How to ride the trillion-dollar corporate buyback wave

|

What do Dow 27,000 and Nasdaq 8,000 mean to you?

With stocks now trading above these levels, does this mean the market is overdue for a big fall? Or are these new highs indicative of something very good ... something very powerful at work that will push the stock market even higher?

I see two massive, seemingly unstoppable forces that indicate a strong stock market ...

First, it is absolutely guaranteed that the Federal Reserve is going to unleash a flood of monetary steroids. Rate cuts are coming ... GUARANTEED.

A friendly Fed alone will goose stock prices. But that's being supplemented by an unprecedented corporate buyback frenzy — one that's helping to drive the broader markets even higher.

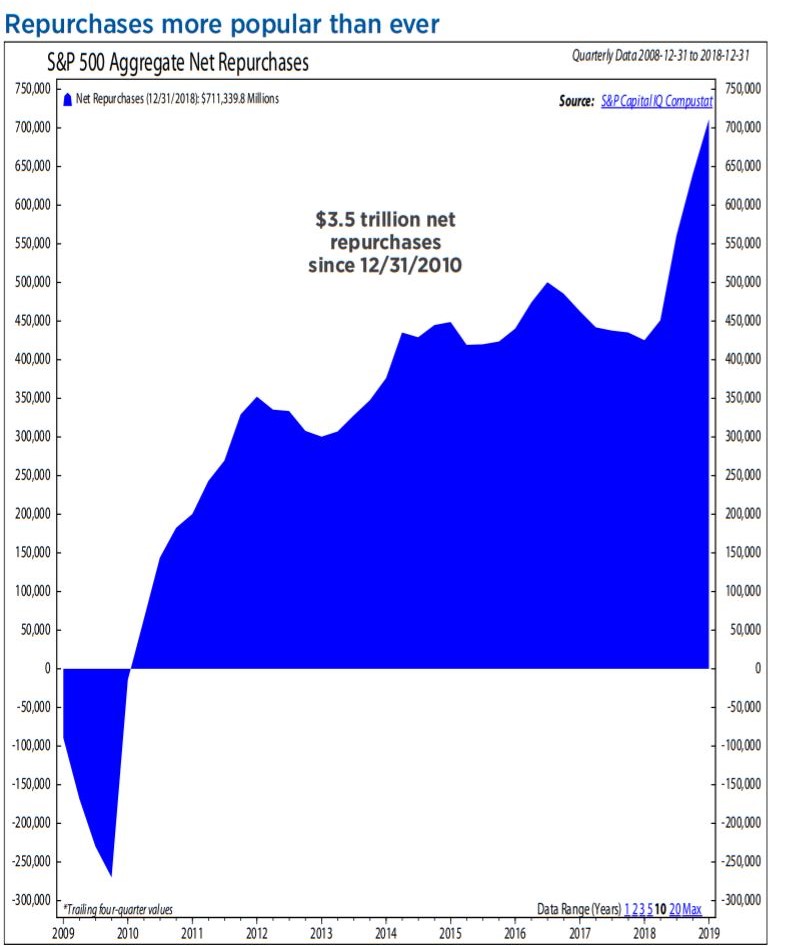

Since 2011, the 500 companies that make up the S&P 500 have spent $3.5 trillion on stock buybacks.

$3.5 TRILLION!

|

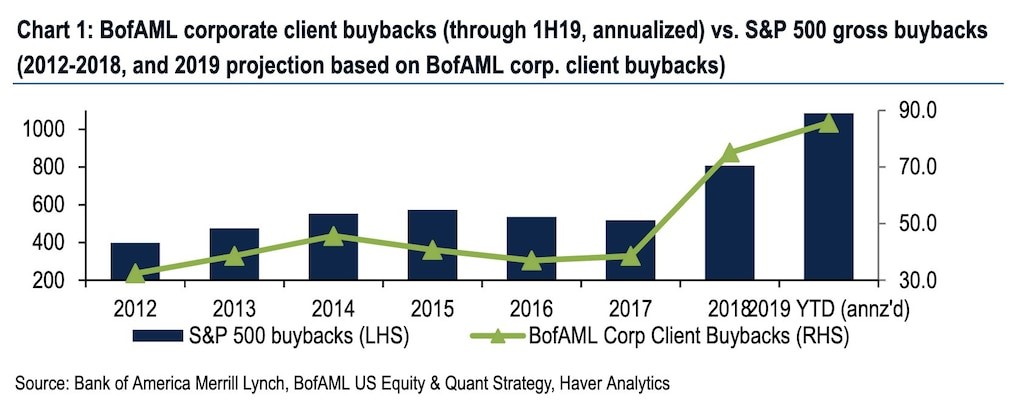

That is a mountain of money, but the pace is quickening. In 2018, buybacks were $217 billion higher than any previous year. And, in just the first six months of 2019, buybacks are $18 billion higher than last year ... and expected to hit $1 trillion this year.

To put that $1 trillion into perspective, that's roughly the market capitalization of the most valuable company in the world — Apple (AAPL).

Speaking of Apple, guess what it's doing with a chunk of its massive cash hoard? That's right, Cupertino's finest is scooping up its own shares at a record rate.

Over the last year, it was the biggest of the big spenders, buying back a massive $75 billion of its own shares. It's spent upward of a quarter-trillion dollars in the past 10 years buying back its stock.

|

Apple is in good company. Oracle, Pfizer, Bank of America and Cisco join it as the top five buyback leaders so far this year. Together, they account for a whopping 27% of all buybacks.

Buybacks not only reduce the number of shares (supply), but they also concentrate corporate profits over a smaller number of shares. This results in higher earnings per share (EPS) ... and this is great for shareholders.

A recent study by the Abu Dhabi Investment Authority found that net buybacks — the number of repurchased shares minus the number of new IPO shares — accounts for the bulk of stock market returns and not economic growth.

That is truly a stunning conclusion.

We've been conditioned to believe that the stock market grows along with the U.S. economy. But the reality is that stock buybacks have a greater impact on stock market returns because of the concentration of earnings over a smaller shareholder base.

In short ...

As long as Corporate America is snapping up its own shares, the stock market is headed higher and higher and higher.

How can you profit from this buyback boom?

There is an ETF specifically designed to invest in the buyback leaders, the iShares U.S. Dividend and Buyback ETF (DIVB). But I believe you can do much better by targeting companies with (1) the largest buybacks and (2) super-solid balance sheets.

I strongly recommend that you take advantage of the basic, free (free is a very good price) Weiss Ratings. To look up our proprietary rating on any stock you own, go to https://weissratings.com.

Access to these detailed, in-depth reports requires an inexpensive subscription, but anyone can access the basic reports for free.

By the way, I have incorporated the Weiss Ratings into my Weiss Ultimate Portfolio and have profited greatly by doing so. Just Wednesday, we grabbed a nice 39.4% gain in PaySign (PAYS), after only being invested in it a little over a month! I'm already targeting our next round of recommendations; I hope you'll consider being on board for those.

To learn more about the Weiss Ultimate Portfolio, click here.

Best wishes,

Tony Sagami