|

| By Tony Sagami |

People ask me all the time if internal combustion engines are going away. I don't think so, and Warren Buffett doesn't either — at least not any time soon.

Warren Buffett's Berkshire Hathaway (BRKA) just purchased 3.7 million shares of Occidental Petroleum (OXY) for $216 million.

That's not his first purchase of OXY stock, either. Berkshire Hathaway now owns 211.7 million shares, worth about $12.6 billion, and OXY is now its seventh largest holding.

Berkshire Hathaway also owns $10 billion of Occidental Petroleum preferred stock with an 8% dividend, plus warrants that permit Buffett to buy another $5 billion of common shares at $59.62.

Also, Berkshire Hathaway has asked for and received permission from the U.S. Federal Energy Regulatory Commission to buy as much as 50% of Occidental Petroleum.

Berkshire Hathaway started buying shares in Burlington Northern Santa Fe railroad in 2008 and gradually increased its stake to 22.6% before paying $26.5 billion to buy the entire company in 2010. I would not be surprised if he did the same thing with Occidental Petroleum.

I'm only half as smart — maybe less — as Buffett, but he clearly believes the fossil fuel business has a bright, prosperous future.

That does not mean you should load up on fossil fuel stocks. In fact, I think there is even more opportunity in renewable energy stocks.

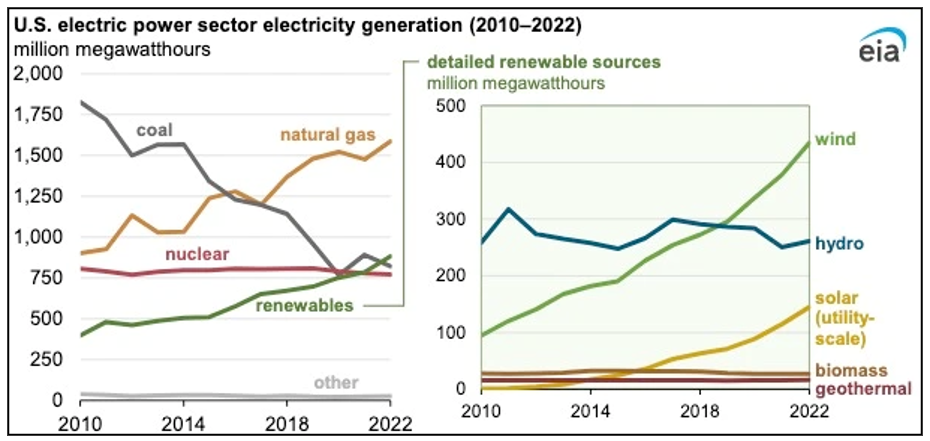

According to the U.S. Energy Information Administration, the amount of renewable power generation — wind, solar, hydro, biomass and geothermal — exceeded nuclear and coal-fired generation in 2022 for the first time ever!

Click here to view full-sized image.

U.S. power stations produced 4,090 million megawatt-hours of power in 2022.

Of that, natural gas is the largest source of electricity generation in the U.S. and has grown from 37% in 2021 to 39% in 2022.

The renewable growth came from wind and solar, which increased from 12% in 2021 to 14% in 2022.

Between solar and wind, however, the most growth is in wind. According to the EIA, solar capacity increased from 61 gigawatts in 2021 to 71 GW in 2022, while wind capacity grew from 133 GW in 2021 to 141 GW in 2022.

The EIA forecasts that both wind and solar will grow by 1% in 2023. But as the attached chart shows, wind is beating solar by a wide margin.

If you want to add wind power to your portfolio, there are several stocks you should consider.

Northland Power (NPI.TO) is a Canadian power producer focused on renewable energy — including wind farms, natural gas and solar energy facilities.

TransAlta Renewables (RNW.TO) is a Canadian renewable energy company that owns and operates wind, hydro and natural gas power plants.

NextEra Energy (NEE) is an electricity power producer utilizing wind, solar, nuclear, coal and natural gas.

Vestas Wind Systems A/S (VWDRY) is a Danish wind energy company that owns massive wind farms in the U.S. and northern Europe.

Clearway Energy (CWEN) is one of the largest renewable energy operators in the U.S., with 5 GW of wind and solar energy projects and 2.5 GW of natural gas generation facilities.

TPI Composites (TPIC) manufactures wind turbine blades that produce one-third of all the onshore wind turbine blades.

If you are more of an ETF investor, take a look at First Trust Global Wind Energy ETF (FAN) and Global X Wind Energy ETF (WNDY).

Click here to view full-sized image.

Wind energy will play an increasingly important role in reducing carbon emissions and should be an integral part of every green energy investor's portfolio.

And you just might make more money than Warren Buffett does on his Occidental Petroleum shares.

All the best,

Tony

P.S. According to my friend, colleague and Weiss Ratings Startup Investing Specialist Chris Graebe, the recent banking panic is already driving promising companies to equity crowdfunding, an alternative funding that allows regular, nonaccredited investors to invest in early, pre-IPO companies. This presents a huge opportunity for Weiss Members. Earlier this week, Chris unveiled one such opportunity that is well positioned to disrupt a $100 billion industry. Click here to learn more about how to claim an early stake.