Airline Profits are Taking Off! Here's How to Bag Gains

If you haven't seen Martin's new Megatrends and Megaprofits video yet, I urge you to watch this urgent 2020 preview right away. Martin is revealing the entire Weiss Ratings team's 6 forecasts for 2020 … the 4 most profitable megatrends we plan to ride for the next decade … 3 risks for a stock market correction next year … what happens to the stock market after the November election … and our top 7 picks for growing your wealth safely starting today.

All this urgent information is waiting for you online here.

I'm telling you, there's no limit to how wealthy the stock market can make you. Well, maybe the sky. And even THAT is near infinite.

Here's what I mean by that …

“For a smart guy, you are really stupid sometimes,” my sister said to me once.

I don't want to say she's right. But you might agree with her after you hear this story …

See, I had booked airline tickets for the four of us — my sister, her 22-year-old son and my youngest son — to Las Vegas. Of course, I picked the cheapest tickets I could find and bought us “basic economy” seats.

Stupid me. Basic economy doesn’t allow seat selection and you have to pay extra to check luggage. The result was that three out of the four of us ended up with a dreaded middle seat, and we paid $30 for each piece of checked luggage.

Those baggage fees have become BIG business.

|

In 2018, American Airlines (AAL) and United Airlines (UAL) made a respective $1.2 billion and $889 million from baggage fees alone. According to the Department of Transportation, the U.S. airline industry as a whole made $5 billion in baggage fees last year.

In just the first quarter of 2019, that dollar amount jumped to $2.1 billion, a 25% year-over-year increase from Q1 2018.

Worse yet, now some airlines even charge for carry-on bags!

These baggage fees are becoming important profit centers for the airline industry. Particularly in the case of low-cost carriers. Baggage fees alone generated 19%, 16% and 14% of total revenues for the low-cost carriers Spirit (SAVE), Frontier and Allegiant (ALGT), respectively.

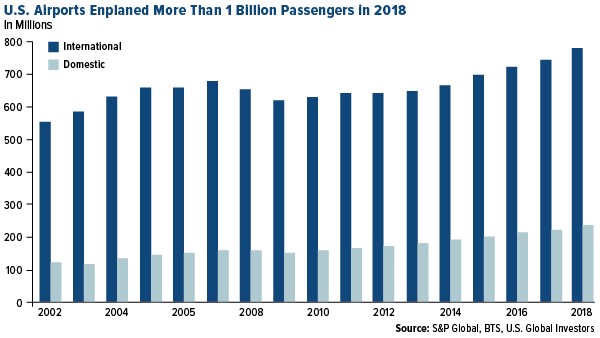

An average 2.7 million people fly every day in the U.S. In fact, 45% of Americans took at least one flight in 2018.

I can’t think of the last time I had an empty seat next to me. The average load factor (airline-speak for occupancy rates) has increased from 75% in 2005 to an all-time high of 86% last year.

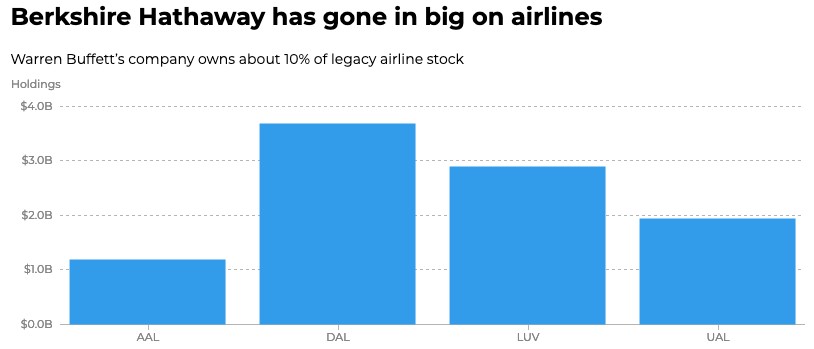

You know who really loves the airline industry? Warren Buffett, who has invested almost $10 billion in all four major U.S. carriers—

American, Delta (DAL), Southwest (LUV) and United.

|

There are several airline stocks you could buy, such as Delta, United, Southwest Airlines (LUV), JetBlue Airways (JBLU), SkyWest (SKYW), Alaska Air Group (ALK) or Spirit, all of which have Weiss Ratings in the "B" to "C" range.

If you’re more of an ETF investor, take a look at U.S. Global Jets ETF (JETS), which provides exposure to the global airline industry, including airline operators and manufacturers from all over the world. JETS currently merits a "C+" grade.

But whatever you do, never stick your little sister in the middle seat. You’ll never hear the last of it!

Best wishes,

Tony Sagami