Get Ready for Price Spikes in Miners of These Industrial Metals

|

| By Sean Brodrick |

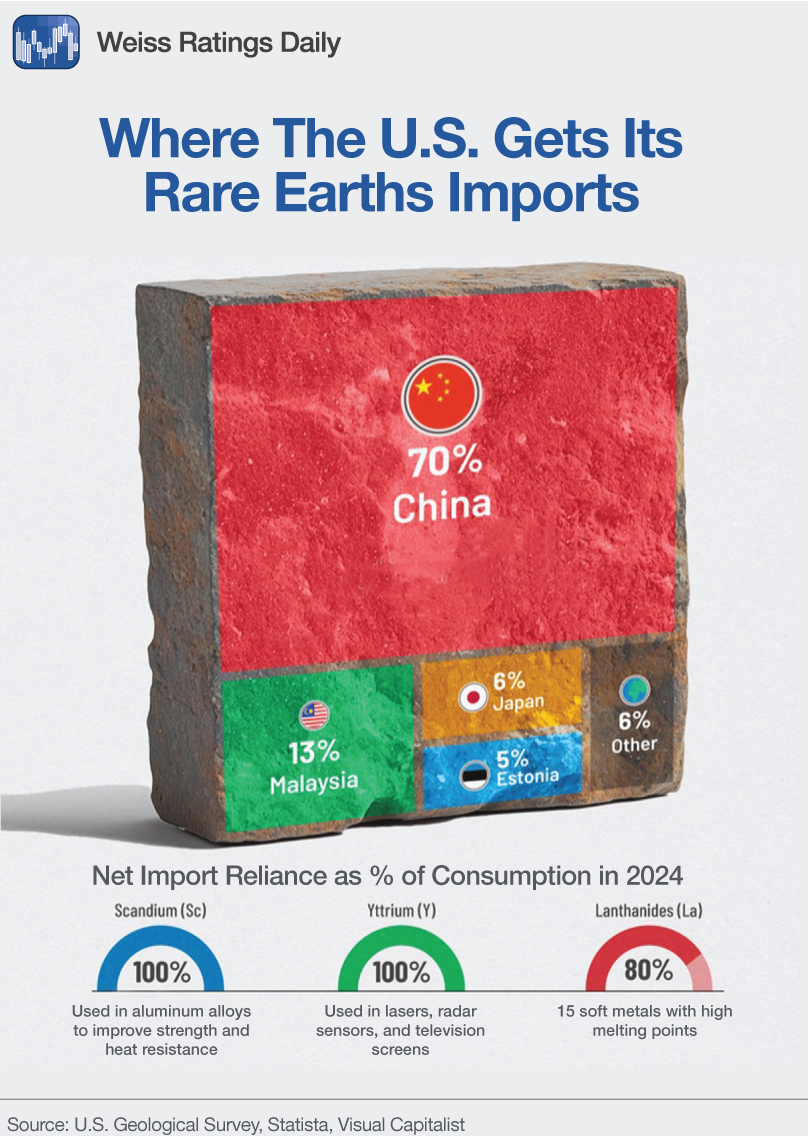

Last month, China imposed restrictions on exports of seven rare earth metals critical for all sorts of things, including America’s most advanced weapons. This was in response to the U.S. imposing high tariffs on Chinese-made goods.

These restrictions may go away, if and when the trade dispute with China is resolved. But this action makes it crystal clear that China has its boot on America’s neck when it comes to rare earths.

The U.S. needs to crank up the production and refining of rare earths by America and its allies into overdrive. And this opens up an enormous opportunity for select companies.

On April 4, China’s Ministry of Commerce announced new export controls on Samarium, Gadolinium, Terbium, Dysprosium, Lutetium, Scandium and Yttrium — which are vital for everything from high-performance magnets to jet fighters.

The bad news is that the U.S. gets 70% of its rare earths from China.

Beijing has Uncle Sam over a barrel.

Interestingly, China has previously put restrictions on rare earth exports. That was back in 2010. China slashed export quotas for rare earth elements by about 40%, citing environmental concerns.

This triggered a global supply shock, and prices of select rare earths skyrocketed, as you can see in this table.

The kerfuffle ended in 2014, after the U.S., the European Union and Japan filed a complaint with the World Trade Organization, and the WTO ruled against China.

In May 2015, China removed its export quotas. Even before the quotas were lifted, prices slumped.

This Time, America Is the Target

Now, in a twist, China is slapping export controls that impact its major customer — the U.S. This time around, the price of rare earths in China is slumping, because China chopped off its own market.

And this time around, the real opportunity is for those companies that can fill the gap. Those Western companies that can replace Chinese supply.

Even before the new Chinese export ban, rare earth elements (REEs) looked at a boom year in 2025. It’s cyclical.

According to data released by the China Rare Earth Industry Association, last year saw the rare earth price index slide 17.42%.

This year looked supply-constrained, according to Guotai Junan Securities, which published the following:

"The continued growth in demand for new energy vehicles and wind power, along with the effective boost in demand for industrial motor equipment upgrades, is expected to elevate the demand curve for 2025-2026.”

Indeed, the global market for rare earths is forecast to grow at a compound annual growth rate (CAGR) of 8.75% between now and 2032, according to analysts at Strategy & Stats.

This year, demand for rare earths in the U.S. is also expected to rise, thanks to demand for electric vehicles, defense, aerospace and more.

And the race is on to fill that supply gap!

What Could Go Wrong

The U.S. and China will sort out their trade dispute eventually. And China could lift restrictions on exports. That would send prices lower.

However, President Trump is taking a strong “America First” stance. His administration is actively funding rare earth development, and he’s using wartime powers to lift obstacles from the paths of mines and processing plants.

The next logical step is to protect U.S. producers from price dumping. We’ll have to see how it works out, but I expect that’s how the White House will go.

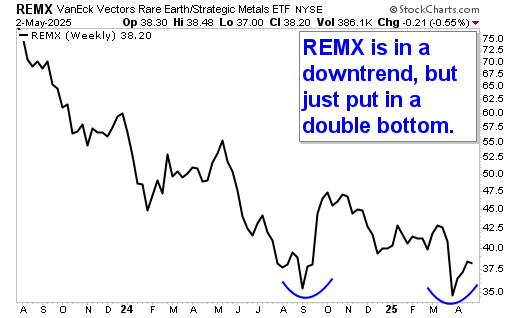

I’m saving my picks in rare earths for attendees at the Weiss Investment Summit and for subscribers to my newsletters. But you can buy an ETF with a basket of rare earth companies: The VanEck Rare Earth and Strategic Metals ETF (REMX). It has an expense ratio of 0.56% and a dividend yield of 2.51%.

REMX is not perfect because it also holds lithium and some Chinese companies, which are hurt by the new export restrictions. But you can buy it or drill down into its holdings to find top rare earth companies.

REMX has been under pressure for a while, as prices for rare earths compressed last year.

Analysts were already expecting higher prices this year to go along with higher global demand, and China has knocked over the table with its export restrictions.

The prices of select rare earth companies could do very well indeed.

All the best,

Sean