Get ready to take cover. This is going to be a very rough ride.

While the U.S. celebrates the birth of two presidents, the E.U. mourns the death of its economic boom.

Italy has just sunk into recession.

Germany is within a hair of doing the same.

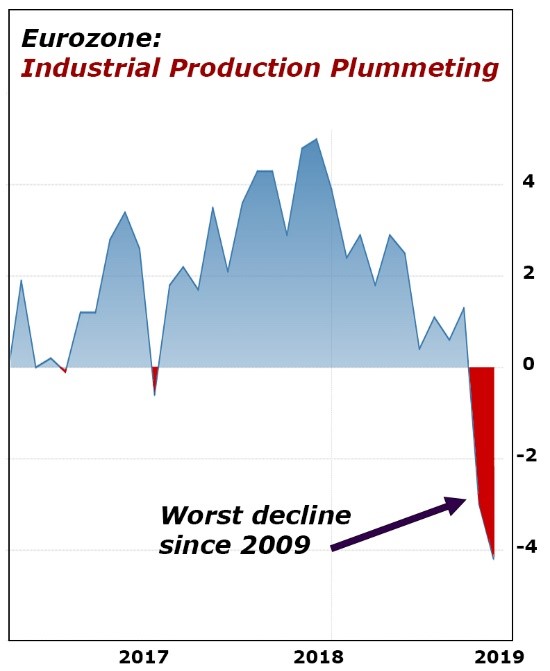

The E.U.’s industrial production, the meat and potatoes of the economy, is plummeting.

And it’s even worse in the eurozone, which includes all the largest countries:

In December, its industrial production suffered the biggest decline since 2009, during the height of the great debt crisis.

This is big.

|

It’s happening right now.

And no matter where you are in the world, it’s going to impact your investments.

But it’s just the beginning.

No One Left to Save the Day

The last time this happened, German Chancellor Angela Merkel was calling the shots in Berlin and Brussels.

Germany pumped desperately needed capital into five countries with collapsing economies — Portugal, Ireland, Italy, Greece and Spain (the PIIGS).

|

And they saved the day. But this time around, that won’t be possible.

According to Finance Minister Olaf Scholz, the German economy is now “uniquely vulnerable to external shocks.” Every single one of its four largest export markets — the United States, France, China and the U.K. — are closing import doors, sinking fast, or bowing out entirely.

No-Deal Brexit Expected March 29th

A no-deal Brexit, scheduled for just 39 days from today, will be the biggest shock of all.

But what’s even more shocking is the fact that virtually nothing is being done to prevent it.

In fact, they’re doing precisely the opposite.

U.K. banks and insurance companies are scrambling for E.U. licenses, shifting some operations to the Continent, and trying to prepare for the day after the cataclysm.

Five of the largest banks are set to move $846 billion to Frankfurt.

In the aerospace industry, Airbus says the no-deal Brexit will be “catastrophic.” They’ve already spending tens of millions of euros to prep for the disaster — stockpiling parts, securing IT systems, making travel arrangements for employees.

On both sides of the English Channel, everyone is battening down the hatches and preparing the lifeboats.

The Fall of Two Unions

If all this sounds improbable, remember that it isn’t the first time we’ve seen the fall of a giant, dominant union in the region. It also happened on Christmas Day of 1991, when the red flag of the Soviet Union was lowered from the Kremlin for the last time.

You may think that story is irrelevant. But there are four major similarities —e all more powerful than the obvious differences.

Similarity #1

Economic Growth and Decline

In the early postwar years of the Soviet Union, authorities could boast a series of economic achievements: Explosive GDP growth. Low unemployment. Free education and medical care. Plus, the aura of income equality.

But then began the two-decade period known as zastoi (stagnation), widespread corruption and, ultimately, mass resentment of Moscow.

The European Union and eurozone also enjoyed a series of early successes: Strong growth and expansion. The second most-widely traded currency in the world. Low unemployment in most member states. One hundred of the world’s largest corporations.

But in the wake of the 2008 debt crisis, economic stagnation overtook much of the Continent. GDP sputtered. Unemployment surged.

According to the European Commission, corruption across the European Union was “breathtaking.” Three-quarters of Europeans surveyed said it was widespread. Nearly all said it was getting worse.

Similarity #2

Growing Demands for Autonomy

In the years leading up to the collapse of the Soviet Union, separatist movements spread from the Baltic Republics to the Caucasus Mountains and beyond.

Fast forward to the European Union of the 21st Century, and you see a similar trend.

As I documented here two weeks ago, Brexit and Frexit movements are spreading like wildfire — not only in Britain and France, but also in the Netherlands (Nexit), Poland (Polexit), Sweden (Swexit) Finland (Fixit) and even in Germany itself (Dexit).

And they want out. Just last month, the surging Alternative für Deutschland party (AfD) voted to campaign for the country’s exit from the E.U. The AfD even wants to shut down the European Parliament in its entirety.

Everywhere, populist parties are rising to power. And like the United Kingdom, they all want out.

Similarity #3

A Flawed Union

In both cases, there emerged a fundamental flaw in the very structure of the union.

In the USSR, it was inflexible central planning. In the E.U., it was an unwieldy monetary policy, effectively imposing a single interest rate on all countries.

Result: E.U. member governments forfeited their power to control their financial destinies, including steps they could take to avoid their own bankruptcy.

Similarity #4

Trigger Events

In both cases, we can identify trigger events that precipitated eventual dismemberment:

In the Soviet Union, they were carefully planned, relatively modest reforms of the Soviet system — Perestroika (Reformation), Glasnost (Daylight), plus clear signals to Eastern European governments that Moscow would no longer send in its tanks to block their own reforms.

In Europe, the trigger events are anything but modest. They began on June 23, 2016, when a majority of British citizens voted to exit the E.U., a shock to Europe, the world and even Britain itself.

But I repeat: The true shock will come 39 days from now when it actually happens. And unless Prime Minister Theresa May can pull a magic rabbit from her hat, it will strike with no deal to soften the blow.

The Impact on the United States

Right now, we’re seeing a revival of the great money tsunami we first predicted a few years ago — flight capital rushing to U.S. markets, boosting U.S. asset values and staving off America’s own day of reckoning.

This could continue. And if it does, the U.S. stock market will avoid a crash (for now).

But looking beyond the immediate horizon, a disaster in the E.U. economy cannot be good news for the U.S. economy — let alone for American investors.

Look. The E.U. GDP is only a tad smaller than America’s. Its population is much larger, with 180 million more people. It’s the most closely linked to the United States culturally and financially. Its central bank was among the quickest and most aggressive in mimicking America’s race to print money in the wake of the 2008 debt crisis.

And now, here it is, on the verge of political and economic collapse.

Get ready to take cover. This is going to be a very rough ride indeed.

Good luck and Gold bless!

Martin