Shattering 4 Myths Cherished by Investors and Economists

|

Most people cannot fathom the sheer depth of Venezuela’s crisis — let alone learn the true lessons it has to offer.

I can. My family and I first went to Venezuela when I was 14, when my sister lived in the upscale Las Mercedes neighborhood of Caracas.

Luxury stores lined immaculate avenues. Today they’re shuttered or in ruins.

|

My father walked my nephew to his school bus stop each morning. That would be suicidal today.

On a subsequent trip, I visited the Ciudad Universitaria, thinking I might try attending classes there for a semester or two. Today, it’s in shambles.

We toured the countryside by car. Now, people cringe at the mere thought of doing so. You’d need a police escort or someone riding shotgun.

But the Venezuela story is not simply an isolated anomaly in an otherwise normal world; it shatters widely cherished myths about all modern economies …

Myth #1. “The situation is so bad it couldn’t possibly get any worse.”

Everyone believed — or desperately wanted to believe — that modern economies have a built-in floor that protects citizens from utter collapse.

Venezuela has proven them wrong. Every time it was said that the country had hit rock bottom, it promptly got a lot worse.

Most economists adhere to a similar theory. At Wharton and the Fed, they’ve built elaborate computer models to predict GDP growth and inflation. But they’re also wrong.

As you’ll see from the next shattered myths, those models have no way of factoring in social and political chaos — let alone predicting their economic impact.

Myth #2. “Hyperinflation like we saw in Germany in the early 1920s is impossible in modern, resource-rich economies.”

After World War I, Germany’s productive capacity was leveled by war, and the government was unable to meet its reparations payments to the Allies. So, Berlin’s Weimar regime ran the printing presses 24/7.

In 1922, a loaf of bread cost around 160 marks. Less than one year later, it went for 200 trillion marks.

Fast-forward to the 21st Century and ask any economist if that kind of extreme hyperinflation would be possible in peacetime, in a relatively large economy with the richest oil reserves in the world.

|

What would they say? “No way, José!”

Venezuela proves them wrong, too.

