4 Steps to Take When Fed Cuts Don’t Boost Borrowing

|

You can lead a horse to water, but you can’t make it ... borrow money?

I know that’s not how the saying usually goes. But it’s a version that applies today. And that has incredibly important implications for investors like you.

Let’s start with a few basic policy points:

The Federal Reserve cuts interest rates to stimulate borrowing and lending ...

Because when it’s cheaper to borrow money, more consumers and business do so.

This, in turn, results in more spending and investment. And that keeps the economy chugging along.

That’s the theory anyway. And it works reasonably well ... most of the time.

But in every single modern economic cycle, things eventually reach an exhaustion point. No matter how cheap the Fed makes money, borrowers stop borrowing it. Lenders stop lending it. Investors stop using it to speculate in financial markets.

And the cycle turns.

Just look at what happened with housing and mortgages in the mid-2000s. Once house prices started falling, defaults started climbing and banks started losing buckets of money.

What happened? The economy ground to a halt. And even though the Fed slashed its benchmark interest rate from 5.25% to practically 0%, mortgage lending and the housing market cratered anyway.

Fast-forward to today and some interesting things are happening. The Fed stopped raising rates back in December 2018. Then it cut them three times last year, by a quarter-point each in July, September and October.

The official funds rate target range is now 1.5% to 1.75%. In testimony before Congress this week, Fed Chairman Jay Powell indicated he’s inclined to leave it there for the foreseeable future.

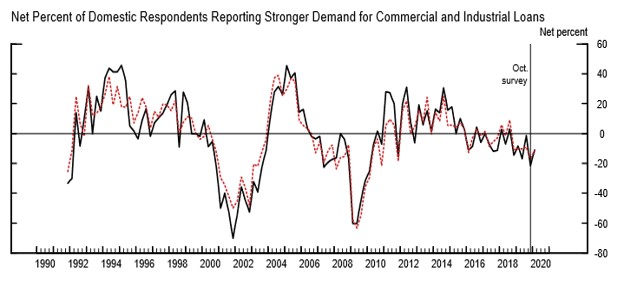

But look at this chart from the Fed’s own quarterly survey of bank lending activity.

|

|

Source: Federal Reserve Senior Loan Officer Opinion Survey on Bank Lending Practices, January 2020 |

It shows how the net percentage of banks reporting stronger demand for Commercial & Industrial Loans — or basically, core business financing — has slowly gone down over time.

This number has been sinking for the last several quarters. It’s now well below the “0% line.” This means that, on average, banks are seeing lower and lower demand for business loans.

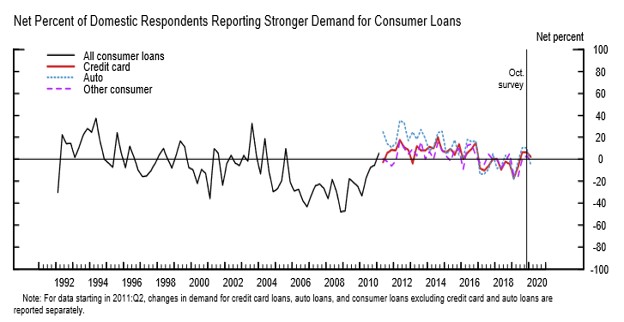

What about consumers? It’s essentially the same story. You can see that the trend is down and to the right for this index, which measures demand for credit card, auto and other consumer loans.

|

|

Source: Federal Reserve Senior Loan Officer Opinion Survey on Bank Lending Practices, January 2020 |

Even as demand is slipping, lenders are slowly but surely tightening their standards. More banks are also raising the extra “spread” they demand over and above their cost of money to make loans.

Translation: It’s gradually getting more difficult and more expensive for many borrowers to borrow money.

Things are nowhere near as tight as they were in 2008, of course. We’re not in another great financial crisis or recession ... yet.

But when I talk about a gradual, consistent turn in the credit cycle this is the kind of stuff I’m referring to. It’s one of many things that raises the risk of recession in 2020.

These charts show that the recent volatility isn’t a short-term trend, despite being spurred by the coronavirus outbreak, political upheaval in the U.S. and elsewhere. No, things have been slowing for a while.

My advice? If the Fed is having trouble getting our metaphorical horse to drink (read: borrow more!), you should keep sticking with a “Safe Money” investing strategy.

How can you do that? By following these four steps:

- Focus on higher-yielding, late-cycle, lower-volatility names in defensive sectors like utilities, REITs and so on.

- Boost your exposure to gold, silver, and precious metals miners.

- Invest in Treasuries rather than risky debt issued by junky companies.

- And carry higher levels of cash.

That approach is working best now. It’s been the best approach for more than two years. And it will work best in 2020 and beyond if I’m right about the Fed’s inability to spark a renewed borrowing, lending and spending binge!

Until next time,

Mike Larson