|

Whew! I'm happy to leave October behind us.

How bad was it? The stock market lost almost $2 trillion of its value, making it the worst month since September 2011.

The pain was particularly severe for tech stock investors. The Nasdaq Composite lost 9.2% in October. But some of the most popular tech stocks — like Amazon (AMZN) and Netflix (NFLX), which both lost 19% of their value — dropped by even more.

|

What was behind the sell-off? People are citing the Trump tariffs, rising interest rates, the overdue exhaustion of a nine-year bull market, and election anxiety.

While the answer is probably "all of the above" to some degree, I think the bulk of the blame belongs to the Federal Reserve. It has raised interest rates eight times since 2015 and drained a few hundred billion dollars' worth of QE.

In fact, Fed Chairman Jerome Powell kicked off the month with the warning that the Fed is "a long way" from neutral interest rates, saying:

"Interest rates are still accommodative, but we're gradually moving to a place where they will be neutral. We may go past neutral, but we're a long way from neutral at this point, probably."

Wall Street is now anticipating at least three more rate hikes, with the next one expected in December.

So, forget about the often-discussed Fed "put" and instead focus your attention on the Fed "strangle."

Strangle as in choke to death.

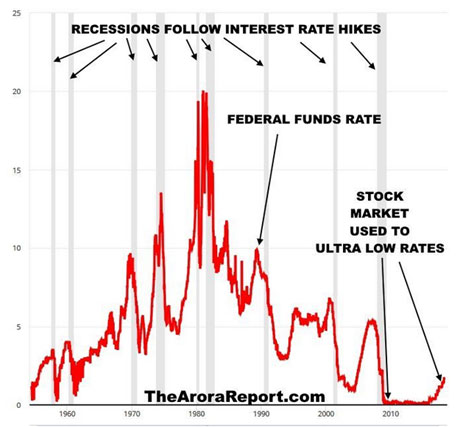

There have been nine recessions in the last 65 years. And 100% of those recessions were accompanied by a series of rate hikes from the Federal Reserve.

If you're my age or older, you may remember that the prime rate hit 21.5% 1980. Yes, 21.5%!

"Bear markets do not just pop out of the air.

They are caused by tight money, recessions or both."— David Rosenberg of Gluskin Sheff & Associates

And each of those nine recession/rate-hike combinations resulted in a painful bear market, as this chart from my friends at Arora shows …

|

Not only is the Fed raising interest rates, but it is simultaneously reducing its $4.5 trillion balance sheet. That balance sheet ballooned under the Quantitative Easing I, II and III programs.

Of course, the Fed isn't purposely trying to engineer a bear market. And the idea that a bunch of highly educated bureaucrats could adroitly manipulate our country's business cycle is ludicrous.

But well-intentioned or not, the Fed's fingerprints are so plastered over past bear markets that I consider the Fed to be Public Enemy No. 1 when it comes to the stock market.

This doesn't mean that you should sell all your stocks Monday morning. But it does mean that you should have a clear exit strategy. One that quantifies under what conditions you would switch your priority from making money to preserving money.

Best wishes,

Tony