3 Shocking Charts: Don’t Let Them Crush Your Income

|

You know all about ridiculously low-income interest rates.

You’re reminded every time you check your bank CD or money market account.

If they pay you more than 0.30%, they think they’re giving you a “great deal.”

You also know about the inflation surge — not just on things they can blame on supply bottlenecks like food and gas prices …

But also on medical care, college tuition, housing, even water and sewerage charges.

So, let me ask you some basic questions …

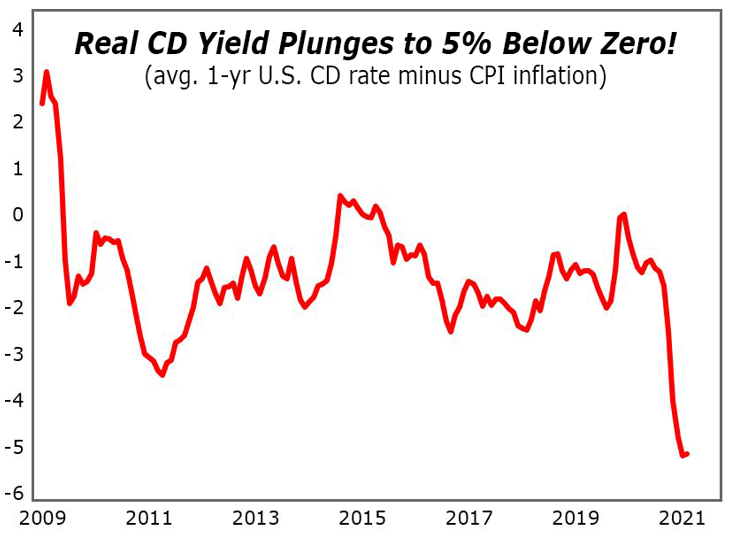

Have you seen how bad the interest-rate crush really is?

Have you seen the real drama of the inflation surge?

Do you realize how truly unusual and extreme this combination is?

