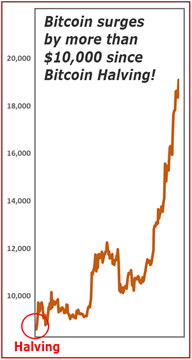

Bitcoin Surges by More Than $10,000 Since May! Here’s What’s Coming Next ...

|

In February, we alerted you to a landmark event coming in the Bitcoin market.

We said it would happen in mid-May.

And we said it would drive Bitcoin through the roof.

Now, that’s exactly what has happened

The landmark event was the Bitcoin halving, a pre-programmed 50% cut in new Bitcoin supplies.

It took place right on schedule — on May 11.

And since then, it has driven Bitcoin prices through the roof — by more than $10,000.

See for yourself ...

|

On the date of the halving, Bitcoin closed its trading day at $8,602.

Two months later, it pierced the $10,000 level.

It took just another nine days to break through resistance at $12,000.

And since then, it has knocked down one barrier after another in rapid succession:

$13,000 three days later ...

$14,000 11 days after ...

$16,000 in eight days more ...

$18,000 in another eight days ...

And now, close to $20,000.

That’s fast.

But it’s not nearly as fast as other digital assets meriting high Weiss Crypto Ratings.

Look, I’m 74 years old.

I’ve personally witnessed decades of history on nearly every continent. And I’ve seen some truly crazy times.

Booms and busts. Hyperinflation and deflation. Military coups, civil wars and social revolutions. Not to mention sweeping technological revolutions.

But I have never seen anything like the wild things happening around the world today — almost all big drivers behind cryptocurrencies.

Even before the latest crisis began, the global economy was already in transition, already on the verge of turmoil with a massive shift in wealth and power.

Then, a frightening new coronavirus suddenly burst onto the scene, spread rapidly around the globe and mutated into an even more contagious strain.

Our cities became ghost towns. Global markets plunged. Leaders lurched from inaction to reaction.

The U.S. Federal Reserve unleashed the greatest tsunami of money printing in the history of civilization.

And massive amounts of wealth rushed from the brick-and-mortar economy to the modern-digital economy.

All these sudden changes — the pandemic, the economic collapse, the Fed money printing and the massive shift in wealth to the digital economy — happened in rapid succession, one right after the other.

And nearly all of these changes are helping to drive crypto values higher.

What’s more, they’re continuing to accelerate right now!

But the dramatic changes you’ve seen so far pale in comparison to what’s coming next.

I’m talking about the great crypto revolution — and the single greatest investment opportunity — the world has seen in centuries past ... or will probably see in centuries to come.

This money revolution will transform nearly every investment and nearly every investment MARKET in the world today.

It will radically change how you borrow and lend money, how you buy and sell stocks, bonds, commodities, real estate and more. It will directly compete with — or even replace — stockbrokers, commercial banks, investment banks, even central banks.

It’s so pervasive, so fundamental and so far-reaching that I can only describe it as the “Greatest Money Revolution of All Time.”

Stay tuned. Because we will be telling you a lot more about it in the days ahead.

Good luck and God bless!

Martin