|

| By Tony Sagami |

In 1986, my younger brother said to me, “Don’t be stupid. Buy Microsoft.”

I was skeptical. In May 1984, Microsoft Corp. (Nasdaq: MSFT) started selling something called a “mouse” for $195, bundled with Microsoft Word and Microsoft Notepad.

In 1984, $195 was a lot of money, about $520 in today’s dollars.

“Are you sure?” I asked my brother.

“YES, I AM SURE,” he replied. (Yes, in all caps ... )

|

I was a retail stockbroker in Tacoma, Washington, at the time, and Microsoft was considered a local darling. Given all that, I took my brother’s advice, and I put every one of my Merrill Lynch clients into Microsoft stock.

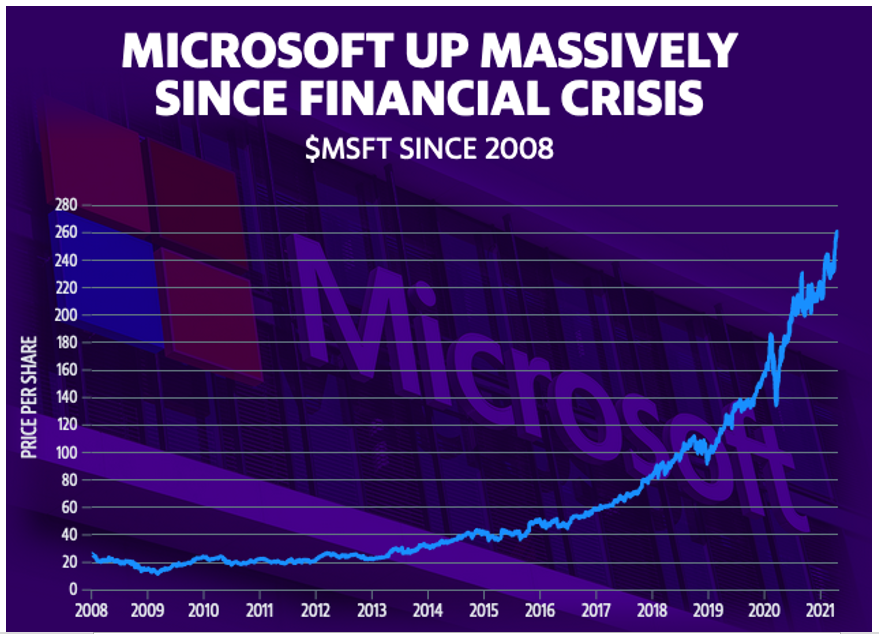

Microsoft went public on March 13, 1986, and has gone on to enrich everyone who bought early. MSFT has split nine times since its initial public offering (IPO). Its split-adjusted IPO price is just over a mere 7 cents.

At today’s price of around $250, we’re talking about a total return of 357,000%. A $1,000 investment in Microsoft made March 13, 1986, is worth $3.57 million.

My clients were delighted with their profits, and I was able to quickly grow my book of business on solid word-of-mouth recommendations.

I don’t exaggerate when I say I wouldn’t be where I am today without my brilliant brother and Bill Gates.

So, what was so special about Microsoft that made it skyrocket? Simple: Microsoft made it possible for computers to talk to each other. Sure, that’s a gross oversimplification. But it captures the powerful essence of what made MSFT a millionaire-maker.

There’s another simple but powerful revolution going on at Microsoft today that I expect to keep enriching MSFT holders.

I’m talking about the “cloud.”

For decades, Microsoft had a near-monopoly on the PC market, and most investors still think of Microsoft in terms of Windows and Office.

Microsoft certainly makes a mountain of money off those products. But Satya Nadella, who became CEO in February 2014, has changed Microsoft into a dramatically different company.

Today, Microsoft is the cloud’s biggest player and is making a rapidly growing fortune from services built “in” it.

In 2015, Wall Street laughed when Microsoft said it would pull in $20 billion of cloud revenue by June 2018. Wall Street isn’t laughing today. Microsoft easily eclipsed that benchmark on the way to transforming itself into the undisputed leader of the cloud.

The bottom line is Microsoft is still printing money from its traditional Windows and Office business and is now supplementing that prodigious flow with a new $20 billion-plus cloud business that’s growing like wildfire.

Azure — Microsoft’s cloud services unit — now generates 20% of Microsoft’s total revenue.

|

| Source: Microsoft, Yahoo Finance |

In the most recent quarter, Azure revenue surged by 50% on a year-over-year basis to $15.1 billion. Think about that: Something monumental is happening when a multibillion-dollar business can grow by 50% in a year.

The best part is that Azure’s are recurring, subscription-based contracts. A whopping 86% of those billions are a recurring annuity stream.

And it still makes a fortune from Windows software, Microsoft Teams, Microsoft Office, LinkedIn and Xbox.

In the last 90 days, Microsoft pulled in $41.7 billion of sales and cranked out $15.5 billion of profit. Yup, $15 billion-plus of profit in just 90 days.

I asked my brother if he still liked Microsoft. “Don’t be stupid. Of course, I do.”

Enough said.

Best,

Tony Sagami