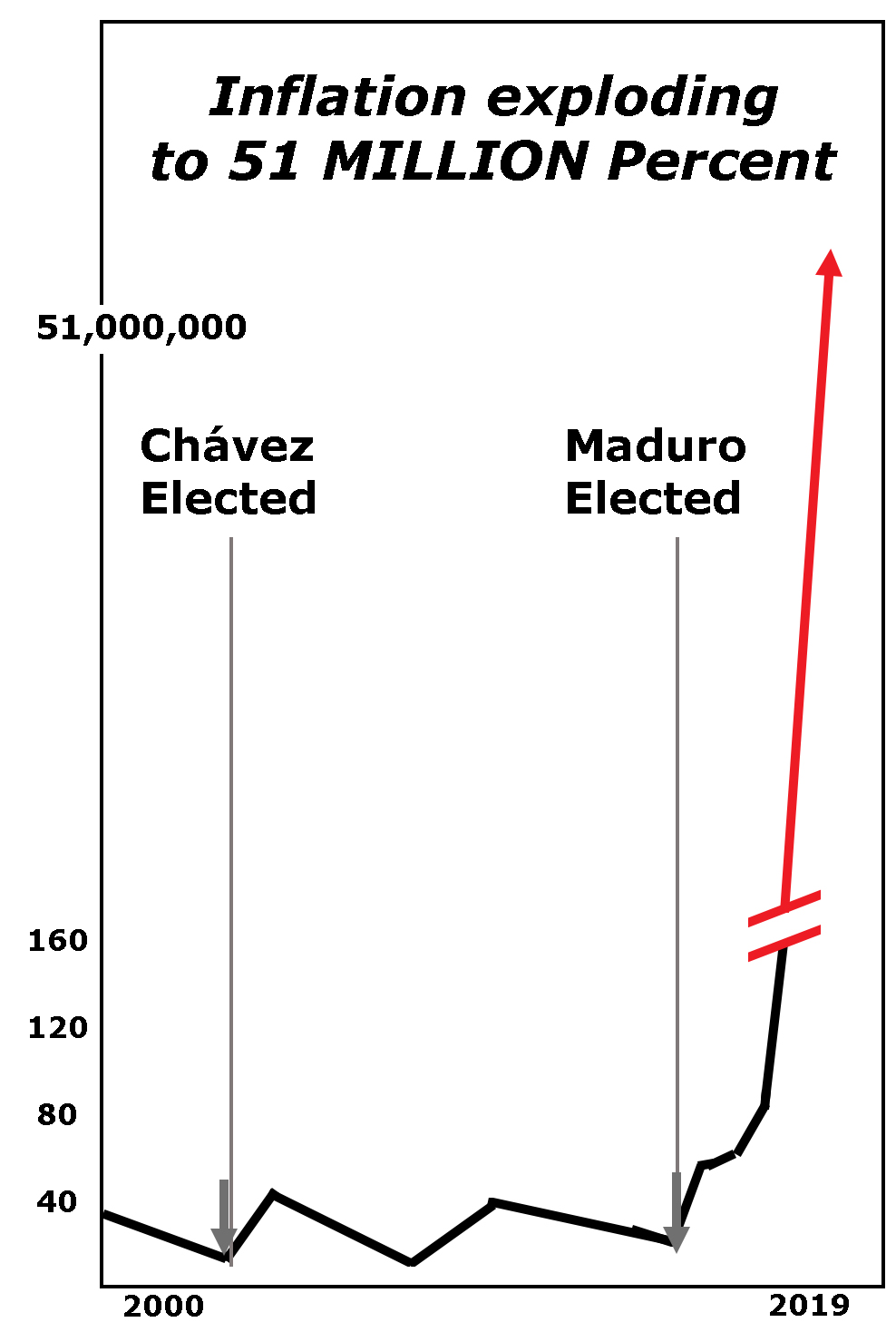

A few years ago, for example, widely-respected economists predicted that Venezuela’s inflation rate would peak at around 1,000%. That was already said to be “beyond extreme.”

More recently, the International Monetary Fund figured they’d get ahead of the inflation forecasting game and went out on a limb. They said Venezuela’s inflation would reach an unthinkable 1.3 million percent.

Wrong again! Venezuela’s inflation this year will be close to 51 million percent.

Myth #3. “In a bad depression, the economy contracts between 5% and 10%.”

In America’s Great Depression, GDP fell four years in a row.

It contracted by 8.5% in 1930, 6.4% in 1931, 12.9% in 1932 and 1.2% in 1933.

Thus, in modern, resource-rich economies today, that experience is generally viewed as the worst-case scenario. Typically, the biggest declines that economists envision are in the 5%-10% range.

So, you can imagine their shock when they saw the GDP numbers coming out of Venezuela:

