ago, it’s to expect the unexpected.

So, here goes.

I wouldn’t rule out the possibility of stagflation down the road. Mind you, down the road does not mean today or tomorrow. It means if the economic trends we’re currently seeing continue, it’s something we should be prepared for.

You already know about two economic reports that are causing my mind to wander back to the 1970s. Hint: It’s not because of bell-bottom jeans, Watergate, hippies, or disco.

But I’ve found a report about the labor market, not the unemployment rate, that combined with the economic news we already know about raises my suspicions.

Let’s start with …

What We Know

About the Economy

Prices had already moved in the wrong direction in January and February. But the 3.5% jump in the consumer price index (CPI) for March on an annual basis raised its share of eyebrows for those least expecting it.

Now, independent of other data, the rise in prices appears to be a mild blip in the Fed’s fight.

However, combine it with the second-lowest level of year-over-year GDP growth since Q2 2022 — 1.6%. That figure caught a whole lot of folks off guard, coming in well short of the 2.4% consensus and the 3.4% growth in Q4 2023.

So far, my friends, that is nearly the Merriam Dictionary’s definition of stagflation: high inflation and slow economic growth. That alone doesn’t seal the deal, and a couple months do not constitute a trend. Plus, the third part of the definition is “relatively high unemployment.”

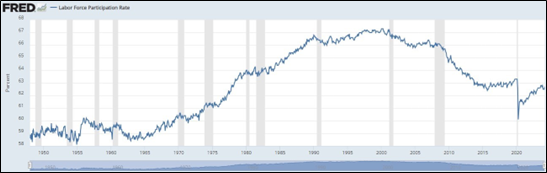

The current unemployment rate of 3.8% suggests a healthy labor market. However, today’s Labor Force Participation Rate (LFPR) is cause for concern. Here’s the difference.

The unemployment rate is based on the number of people out of work and looking for jobs divided by the total number of people in the workforce. Consider, though, that a good chunk of people aren’t classified as part of the work force for various reasons.

Some people want a job, but believe no jobs are available for them and they have not looked for a job in the previous four weeks. They are called discouraged workers. Other reasons people not in the labor force include retired folks, students, people with family responsibilities that would conflict with employment.

The Labor Force Participation Rate, on the other hand, represents the share of the potential workforce that is actually working or looking for work. And it currently stands at 63%, the lowest since the 1970s.

The fact that there are more job openings than unemployed workers suggests strength in the labor market. Yet, an estimated 2.3 million workers are missing from the ranks of the employed.

The number of missing workers has only grown since the pandemic in 2020, and it’s created an employment gap.

Here’s why, according to a U.S. Labor Department survey:

- Two-thirds (66%) of Americans who lost their full-time job during the pandemic say they are only somewhat active or not very active at all in searching for a new job.

- About half (49%) are not willing to take jobs that do not offer the opportunity for remote work.

- More than a quarter (26%) say it will never again be essential for them to return to work.

- Nearly one in five have altered their livelihood — 17% have retired, 19% have transitioned to homemaker and 14% are now working part-time.

- Almost a quarter (24%) say government aid packages during the pandemic have incentivized them to not actively look for work.

- Younger respondents, aged 25-34, are prioritizing personal growth over searching for a job right now. 36% say they’re more focused on acquiring new skills, education or training before reentering the job market.

And all of these missing workers aren’t buying as much as they used to, not paying as much in taxes and just not contributing to economic growth the traditional ways.

Here’s another way of looking at it. If the unemployment rate is 3.8%, that means out of 100 people, only four aren’t working, but are still looking for jobs. That’s pretty good. But if you consider that of those 100 people, 62% or 62 of them can work, but are choosing not to work for various reasons, that doesn’t bode well for the future.

A stable, healthy workforce is extremely important to economic growth. And if the numbers continue to drop, stagflation will become a distinct possibility. I mean, AI can only carry our economy and markets for so long.

With so many economic reports, earnings and new data coming out, the one-stop shop for investing mental clarity should be Weiss Ratings, always.

Cheers!

Gavin

P.S. AI might not be able to carry markets indefinitely. But it has already proven it can beat market performance. Tomorrow, Dr. Martin Weiss will reveal exactly how. But you need to sign up today to see his presentation.