Economic Predictions Delivered by the Trucking Industry

|

“A chorus of signals calling for an economic contraction.”

— Donald Broughton, creator of the Cass Freight Index.

When it comes down to it, the foundation of commerce boils down to two tasks:

- Making things, and ...

- Delivering those things to the people and businesses that need them.

Makers and takers.

There are millions of “makers” in the U.S., producing everything from avocados to automobiles to shampoo to sofas. But of all those millions of products, there are only a few ways to transport them from the production plant to the end user: Boats, planes, railroads, and trucks.

The vast majority — approximately 70% — of goods in the U.S. are delivered by trucks. So, I pay more attention to the health/sickness of the trucking industry than that of planes, trains or boats.

Let me tell you, the trucking industry is looking pretty darn sick based on these five warning signs ...

Warning No. 1: In the first six months of 2019, 640 trucking companies — including New England Motor Freight and Falcon Transportation, two of the largest in the U.S. — went out of business. For perspective, that is more than triple the 175 during the first half of last year.

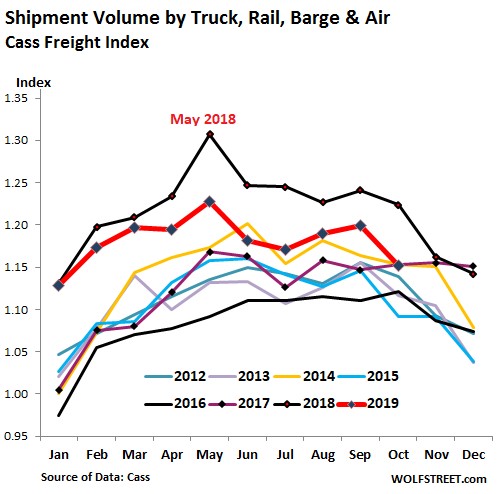

Warning No. 2: Shipment volume is now below 2014 levels, which is bad. But even worse is that it’s lower than in October 2017, which predates the Trump tariffs.

|

Warning No. 3: October volume dropped by 5.9%. That was the 11th month in a row of year-over-year declines, and the third monthly drop of more than 6%. Even worse, the creator of the Cass Freight Index warned that conditions have gone from “warning of a potential slowdown” to “signaling an economic contraction.”

Warning No. 4: The American Trucking Associations (ATA), an industry group that represents trucking companies, said that 4,500 truckers have been laid off this year in what it calls a “bloodbath.”

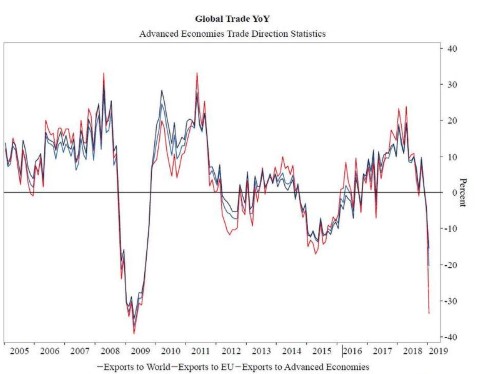

Warning No. 5: We do live in a small, small world, and shipping slowdown goes beyond U.S. borders. This is certainly tariff related, but your guess is as good as mine when Trump signs a deal with China.

|

|

Source: BMO CM & Macrobond |

The transportation industry is a pretty good proxy for the overall economy. So, despite the new record highs in the S&P 500, I think it is very likely that the next few quarters of GDP growth will be substantially lower.

In fact, the Atlanta Federal Reserve and the New York Federal Reserve just lowered their fourth-quarter GDP growth forecasts down to 0.3% and 0.4% respectively.

That is barely above economic stall speed. This tells me that caution, not greed, should dominate our investment decisions. In fact, I just made exactly such a move with the Weiss Ultimate Portfolio.

Our system had us getting out of our ETFs and into three categories of conservative stocks. Why? Our short-term model turned negative.

Smart investors should follow our lead.

Best wishes,

Tony Sagami