The preliminary offer by Mondelez International Inc. (MDLZ) to take over Hershey Co. (HSY) wasn’t sweet enough, and the creation of the world’s largest candy company will have to wait, or not happen at all.

Mondelez was willing to pay $107 a share, or $23 billion in cash and stock, hoping to add the Hershey brand to its Oreo cookies and Cadbury Chocolate bars and to bypass Mars Inc. becoming the number one confectioner. (Mars Inc. is privately held by the Mars family and is not publicly traded).

Any prospects of the deal were shot down by the Hershey Trust, 10 trustees to be exact, that holds most of the company’s voting power. There was no clear explanation as to why the bid was rejected.

Hershey is struggling mainly due to the fact that most of its business is based in North America where the company is facing push-back from consumers as more and more Americans try to reduce sugar in their diet and buy less candy. Mondelez’s global exposure makes it less susceptible to dietary changes in just one region making it a superior of the two.

The bid announcement sent Hershey shares soaring last Thursday—it finished the day up 16.8 percent, trading at $113.49 a share. Mondelez was up 5.9 percent trading at $45.51 per share. It is still possible the negotiations will continue and the stock value of the two companies will fluctuate accordingly.

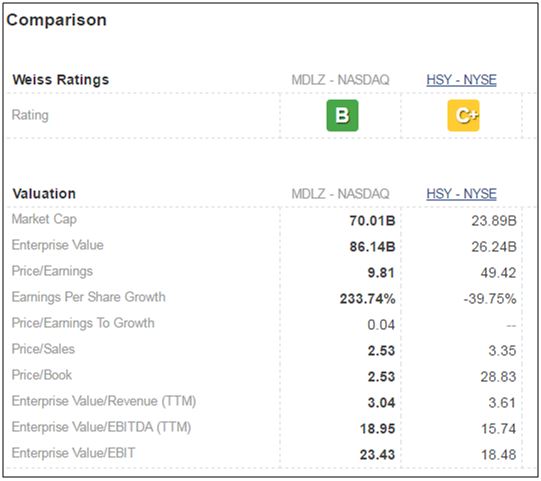

Mondelez has a $70 billion market capitalization with an enterprise value of $86.1 billion while Hershey’s capitalization is at $23.9 billion and enterprise value at $26.2 billion. Mondelez’ net income of $7.5 billion overshadows Hershey’s $498.1 million and its superior profit margin of 26.5 percent is above Hershey’s 6.8 percent.

The comparison below was built using Weiss Rating comparison tool where you can set up companies side by side for analysis.

Hershey has $5.3 billion in assets and represents 0.5 percent of the consumer staples sector while Mondelez holds $64 billion in assets and represents 1.3 percent of the sector.

Mondelez currently holds a B rating from Weiss after being downgraded back in March. Hershey was upgraded to C+ in May.

We will see what happens next … will Mondelez increase its offer to sweeten up the deal for the Hershey’s trust and the deal will go through, or will this be the end of it?

Follow these two stocks by adding them to your Watchlist and we will send you an email with any rating changes.

Stocks

Lions Gate Entertainment (LGF), the studio behind “The Hunger Games” movies and “Mad Men” TV show, buys Starz (STRZA) for $4.4 billion in cash and stock deal. The company hopes to add stability through Starz subscriptions to its volatile studio business and aims to increase revenue.

Lions Gate stock dropped 3.4 percent, trading at $20.23 per share by the end of last Thursday and Starz was up 5.9 percent at $29.92 a share. Lions Gate currently holds a D+ (SELL) investment rating from Weiss and Starz receives a C (HOLD).

The agreement marks another big media deal this year with Charter Communications acquiring Time Warner Cable back in May.

ETFs

With global economy in the turmoil it is difficult to find a place where your money can be invested without worries. Many investors, big and small, believe that precious metals are the safe house for you cash.

