|

The banks are in trouble.

With 22 million Americans out of work and unable to pay their bills, banks are seeing delinquencies rise. And banks with more exposure to high-risk loans are really feeling the pain.

You might think that we’ve already begun to see the tidal wave of defaults piling in. But we haven’t. Not yet, anyway.

In fact, the real spike hasn’t even begun.

Just take a look at these two charts. What do they tell you?

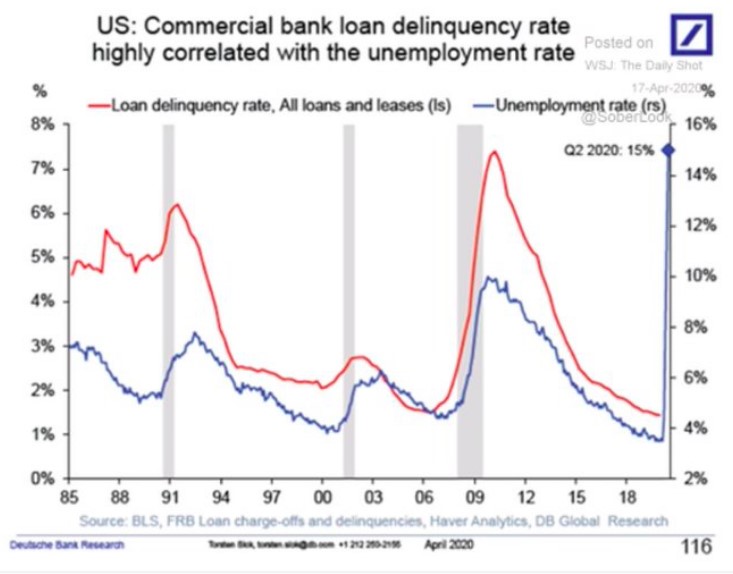

Chart No. 1: Relationship Between Unemployment Rate and Loan Delinquency Rates. No surprise here; when the national unemployment rates increases, businesses find it increasingly difficult to service their debt.

|

|

Source: PBS |

The most obvious warning sign on this chart is that even though unemployment has skyrocketed, the delinquency rate has yet to move higher. But trust me, it will.

