|

“When are you going to retire, dad?” asked my son.

His question was prompted by my 64th birthday, which I celebrated yesterday.

The answer to my son’s question is — God willing — I will work until the day I die. I really love studying markets, economies and companies. And to be honest, I’d rather be doing this than anything else in the world.

I could retire if I wanted. I have a good-sized nest egg, ZERO debt and live the same comfortable-but-simple life that my farming parents did. Heck, I might even be able get by on my Social Security check alone.

Your Social Security check will probably be different. Each one of us has our own Social Security account, and how much you receive depends on your contributions over your working career.

Today, the average Social Security check is about $1,500 a month. Even with zero debt and a simple lifestyle, I couldn’t survive on $1,500 a month, and I doubt you’d want to try.

The lesson to learn here? We all need to save enough money to supplement our Social Security check.

In general, most financial planners suggest a nest egg of 10 times your pre-retirement salary. Someone who makes $50,00 a year should save $500,000, while someone who makes $100,000 should save $1 million dollars.

That’s just a general rule of thumb, though. You may need more (or less) depending on your retirement lifestyle. If you’re going to travel the world, golf and splurge on a luxurious RV … you’ll need more.

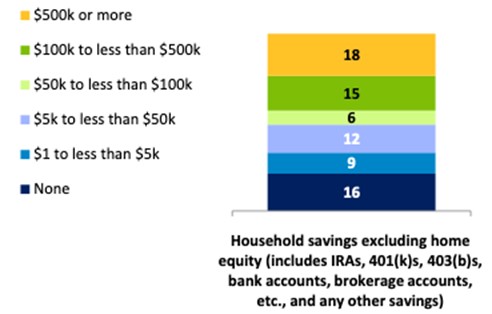

Source: transamericacenter.org |

Unfortunately, the typical retiree has fallen woefully short of that guideline and only has an average of $45,000 in savings (excluding home equity), according to a new Transamerica report.

I get it. Saving money isn’t easy. Especially in your 20s when you’re not making a lot of money and in your 30s and 40s when you’re typically raising a family.

However, even if you find yourself with a small pot of retirement savings, you should consider working well past the traditional retirement age of 65.

For every year you delay collecting Social Security past your full retirement age, or FRA, your monthly checks increase by 8% up to age 70. In my case, my Social Security check increases from $3,011 a month if I retire at the FRA, to $3,790 if I wait until I turn 70. That’s an extra $779, or 25%, each month.

That is the first step of my retirement plan — to wait until 70 to turn on the Social Security spigot.

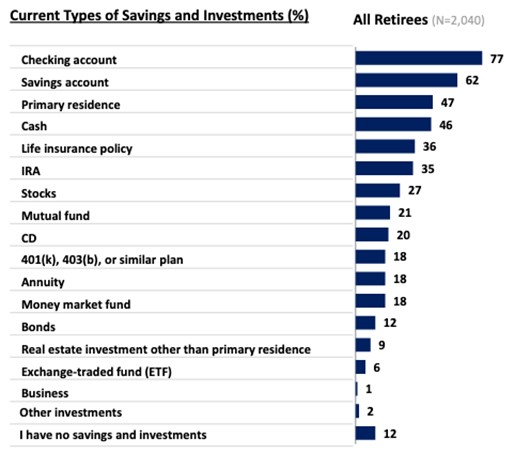

Source: transamericacenter.org |

$779 X 12 months = an extra $9,349 a year.

Plus, that extra five years will allow you to pay down more debt and sock more dollars into your 401k.

The second step of my retirement plan is to make my money work as hard as I do.

I was disappointed to see how little money people are saving for retirement, but I was absolutely shocked at how ineffectively Americans are investing their savings.

According to Transamerica, the four most popular investments (other than your home) are checking accounts, savings accounts, cash and life insurance.

As Democratic presidential nominee Joe Biden would say, “Come on, man!”

The stock market is your very best shot at building a fat enough nest egg to finance a comfortable retirement. So, I suggest you either teach yourself how to invest, or follow the advice of someone who knows what they are doing.

My third step is to invest in safe-haven assets that aren’t subject to the Federal Reserve’s control.

The Fed has stated recently that it’s OK with inflation of more than 2%. Change the word “inflation” for its synonym — “cost of living” — and you can see where the average American would have a problem with that.

One safe-haven asset seeing a boom over the past few months, as the stock market has been levitated by the Fed’s quantitative easing policies, is gold.

But according to Weiss Rating’s metals expert Sean Brodrick, the boom you’ve witnessed so far is NOTHING compared to what’s coming next. And, if you get in right now, you have the potential to bank enormous, life-changing profits.

That’s why I want you to know about his urgent investment briefing, The Great Reckoning, this coming Wednesday, Sept. 23, where Sean will reveal how this Great Reckoning could give you the opportunity for powerful potential profits

To secure your free seat at this special briefing, click here now.

In my book, he’s the best in the business, so you don’t want to miss out.

Best wishes,

Tony Sagami