Lyft Lessons: Avoid Startups That Can't Stop Losing Money for Investors

|

"How can I get some Lyft (LYFT) shares?" asked a friend of my millennial-aged son, before the company started trading on the Nasdaq in March. "I think it's going to double or triple!"

My son's friend had lots of company. Lyft's Initial Public Offering was so popular that the shares — which were initially priced at a range of $62 to $68 — were raised to a range of $70 to $72.

And don't think that it was just a bunch on dumb kids who were enthralled with Lyft. The Wall Street crowd was doing even bigger cartwheels. Demand was so strong that the Lyft IPO was oversubscribed after just two days of its institutional roadshow.

Thanks to those drooling Wall Streeters, Lyft sold 32.5 million shares and pulled in $24.3 billion of investors' money.

By the way, the Lyft founders were more than happy to unload their own shares. After the IPO, the founders of Lyft owned less than 5% of the stock.

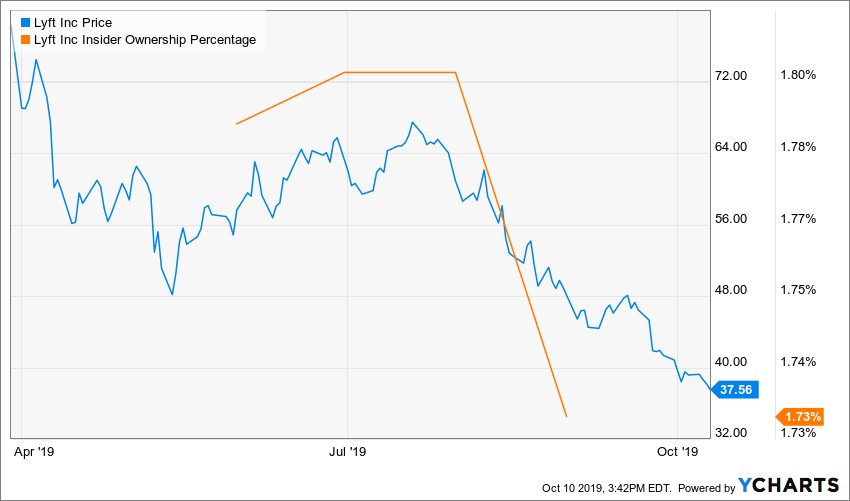

Take a look at the yellow line on the chart below — that's insider ownership taking a tumble …

|

|

Lyft lost $911 million in the year leading up to its IPO, more than any other U.S. startup, per S&P Global Market Intelligence. |

“Suckers!” they must have exclaimed.

Why? Well …

Lyft lost more money in the year leading up to its IPO than any startup in history — a total of $911 million in the preceding 12 months .

Yup, almost a billion dollars.

I don't care who you are; it isn't easy to lose $1 billion.

Lyft has lost more than 50% of its value since that IPO, so all its original cheerleaders have lost their shorts.

As for my son's friend, the Lyft IPO was so popular that he couldn't get any shares before their March 29 debut. Lucky for him, he avoided what would have been a painful loss.

I don't mean to pick on Lyft. It has LOTS of company when it comes to failed IPOs.

Just take a look at the performance of the Renaissance IPO ETF (IPO), a fund that specializes in Initial Public Offerings …

|

|

The Renaissance IPO ETF is down about 1% over the past year. It fell 10.5% over just the past two months. |

The fund is filled with the high-flying, red-hot IPOs that greedy investors couldn't get enough of: Spotify (SPOT), Roku (ROKU), Pinterest (PINS), Beyond Meat (BYND), Dropbox (DBX), Uber (UBER), CrowdStrike (CRWD) and, yes, Lyft.

Performance over the past two months is ugly. This tells me there is a seismic shift out of high-risk, high-beta stocks and into more-conservative, mature, blue-chip companies with actual profits. (Something many of the recent IPOs don't have.)

This risk-off rotation doesn't necessarily mean that the stock market is headed for a tumble. But it definitely means that you need fill your portfolio full of "safe money"-type stocks, such as utilities, Real Estate Investment Trusts, consumer staples and hard-asset (gold, energy, and natural resource) stocks.

In fact, what you should do is take a long, close look at Mike Larson's Safe Money Report. Larson has absolutely nailed the strategy for sidestepping the recent turmoil and is the best in the business when it comes to navigating bear markets.

His subscribers are benefiting from his careful recommendations and are currently tracking open gains of up to 23% on solid, slow and steady earners. Click here to join them.

Take a look. I think you'll be very impressed.

Best wishes,

Tony Sagami

P.S. Another IPO that hasn't lived up to the hype is Uber. Not yet, anyway, according to my colleague Jon Markman, who points out that it's more than a taxi-on-demand service — its mobility platform is what's "ingenious." More than that, its brand-new Uber Works may just become the killer app of the gig economy. Check out those stories, and see if you agree.