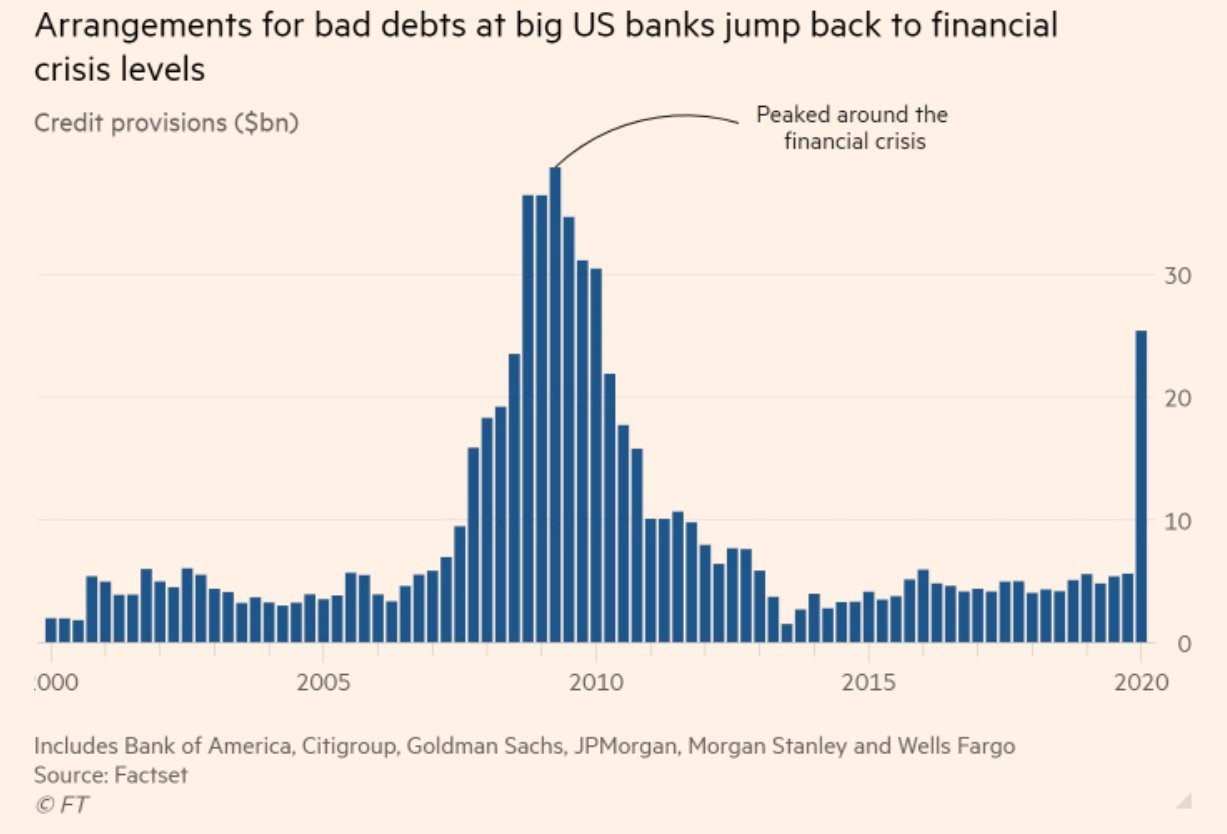

Chart No. 2: Soaring Loan Reserves. Banks know before anybody else if businesses and people aren’t making payments on loans.

That’s why the Treasury Department requires banks to set aside a reasonable amount of reserves to cover bad loans and to adjust them upward if delinquencies start to rise. It’s a solid, common-sense rule as it prevents banks from going out of business and undermining our entire banking system.

|

The obvious conclusion from these two charts is that loan delinquencies are about to take off. We’ve only seen the tip of the bad loan iceberg to this point.

As you know, the Federal Reserve has chopped interest rates to zero and initiated a massive unlimited bond buying spree with the goal of keeping interest rates as low as possible for the foreseeable future.

This is a dumb move. Jerome Powell and his Fed buddies better wake up. Keeping interest rates near zero will destroy the banking industry.

In fact, the banking system is in danger of imploding because of zero interest rates and a pancake-like flat yield curve. The business model of banks is based on borrowing at low short-term rates and lending the proceeds at higher long-term rates. But, if the gap between short- and long-term rates has evaporated, that means lending will soon come to a standstill.

One of the most vulnerable banks is Capital One Financial (COF) for two reasons: collapsing oil prices and credit card defaults.

Profit Killer No. 1: Collapsing Oil Prices. We’ve seen oil prices drop into negative territory. I have to admit, I never thought I’d see negative oil prices in my lifetime.

The problem is that oil prices are now way below the cost of production for all U.S. oil shale producers. No one is buying, even if they wanted to try and sell. And Capital One has loaned more than $3 billion to them. Worse yet, Capital One is the only major bank dumb enough to increase its exposure while all other major U.S. banks have been reducing it.

Best case scenario, Capital One will have to dramatically increase its loan loss reserves, which would crush profits. Worst case, Capital One will get stuck with billions of bad loans. Either way, Capital One is an accident waiting to happen.

Profit Killer No. 2: Surge in Credit Card Defaults. What’s in your wallet? For millions of Americans, the answer is Capital One, which has more than $110 billion of outstanding credit card loans.

If Treasury Secretary Steve Mnuchin is even remotely right about a 30% unemployment rate, Capital One is going to get stuck with billions of dollars of defaulted credit cards.

Lastly, Capital One has suspended its stock buyback programs, which means that one of its most powerful drivers of higher stock prices is gone. Long gone. I also expect Capital One to chop or discontinue its dividend.

If you own Capital One … get out now. I believe the banking industry is full of accidents waiting to happen. After eliminating your exposure to the banking industry, make money from falling stock prices.

How? By watching Dr. Martin Weiss’s emergency three-part briefing, Collapse of 2020: How to Prepare and Profit. In it, he lifts the veil on the single biggest threat and opportunity this country has seen in a half-century.

He’ll explain how you can protect yourself from the current volatility and even profit from it.

To watch this urgent briefing, click here now.

Until next time,

Tony Sagami