19M Americans Think They Can’t Afford Retirement – But I Can Help!

I sure hope you aren’t one of them.

I’m talking about the 19 million Americans who, according to a survey from Bankrate.com, feel they will never be able to retire.

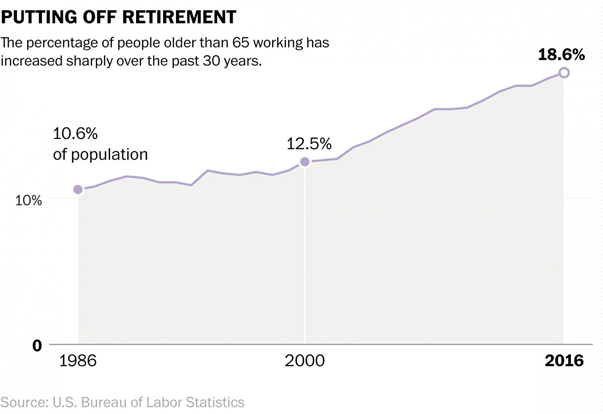

Unfortunately, their worries are backed up by actual numbers. The percentage of Americans older than 65 who are still working has been steadily climbing from 10.6% in 1986 to 18.6% today.

|

Some of those 65-plus Americans are working because they want to. But the sad reality for most is that they can’t afford NOT to work.

Roughly 20% of Social Security recipients rely on the program for 100% of their retirement income. And 33% get more than 90% of their retirement income from it.

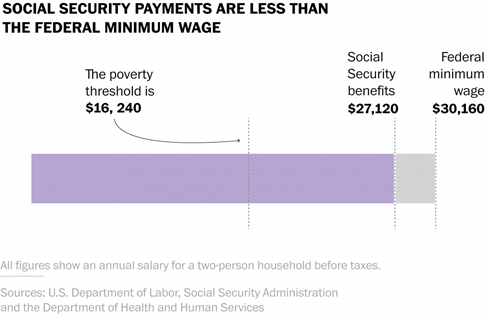

But I probably don’t have to tell you how little Social Security pays. The average retirement check is $1,411 a month today — and that certainly isn’t enough for me to live.

In fact, that Social Security payout is actually less than the federal minimum wage!

|

|

The percentage of 65+ people working has soared in the last 30 years. |

Clearly, you’ll need to build up a substantial nest egg to stay out of the retirement poorhouse. But how much do you need to save? Depending who you ask, the answers are all over the board. In that Bankrate.com survey, here’s how people answered:

• $250,000 or less: 8%

• $250,000-$1 million: 15%

• More than $1 million: 8%

• “Don’t know”: 61%

• “Never plan to retire”: 8%

That last 8% translates into the 19 million Americans I mentioned earlier. But I find the news that 61% of those surveyed answered “don’t know” to be terrifying.

The fact that you’re reading this column means you’re at least interested in investing and already saving for retirement. How much have you saved? According to Fidelity, the average 401(k) balance by age is:

• 40–49: $91,000

• 50–59: $152,700

• 60–69: $167,700

If you’re below those averages, you better get your rear in gear and get serious about building your nest egg. In fact, I think you’re in trouble if you don’t have AT LEAST double those amounts saved already.

|

|

You'd earn more making minimum wage than with Social Security. |

By the way, brokerage and insurance companies are getting rich off your 401(k). The Center for Retirement Research reported that the financial services industry earned $33 billion in fees last year. Wow!

You need to either save more — which I know is much easier said than done — or make the money that you do have saved work harder for you.

That is why Martin Weiss and I developed the Weiss Ultimate Portfolio, a unique investing service that has trounced the returns of the S&P 500 and that’s designed to grow your money into a mountain of retirement savings dollars.

Just in the past week, our Weiss Ultimate Portfolio system helped us lead subscribers to two rounds of banked gains, to the tune of 41.2% and 13.1% — both in just two months' time. And there are plenty more profit opportunities where those came from! Enrollment is currently closed to new members, but keep a close eye on your inbox next week for a special offer to get in on the action.

Best wishes,

Tony Sagami