This Sector Has Seen 4,000% Growth in 1 Year. Much More to Come ...

|

This topic is extremely timely. So I’ll get straight to the point.

Bitcoin has just suffered a typical correction.

The last time this happened was in January, when Bitcoin fell from about $41,000 to close to $30,000 … and then surged to nearly $58,000.

How far it might surge on its next upswing is anyone’s guess. But …

There are three things I can say with confidence, and they are all quite amazing …

First, the same powerful supply-and-demand forces that have quadrupled the price of Bitcoin in the past five months are still here.

We still have extremely limited new supplies.

We still have big new institutional money pouring into Bitcoin.

And we still have the world’s central banks printing money like crazy, holding official interest rates near or below zero and driving increasing amounts of flight capital into Bitcoin.

Second, we don’t see any signs of a Bitcoin bubble.

The best evidence: The public is not yet going gaga on Google:

|

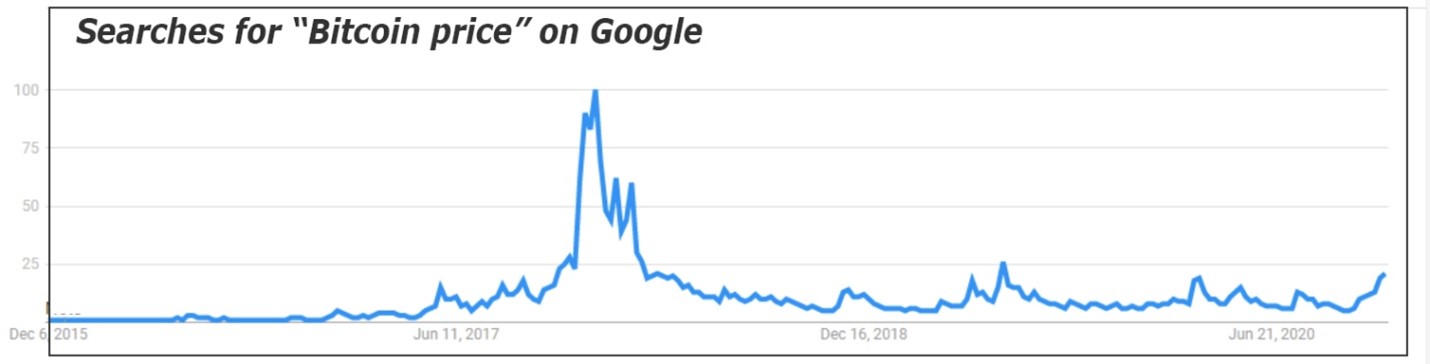

This chart shows the tally of Google searches for “Bitcoin price” since December 2015, and the pattern is very clear.

Yes, public interest in Bitcoin has gone up somewhat since in recent months. But it’s still very far away from the frenzied interest in Bitcoin of late 2017, when Bitcoin was near $20,000, its all-time high for that cycle.

Here’s they key:

Although the price of Bitcoin is now more than double its peak price in 2017, the public’s interest in Bitcoin is still far from its 2017 peak. This means there’s still much more potential demand in the market that could drive Bitcoin prices higher.

Third, ever since the advent of other, newer cryptocurrencies (“altcoins”), Bitcoin has never been the biggest winner in crypto bull markets.

Why not? One reason is simply because newer cryptos are invariably smaller cap cryptos. And like small-cap stocks, they have far more room to grow.

Another reason is that many of the new cryptos develop new technologies and use-cases that Bitcoin was never designed for.

You see, Bitcoin has become primarily a store of value and a refuge from monetary abuses by central banks, much like a “digital gold.”

But today, a whole new class of cryptos is aiming to do a lot more. And among these, the most promising are those with the potential to compete with, and even replace, a growing share of the global banking system.

It’s called Decentralized Finance, or DeFi for short. And one corner of this booming industry is already growing like crazy:

|

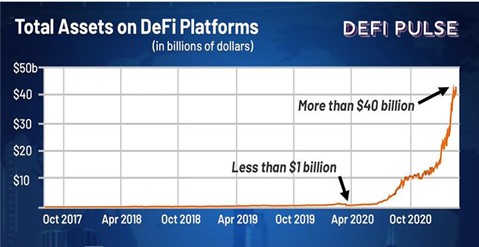

According to DeFi pulse, which tracks this relatively unknown sector of the crypto world, about one year ago, Decentralized Finance platforms for borrowing and lending had less than $1 billion in assets.

Now, they have close to $40 billion. That’s 4,000% growth in just 12 months! Yet few people even know it exists. That’s amazing in itself.

What’s even more amazing to me is that, compared to the $400 trillion global banking system, it’s still tiny, with the strong likelihood of far more growth ahead.

And, of course, with that growth comes equally large profit opportunities, provided you know what to buy and how to buy it.

Stay tuned for more on this topic. It’s just beginning to really heat up.

Good luck and God bless!

Martin