|

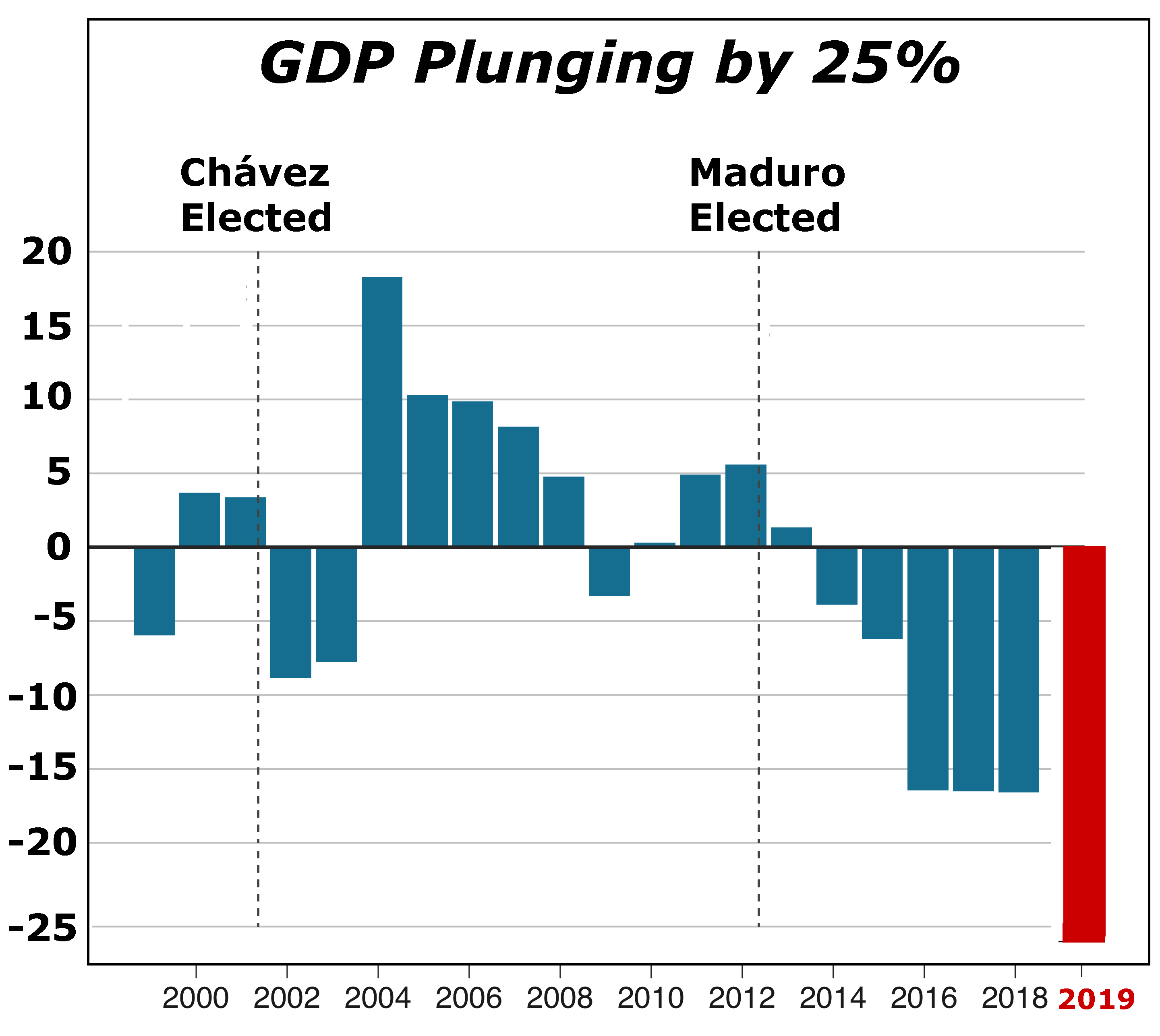

In 2014 and 2015, Venezuela’s GDP contracted by an average of 5% per year, a decline that economists already called a “severe depression.”

Then, just as it was widely believed that the economy would begin to recover, it contracted by more than 16% in 2016, another 16% in 2017, and still another 16% in 2018.

But if you think that’s bad, consider the current estimate for 2019: At least 25% of Venezuela’s GDP is expected to be wiped out this year.