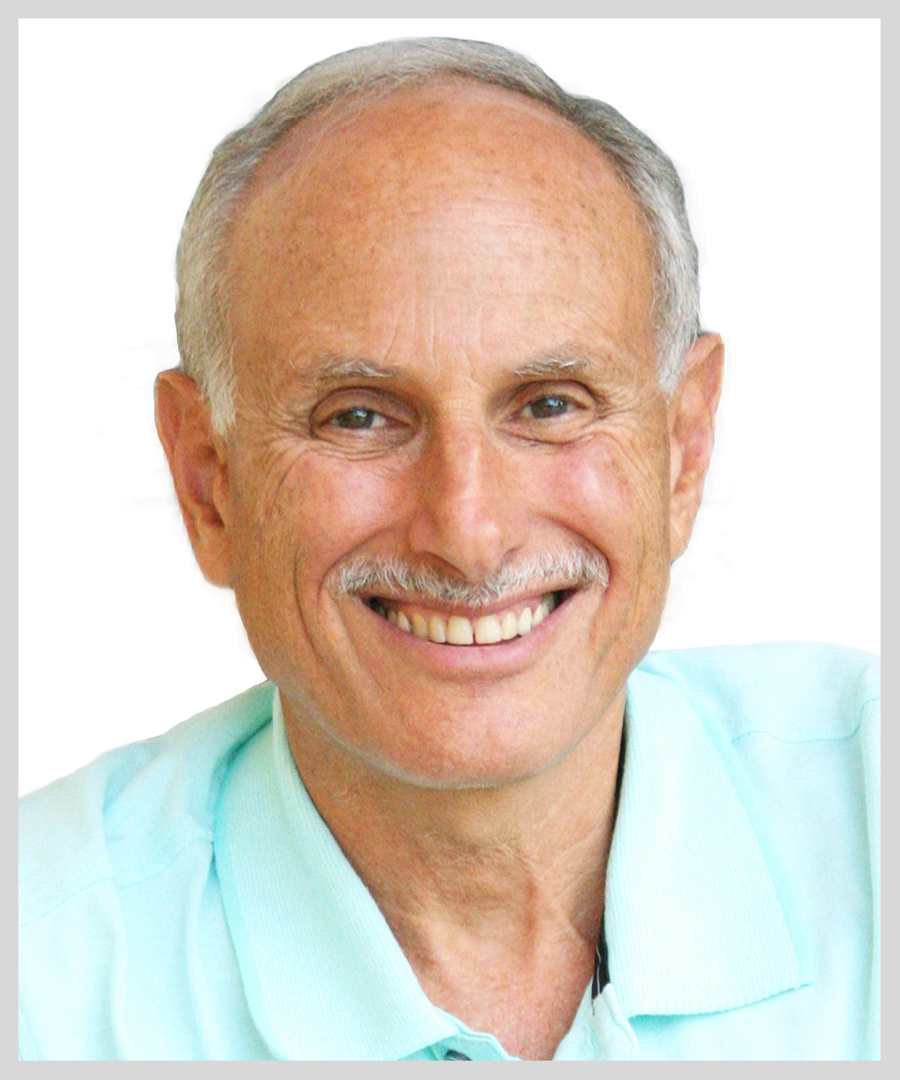

Start with the money you can earn today on a one-year bank certificate of deposit in the United States …

|

Even in the depths of the Great Recession, when abnormally low yields on your money were no big surprise, it was far higher, at 1.2%.

Now, a decade since the end of the Great Recession, it’s less than one-sixth that much — 0.17% to be exact.

That was bad enough a few months ago when inflation was mostly flat. But now look …

|

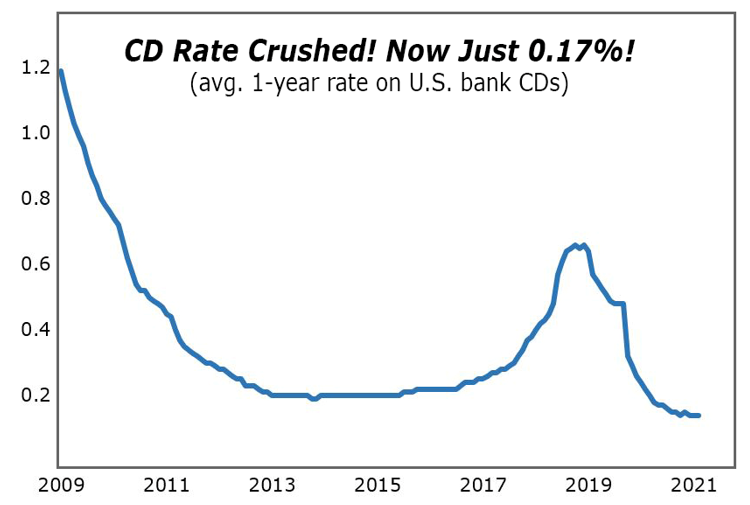

U.S. consumer prices have now surged at their highest pace in 13 years.

Whenever inflation surges like this, interest rates are supposed to rise in tandem, right?

Indeed! That’s what has happened since time immemorial.

But not this time.

This time, the Fed’s monetary jujitsu players have not only slammed interest rates to the mat ... but they’ve also kept them pinned despite the raging inflationary fires.

That’s extreme.

In all the 50 years I’ve been studying interest rates, I’ve never seen anything like this before.

And the consequences for income investors are an unmitigated disaster:

|

After inflation, you lose 5%!

Hard to believe? Then, watch how this works out, play by play …

You plunk down $10,000 in bank CD and lock it up for a full year.

At the end of the term, you collect $17 in interest (before taxes).

Heaping big insults onto small injuries, inflation eats away 5.2%, or $520, from the purchasing power of your principal.

You LOSE $503.00!

The big question is: What do you do about it?

Do you switch from bank CDs to 10-year Treasury notes?

Hah!

Their average yield right now is just 1.24%. So you’d still be losing nearly $500 per year.

What about high-yield junk bonds?

Even worse!

You still lose money — about $100 per year on each $10,000 invested. But on top of that, you risk a massive hit to your principal.

During the pandemic panic of 2020, for example, the average junk bond lost more than half its value almost overnight.

If something like that happens again, instead of losing “just” $500 (on your CD), you’d be losing more than $5,000 (on your junk bonds).

What’s a true solution?

Stand by.

In the days ahead, I will send you tutorials on not just one, but TWO ways to escape this maddening dilemma … giving you the opportunity for returns that far surpass anything available in any bank or bond.

Good luck and God bless!

Martin