Based on Weiss Rating’s analysis of Commodities Precious Metals ETFs we can see that these funds offer year-to-date returns that exceed 30 percent, but they fall in either HOLD (C rated) or SELL (D or E rated) categories making them riskier than any of the BUY (A or B rated) ETFs.

Here is the list of all BUY ETFs that may offer lower risk but in exchange you might get lower returns.

Click here to explore all Weiss rated ETFs, click on any one of them for additional details and reports.

Mutual Funds

As if investing wasn’t enduring and complicated enough, Brexit made it so much more difficult to decide what to do and where to place your hard-earned cash to protect it from the widespread financial turbulence caused by the U.K.’s decision to leave the European union.

Many saw their 401k values drop, the money that you’ve been investing for your retirement is facing uncertainty. We can help you to alleviate some of the stress by doing all the research.

All you need to do is use our mutual funds screener to find investments that fit your needs the best. Simply click on “+Add Criteria” and begin slicing and dicing over 27,000 Weiss rated mutual funds.

You can look for the highest rated funds with highest returns over a period of time and you may even add that you want those funds to be cheap. Select your criteria and see what comes up!

Click here if you need any further assistance on how to use our screeners.

Banks

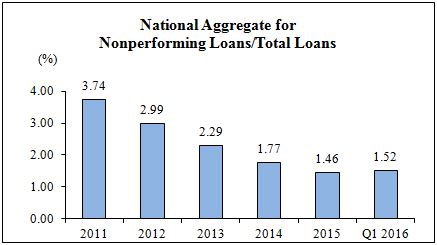

Weiss Ratings’ Q1, 2016 U.S. bank data analysis indicated a slight increase in the aggregate non-performing loans as a percentage of total loans. It was 1.52 percent as of Q1, 2016, up from 1.46 percent in the prior quarter. The increase is small yet indicative of possible underwriting flaws and may also point out a slow-down in the job market and the overall economy.

From the graph below, you can see that although 1.52 percent of non-performing loans in Q1, 2016 is higher than the 2015 year-end, it is significantly lower than 3.74 percent in 2011 and the years that follow.

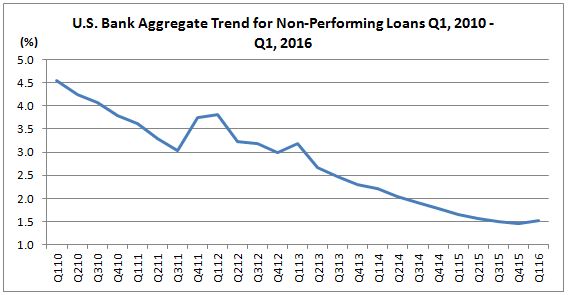

Five year quarterly trend graph below indicates that Q1, 2016 non-performing loans went up quarter-over-quarter for the first time since Q1, 2013.

A loan is considered non-performing when it is past due 90 days or more and its full repayment is doubtful. A low percentage of these loans is better; it indicates that a bank is underwriting responsibly contributing to the overall health of the institution and the economy.

Credit Unions

Weiss Ratings upgraded the safety ratings of 708 credit unions and downgraded 605 based on its analysis of first quarter 2016 results. Weiss, the nation’s leading independent provider of bank, credit union and insurance company ratings, analyzed over 6,000 credit unions.

Weiss Ratings recommends that consumers do business with institutions rated B+ or better. Currently, 811 credit unions, or 13.5 percent, are rated B+ or better, meriting inclusion on the Weiss Recommended List.

For recommended credit unions with assets of $1 billion or more, click here.

Insurance

Last week, Weiss Ratings released Q4, 2015 safety ratings on 670 health insurers upgrading 70 and downgrading 87 of them.

Weiss Ratings recommends that consumers do business with institutions rated B+ or higher. Currently, 72 insurers in the health industry, or 10.7 percent, are rated B+ or better.

To see strongest health insurers (Weiss safety rating of A or B) click here, for the weakest (D and E rated) click here.