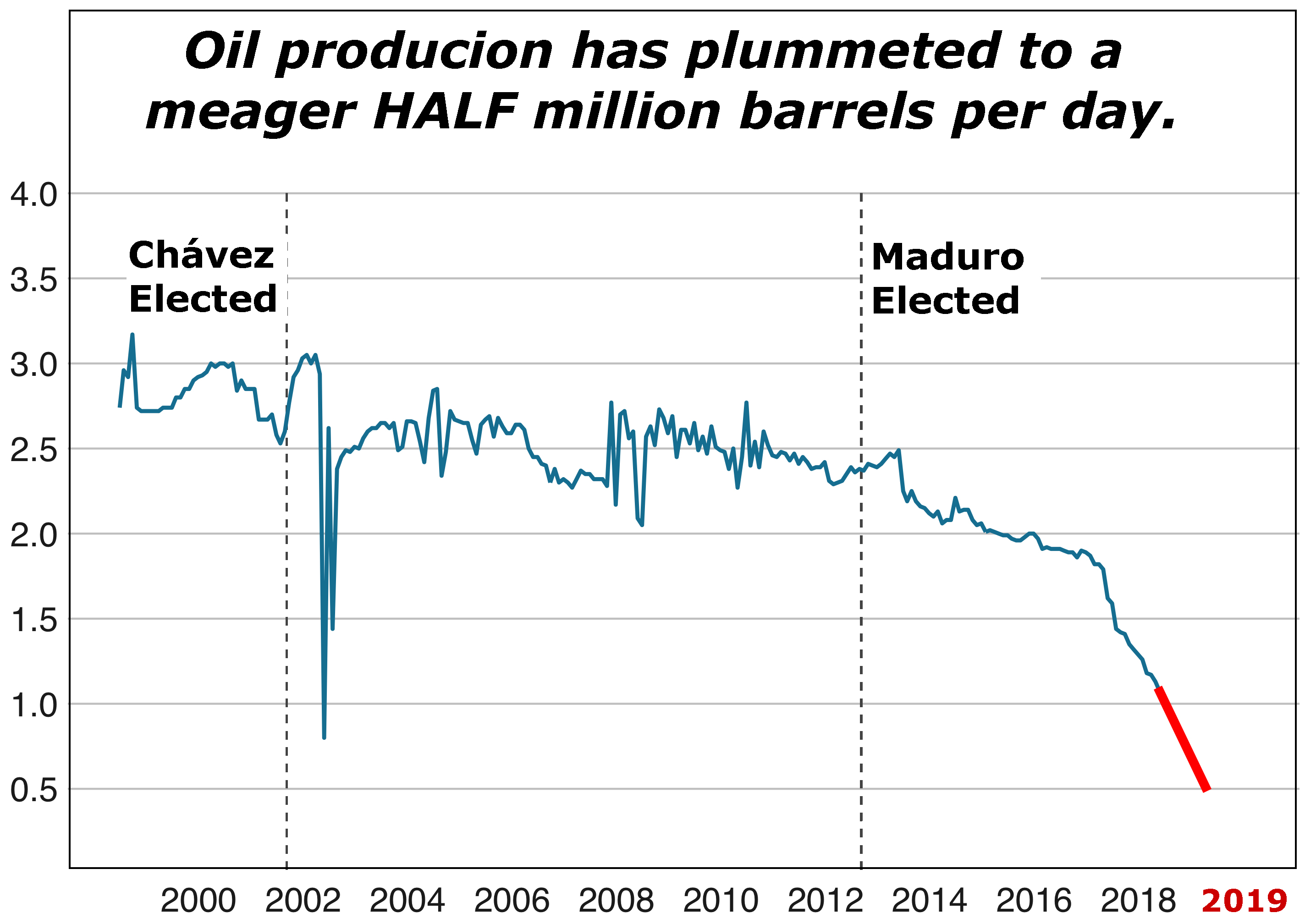

A big part of that collapse is taking place in Venezuela’s oil industry, once its pride and joy:

|

When oil production plunged from 2.5 million barrels per day in 2013 to just over 1 million last year, it came as a shock to both domestic and foreign observers alike. Now, in 2019 it’s expected to fall to just a half million barrels per day.

Myth #4. “Nothing like this could ever happen in advanced countries.”

The fact is, Venezuela is (or at least WAS) an advanced country. So, it already shatters this myth.

Moreover, no country in the world is immune to the two main causes of the disaster: Not just the government’s socialist zeal but also its rampant corruption.

Hugo Chávez, president from 1999 to 2013, can be blamed for introducing the former.

Nicolás Maduro, the disputed president today, did the most to introduce the latter.

And as you can see from the charts, both played a major role in destroying Venezuela’s economy.

So, don’t blindly assume that the people of Venezuela are unique. They don’t have a monopoly on extreme socialism. They certainly aren’t the only ones vulnerable to rampant corruption.

Best,

Martin