When This Key Market Sector Rolls Over, It’s Best to Pay Attention

|

There are all sorts of businesses in the world. But the basis of all economic commerce really boils down to just two outcomes: (1) Making things and (2) Delivering those things.

I call them the "makers" and the "takers."

The maker world is extremely diverse. Clothes, electronics, building materials, food, beer ... you name it. Overlay the ever-changing whims of American consumers, and you have a hodgepodge of business signals that's as hard to wrap your hands around as a greased pig at the county fair.

The transportation industry — the takers — is more homogenous. After all, a railroad car from Burlington Northern isn't any different than a railroad car from Norfolk Southern (NSC). Neither is a 16-wheel semi-truck from J.B. Hunt (JBHT) or Knight-Swift Transportation (KNX).

Teaser: My experience has been that the "takers" are a very reliable forward-looking indicator of the U.S. economy – and this is what they’re saying about the future right now ...

My experience has been that the "takers" are a very reliable forward-looking indicator of the U.S. economy …

|

That's why I pay careful attention to the transportation sector, especially the trucking industry.

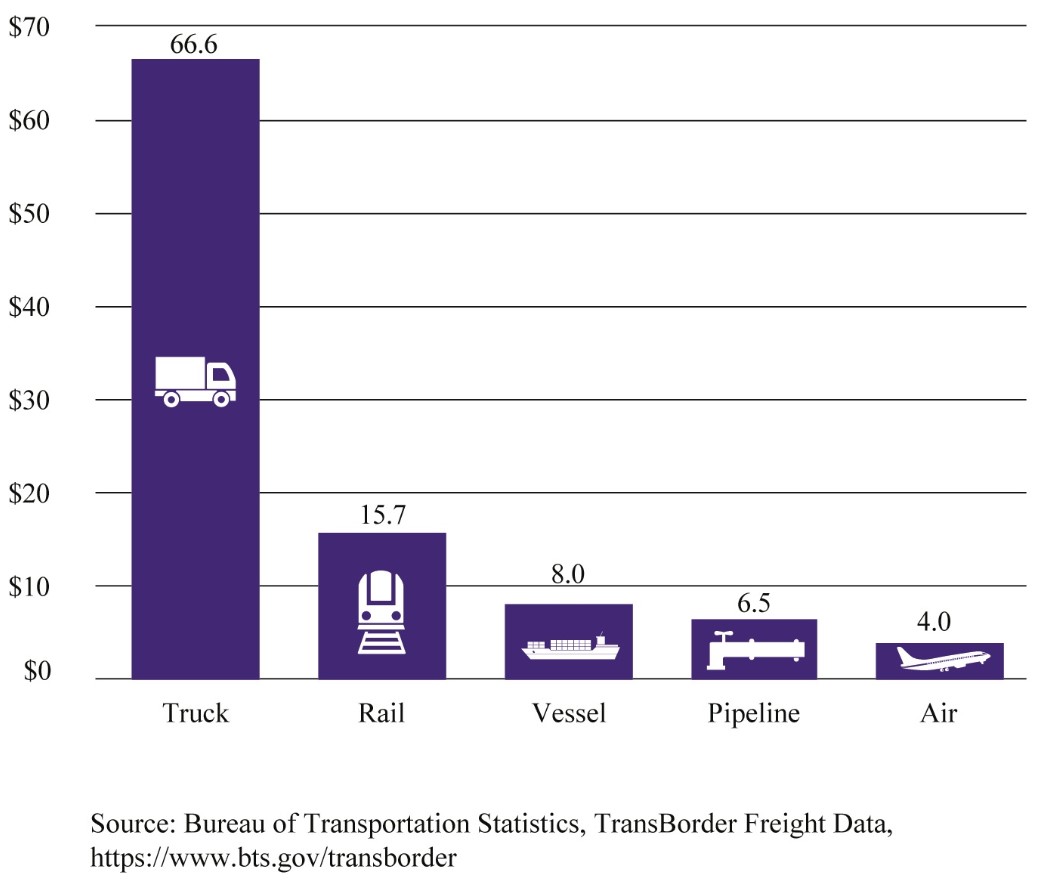

The reason the trucking industry is so important is that almost 70% of all the goods that are shipped around the U.S. are transported by trucks.

