I don’t normally get my news from Yahoo! Finance, but a recent headline caught my eye: “Consumer Confidence Hits a Pandemic-Era High.”

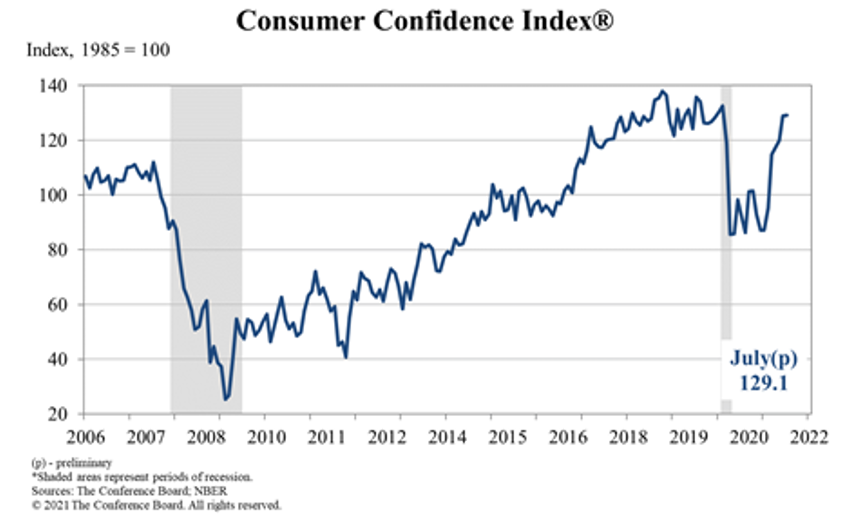

The basis for the headline was The Conference Board’s Tuesday report, so I went to their website to take a look. Their Consumer Confidence Index (CCI) now stands at 129.1, mostly flat from June’s 128.9.

But that doesn’t change the fact that this slight increase is still the highest level of consumer confidence since February 2020.

|

And it means consumers are going to spend big on discretionary goods … so let’s check in with the Weiss Ratings stock screener as we look for winners >>

Lynn Franco, Senior Director of Economic Indicators at The Conference Board, commented:

Consumers’ appraisal of present-day conditions held steady, suggesting economic growth in Q3 is off to a strong start. Consumers’ optimism about the short-term outlook didn’t waver, and they continued to expect that business conditions, jobs and personal financial prospect will improve.

Sounds like consumers are optimistic and will continue their spending on consumer discretionary goods.

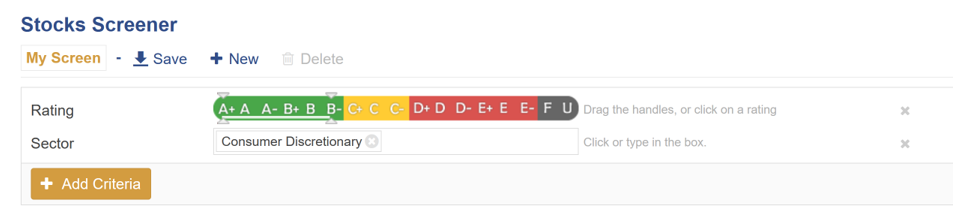

So, I went to the WeissRatings.com stock screener to pull an updated list of “buy”-rated consumer discretionary companies.

Let’s look at the top three ...

First, we’ve got Yum China Holdings, Inc. (NYSE: YUMC). Yum China is the largest restaurant company in mainland China with 10,506 restaurants in over 1,500 cities. The company has exclusive rights for Yum! Brands, Inc. locations in the country, including KFC, Pizza Hut and Taco Bell. It also owns the intellectual property of Little Sheep, Huang Ji Huang, East Dawning and CoFFii & JOY brands.

Throughout 2019, the company held a solid “buy” rating. But in 2020, it slid down to the “hold” range.

However, it’s been steadily climbing back since the beginning of 2021, and now it holds an “A-” rating. Yum China’s last earnings show operating cash flow increased 53%, earnings per share (EPS) increased 52% and earnings before interest and taxes (EBIT) increased 35%.

The company currently pays a quarterly dividend of 12 cents but had to skip two of those payouts last year. It does appear that Yum China is on track to resume quarterly payouts this year. Shares are up 13% since the beginning of 2021.

Next up, we have Academy Sports and Outdoors, Inc. (Nasdaq: ASO), the only other company in the “A” range. Like YUMC, this one has an “A-” rating.

Academy’s mission is to provide “fun for all,” and it accomplishes that by being one of the leading full-line sporting goods and outdoor recreation retailers in the United States.

Originally founded in 1938, the company’s grown to 259 stores across 16 states going public last October. It’s held a “buy” rating since it first qualified for a rating in December.

Since then, it’s been upgraded twice due to increased stability in its balance sheet after quarterly earnings releases. So far this year, shares are up 73% and I’m very curious to see if its next earnings release will be enough to initiate an "A” rating.

Rounding out our top three picks is Target Corporation (NYSE: TGT). Since most Target stores now have groceries, I would argue that this one is more of a hybrid between consumer discretionary and consumer staple. But let’s go along with it.

Target has 1,909 stores in the United States. Since September 2019, the company has only dipped into the “hold” range once. It’s steadily maintaining a “B+” rating.

Unlike many companies, Target not only maintained its dividend last year, it increased it. Additionally, it announced an increase for the upcoming September payment. Shares are up 47% this year.

Worthy of an honorable mention and ranked fourth was pandemic favorite Dollar General Corp. (NYSE: DG). It was one of the few stocks upgraded last year to the “A” range, holding that status through the end of the year.

It currently has a “B+” rating, so the company hasn’t exactly fallen from grace. The downgrade was due to a noticeable decline in the total return index and volatility index ... meaning we could see less total return and more volatility than previously indicated.

There were 91 “buy”-rated stocks when I looked at the consumer discretionary sector this morning, meaning lots of great opportunity for your portfolio.

If you want to see the full list, head over to the WeissRatings.com stock screener. Here are the search criteria I used:

|

The ratings are always a great resource, and I highly recommend you check them out.

Best,

Kelly Green