|

Almost half of American adults — Democrats and Republicans — don’t just disagree with the people on the opposing side. They hate them.If you thought politics and markets were extreme in years past, look at what’s happening now.

Most even say they would never want their kids to marry someone on the other side of the political divide.

That’s scary.

It reminds me of what we saw happen years ago in Northern Ireland or what I’ve witnessed personally growing up overseas.

Never in my lifetime did I imagine anything like that would come to America.

But it has.

And it’s frightening for two reasons.

First, it makes it more difficult for America to confront foreign adversaries.

Controversies about Dr. Seuss get more attention than China’s demolition of democracy in Hong Kong.

News of mass shootings in America’s cities drown out news of 40,000 Russian troops amassing on the Ukrainian border and China’s fighter jets threatening Taiwan’s.

Second, it helps drive those who control the money presses and purse strings in Washington to go hog wild. They print, spend and borrow like never before in the history of the world, and it seems no one bats an eyelash.

That’s not good. Extremes in one direction — initially welcomed by the majority, or a large minority, of the people — typically lead to extremes in the opposite direction, especially in the realm of money and interest rates.

A government’s desperation to avoid depression leads to inflation and even hyperinflation.

Surging markets lead to crashing markets.

Or worse.

And more often than not, it’s the average citizen that suffers the most — with a loss of savings, a loss of income or both.

This also helps explain why extreme events take place, apparently out of nowhere, apparently for no reason …

|

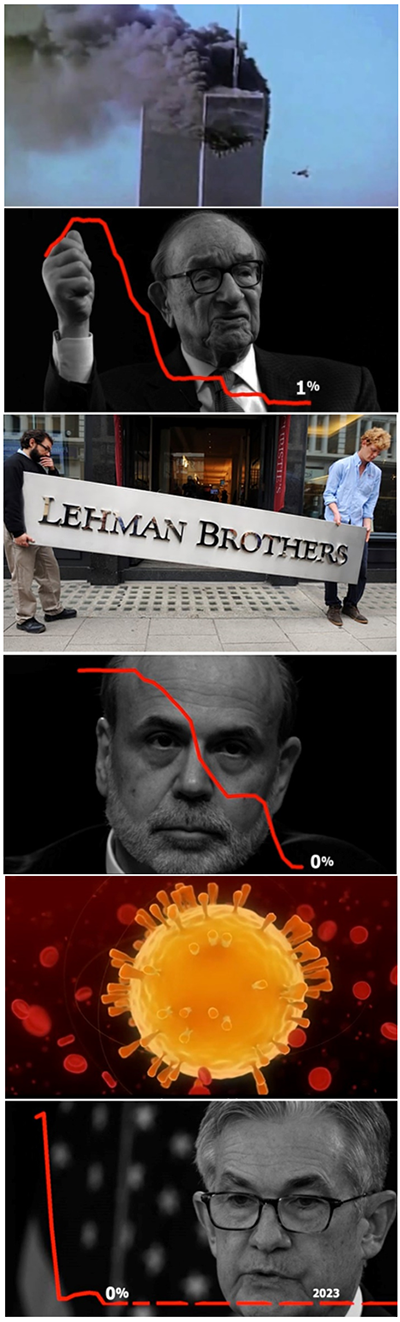

Like the black swan that attacked the very heart of our nation on Sept. 11, 2001, setting off a chain reaction of events that have continued to ricochet through time …

The U.S. invasion of Iraq. The fall of Saddam Hussein. The global spread of terrorism.

In response, Federal Reserve Chair Alan Greenspan printed billions of dollars in paper money, slashing interest rates to 1% and gutting your income.

Or, like the Lehman Brothers failure, the black swan that attacked the very heart of our economy exactly seven years later …

Setting off a chain reaction of bank failures, bank bailouts and disruptions that have also continued to ricochet through time.

In response, Fed Chair Ben Bernanke printed a trillion dollars in paper money, slashing rates down to zero and wiping out your income.

Or, more recently, like the black swan virus that plunged the entire world into economic, social and political turmoil.

What does Fed Chair Jerome Powell do?

He prints nearly FOUR trillion dollars in paper money. And he not only cuts rates to zero, but he also vows to KEEP them at zero through the year 2024.

All of this impacts you in two ways:

First, it creates bigger investment risks. The risk that, at almost any time, the next black swan could strike and damage your principal.

Second, it creates the certainty that now — and for years to come — any yield you could safely earn on your money is gone.

We face ridiculously high risks AND ridiculously low yields at the same time — a dilemma like none other in our lifetime.

How do you overcome it?

Stand by for our answers.

Good luck and God bless!

Martin