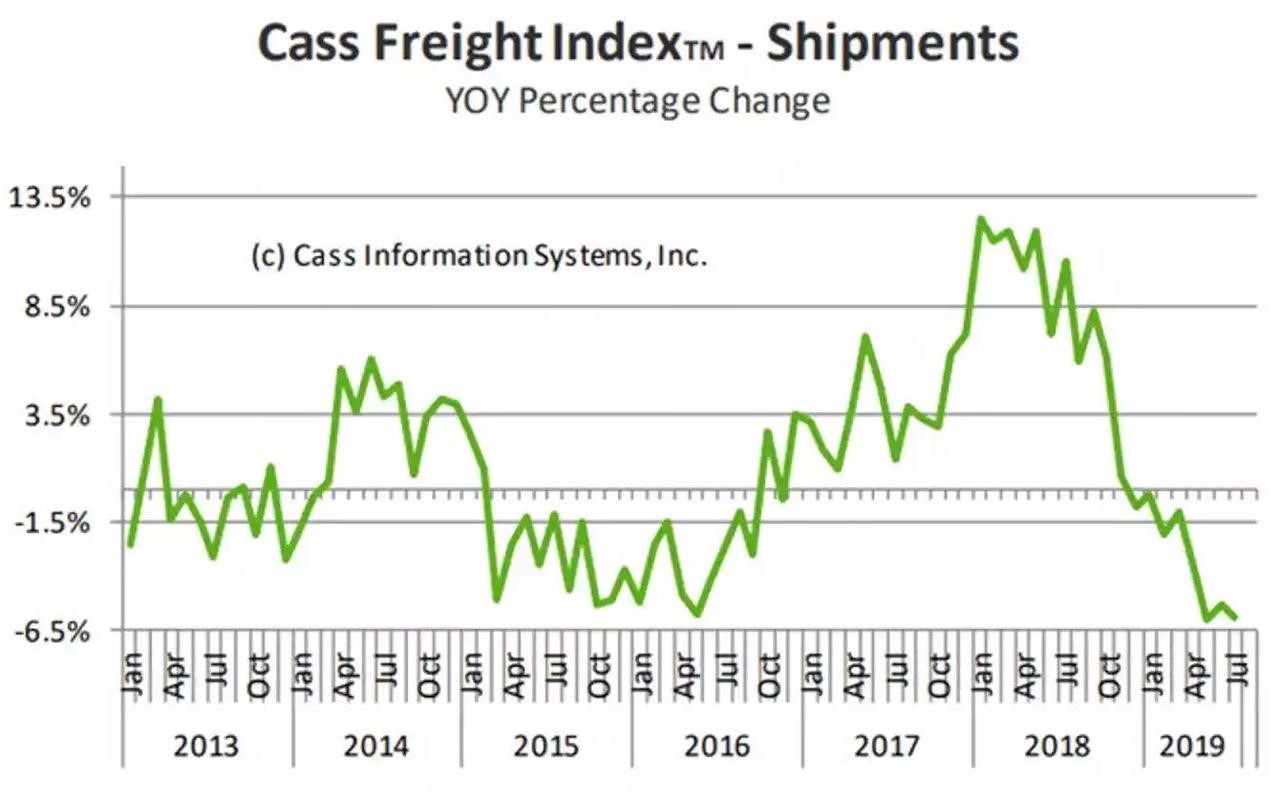

The Cass Freight Index, an index of freight shipment activity, has been falling like a rock. And the newest round of Trump tariffs is only going to make thing worse.

|

- National freight carriers like B. Hunt, Knight-Swift and Schneider National (SNDR) have told Wall Street to lower their expectations for the rest of the year.

- Orders for heavy-duty, class 8 trucks (what you and I call semi-trucks) dropped to a 10-year low in the first six months of 2019.

- The Dow Transports dropped by 8% in August, compared with a 5% drop for the Dow Industrials.

Those are pretty ominous signs. But these weak data points from the transportation industry don't mean the stock market is going to fall out of bed tomorrow morning.

The last time the trucking industry slumped like this was in the last half of 2006. As you know, the financial crisis and Great Recession started in January 2008. But the stock market didn’t top out until late 2007.

In addition to what can be a lengthy lag, any resolution to the tariff war with China would give the transportation industry a steroid shot of new business.

However, I think it is a big mistake to ignore the distress signal that the transportation industry is delivering. Earlier this week, I made a significant change to the Weiss Ultimate Portfolio to make it more defensive and lock in some of the monster gains we've made this year.

I highly recommend that you incorporate a clear strategy to protect your portfolio when the stock market turns south. And buy-hold-and-pray is NOT an investment strategy.

Best wishes,

Tony Sagami