Beat Wall Street to the Punch and Do THIS Right Away ...

Something very important has changed in the markets. Many on Wall Street don’t get it (yet). But they will. So, my advice is simple:

Beat them to the punch!

Let me explain further by first recapping how we got here. We are more than nine years into an epic bull run, the second-longest in history. Some of the move was driven by real fundamentals — an improving economy, better corporate earnings, money rotating out of bonds and into stocks, and so on.

But a large chunk of it stemmed from something else entirely: the biggest infusion of funny money in world history! Not just by the U.S. Federal Reserve, but the European Central Bank, the Bank of Japan, the Swiss National Bank and many others worldwide.

In some cases, the cash infusions were INDIRECT. By slashing interest rates 667 times and going on a $15-trillion-plus bond-buying spree, they drove rates down to their lowest levels in 5,000 years of recorded history.

In some cases, the cash infusions were DIRECT. Take the Bank of Japan. It went on the biggest ETF- and stock-buying spree in history. Last month alone, it spent 833 BILLION yen to buy Japanese stock ETFs. March’s $7.8 billion buying spree was the most in any month in history, and it has left the BOJ owning 74% of ALL the stock ETFs outstanding in Japan.

Related story: More Tech Stock Meltdown Ahead?

But the Fed started raising rates in December 2015. It has done so a total of six times, putting the funds rate at a range of 1.5% to 1.75% vs. 0% where it previously sat for eight years. It’s also beginning to wind down its massive portfolio of bonds, several billion dollars at a time.

The ECB has stated it will soon buy fewer bonds, too. And while other central banks haven’t joined the tightening bandwagon, they sure aren’t announcing new intervention programs every few weeks like they did from 2008 through 2016 or so.

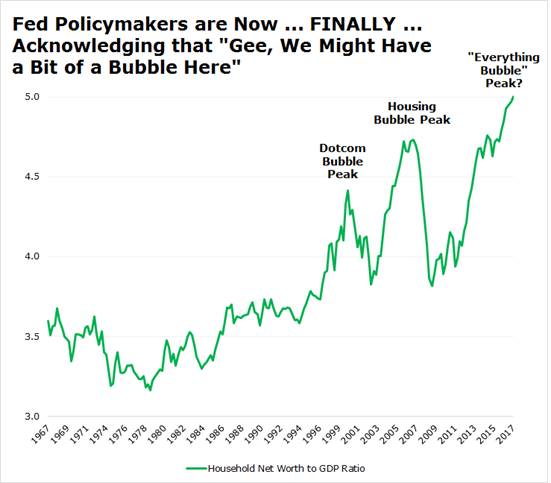

Meanwhile, even Fed officials are (finally, belatedly) warning about the “Everything Bubble” they’ve helped create. They aren’t using that term, of course. They couch their comments in Fedspeak, saying things like Governor Lael Brainard did on April 3: “Valuations in a broad set of markets appear elevated relative to historical norms, even after taking into account recent movements.” But you get the picture.

|

So, what’s the bottom line? What’s the paradigm shift here?

THE CAVALRY ISN’T RIDING TO THE RESCUE ANY MORE!

The ridiculous “We’ll bail you out on every minor dip” stuff that artificially supported the market ... and that helped inflate asset values to their highest, most bubble-icious levels in history ... is over. So, more and more often, investors are actually treating “bad news” as “bad news,” rather than just as an excuse for some policymaker somewhere to launch yet another QE program.

And what if the Fed or another central bank DOES try to intervene again? My response would be that many of the problems facing markets today aren’t the kind monetary policy can do anything about anyway — like trade wars.

Many Wall Street analysts and investors have been blinded by nine-plus years of bull market. So, they don’t get it yet. They still instinctively reach for the “Buy” button every time we get a pullback. And who can blame them? They’ve been conditioned like Pavlov’s dogs for years.

Heck, I swallowed my own philosophical disgust with the policies being enacted and played along for a few years. I bought a lot of stocks and funds in my 401(k) and my brokerage account. I recommended many, many long positions in the services I managed. And that helped make myself and my investors a lot of dough.

Related story: Why I Just Made the Biggest Changes to My 401(k) in Years

But not anymore. What worked since 2008 isn’t going to work going forward. As an investor, your response should be very simple: Recognize the change and adapt to it. If you don’t, I believe you stand to lose a fortune in the next couple of years — and there’s nothing I’d rather avoid.

To get my specific recommendations on what to do in the stock market, the bond market, and throughout your investment portfolio, be sure to check out my High Yield Investing newsletter. The next issue goes online in a couple of days and will be chock full of more details.

But here’s a tip if you’re not ready to take that step: This is a market where you want to start selling rallies. In other words, the next time you get one of those crazy multiple-hundred-point Dow rallies, use it to dump your SELL-rated stocks at better prices. I’d recommend you even lighten up on your stock portfolio overall.

Or if you’re more aggressive, start hedging or targeting downside profits using specialized investments like inverse ETFs and/or put options. I’m going to have much more on this topic in the coming weeks, so stay tuned!

Until next time,

Mike Larson