|

All four of the places in the world where I’ve spent the most time in recent years have experienced frightening surges in COVID-19 cases.

One is northern Italy. We go there to visit our dear friends, who used to own an antique shop here in the United States.

The surge there is mostly behind them (for now), but a big lesson they learned was that health care professionals were far more vulnerable than anyone dreamed possible.

In less than three months, over 150 Italian doctors died of COVID-19, and thousands more were infected.

The second place is Samara, Russia, the hometown of our ballroom dance teacher. We’ve been going there almost every September to visit her family or vacation at their favorite resort in the Caucuses Mountains.

But this year, it’s absolutely out of the question; their region has been hit hard.

Just a few weeks ago, a 69-year-old aunt had a heart attack and was rushed to the ICU. Her daughter was told she’d need ten days in the hospital to recover. But the very next day, a nurse called. “Come pick up your mom and take her home immediately,” she said. When asked why, the nurse was mute.

It was only later that the family discovered the reason: The patient’s doctor had come down with COVID-19 and had infected countless patients. But by that time, it was too late. The aunt and her entire family were also infected.

Obviously, Russia did not learn the lesson from Italy.

Nor did most people in the interior of São Paulo state, Brazil, the third place we go frequently — to stay on our family farm.

On a WhatsApp call this morning, I learned that the nearby town is struggling with the same issue. In one hospital alone, 10 out of 12 doctors are infected, in quarantine and unable to attend patients.

You’d think the story here in South Florida, where we live, would be entirely different. But unfortunately, it’s not.

The SunSentinal reported that doctors at several hospitals in this area were asked to continue treating patients even after they were exposed to the new coronavirus.

In fact, unless they showed actual symptoms, health-care workers were initially expected to keep working and told NOT to follow public health recommendations to isolate themselves for 14 days.

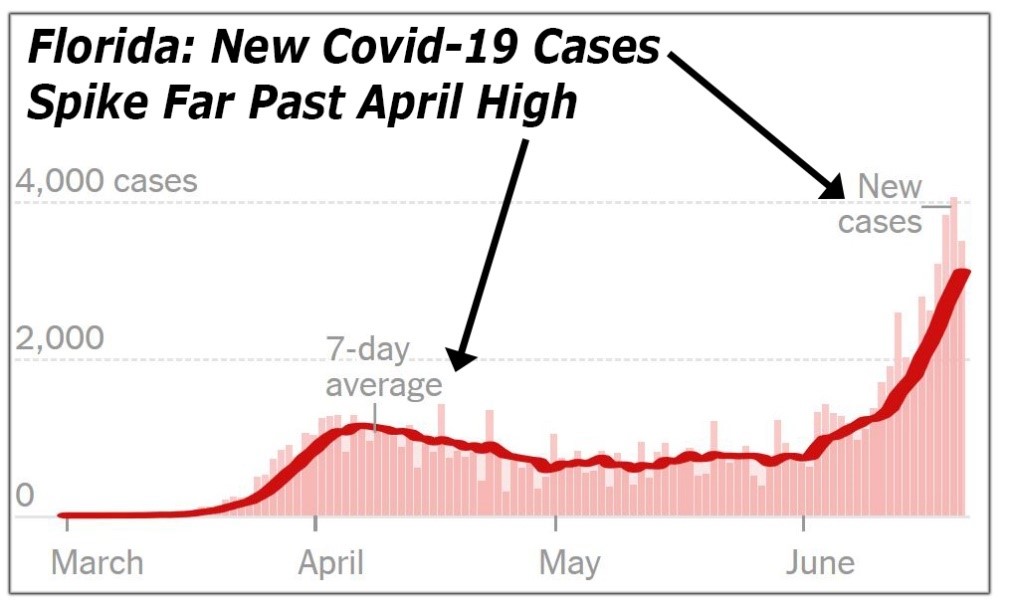

This is one of the many reasons that the number of COVID-19 cases in Florida have just surged, greatly surpassing their highs reached in April.

|

And Florida is not alone. The coronavirus is now spreading in more regions and countries of the world than ever before.

This does not augur well for global financial markets.

So, I often ask myself,

Why can’t we learn from the obvious mistakes of others?

I guess I shouldn’t be surprised. Heck, a lot of smart people can’t even learn from their own mistakes.

Consider the folks at the Federal Reserve, for example.

They’ve forever known that mass money printing is a financial cure worse than the disease.

They’ve forever known that it creates giant speculative bubbles that inevitably burst and tear the economy apart.

Yet, mass money printing is what they tried in the Tech Wreck of the early 2000s, which then led to the Great Financial Crisis of 2007-2008.

It’s what they tried in the Great Financial Crisis, which led to the “everything bubble” of recent years.

And it’s what they’re doing again right now!

But each time, instead of learning the lesson, they just double down and print many times more.

Most stock investors are also poor learners from history or even from their own personal experience.

They rush to buy hot stocks that are grossly overvalued … get killed when the stocks crash … lick their wounds … and then, in the next cycle, rush to buy a whole new set of overvalued stocks.

Here’s our solution:

Five simple steps to build cash and reduce your exposure to risky stocks in these volatile times.

Step 1. Go to www.weissratings.com. At the top of the page, you will find a search window like this:

|

Step 2. At the right side of the search window, click on the down arrow. Select the category “stocks.” This is important because we also issue Weiss Safety Ratings on banks and other financial institutions. But for this purpose, what you want is the Weiss Stock Ratings.)

Step 3. Enter the company name or ticker symbol as shown.

Step 4. Seriously consider selling stocks rated “D+” or lower. Just bear in mind that, in a broad bear market, higher rated stocks can also lose value.

Step 5. Then, for any stocks you hold in your portfolio, create a Weiss Ratings Watchlist and be sure to add them to the list. That way, whenever our rating for your stock changes, we’ll be sure to send you an email alert.

Good luck and God bless!

Martin