|

"We print money digitally. As a central bank, we have the ability to create money.” —Jerome Powell on 60 Minutes May 17, 2020 |

|

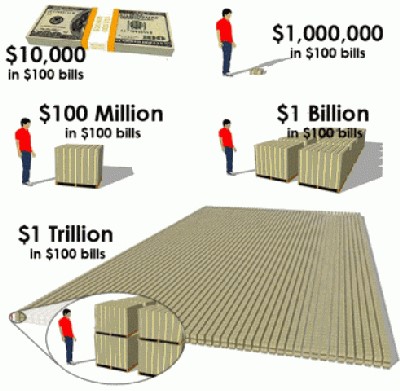

A trillion of anything is a big, big number. One trillion is 1,000 times one billion, or 1,000,000,000,000. That’s 12 zeros.

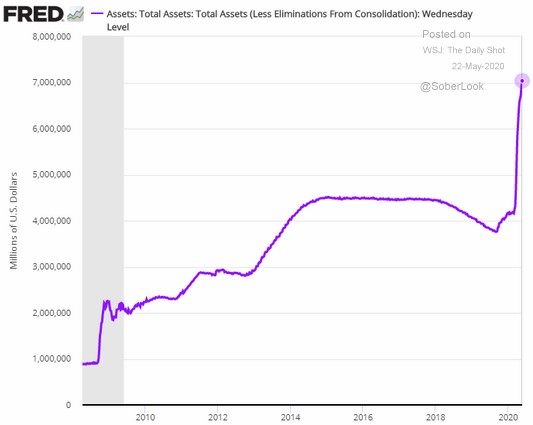

It is hard to wrap your head around the magnitude of one trillion, but the Federal Reserve has created an unprecedented amount of new money to combat the COVID-19 pandemic.

|

| Image Source: Wattsupwiththat |

$7 trillion worth — and counting — because the Federal Reserve is far from finished.

Whenever you start tossing “trillions” around, it is easy to lose perspective of how large it really is.

The Federal Reserve owned $732 billion worth of Treasury securities in 2002, but that has ballooned to $6.93 trillion today, representing a whopping 66.4% increase since the end of 2019.

The Federal Reserve and other central banks governments around the world are piling up debt to the moon and this whatever it takes approach to stimulus is extremely bullish for gold.

Just Getting Started

Jerome Powell assured the world that the Federal Reserve is ready, eager and willing to print a lot more money if it needs to during an interview on 60 Minutes:

But I will say that we’re not out of ammunition by a long shot. No, there’s really no limit to what we can do with these lending programs that we have. So there’s a lot more we can do to support the economy.

What Powell is talking about is an even bigger Quantitative Easing blast, more special lending facilities programs, more asset purchases and more Fed printing.

|

Heck, Powell has even floated the idea that the Fed could buy individual stocks.

|

“Nothing is so permanent as a temporary government program.” —Milton Friedman |

Like Powell said, the Fed can electronically print money at their whim and all that paper money makes gold — and other precious metals — shine by comparison.

Why? Because you can’t print gold. You can’t print silver.

Investors have figured that out and have been pouring money into gold ETFs. According to Bloomberg, inflows into ETFs that hold physical gold totaled $16.8 billion in less than five months.

So, in the first five months of this year, gold ETFs brought in more than they ever have in any previous full year!

Smart investors are following their lead. To be fair, I want to disclose that both my Weiss Ultimate Portfolio and Stock Options Hotline subscribers are already invested in gold. I think you should join us!

And there are several ways to invest in gold and silver.

If you’re more of an ETF investor, take a look at either SPDR Gold Trust ETF (GLD, Rated “B”), iShares Silver Trust (SLV, Rated “D”), or US Global GO GOLD and Precious Metals Miners ETF (GOAU, Rated “C”).

If you prefer mining stocks, look to the gold royalty stocks, such as Wheaton Precious Metals (WPM, Rated “C”), Franco-Nevada (FNN, Rated “C”) or Royal Gold (RGLD, Rated “C+”).

And, if you want to learn how the coronavirus pandemic will push gold even higher … easily up to $3,000 per ounce … I highly suggest you sign up for my colleague Sean Brodrick’s special event, Wild Gold Profits in a World Gone Mad, this coming Wednesday, June 3.

In it, he details the profit opportunities unlocked by this historic move and explains how to possibly shoot for gold returns of 1,000%. Click here to save your seat.

Best wishes,

Tony Sagami