How did I get started in this business? As a stockbroker for Merrill Lynch in the 1980s. In retrospect, I cringe at how naive and dumb I was

back then.

But I somehow managed not to destroy anybody’s financial life. And I made some of my customers a bunch of money by selling them long-term bonds when short-term interest rates were 10%-plus.

However, the biggest mistake I made was not getting them to buy Microsoft stock.

At the time, I was working in Tacoma, Wash. Microsoft was just down Interstate 5 and constantly in the local news.

I simply didn’t understand the simple-but-crucial solution that Microsoft provided. The company was making it possible for computers all around the world to talk to each other via Microsoft DOS and later Microsoft Windows.

What a missed opportunity!

|

Microsoft stock has split nine times, which means that someone who bought 100 shares back when I was a stockbroker would have 34,000 shares today — shares worth more than $3 million.

Yup ... more than 3 million dollars!

I wish my Merrill Lynch cubicle-neighbor — who was putting as many people as he could into Microsoft — would have grabbed me by the ears, slapped me around and told me how big of an opportunity I was missing.

Unfortunately, I don’t own a time machine and can’t go back to the 1980s. But I’m 100 times smarter as an investor today because of what I’ve learned over the years, so I won’t repeat that 1980s mistake. In fact, I see an opportunity today that I think is bigger and more potentially profitable than Microsoft.

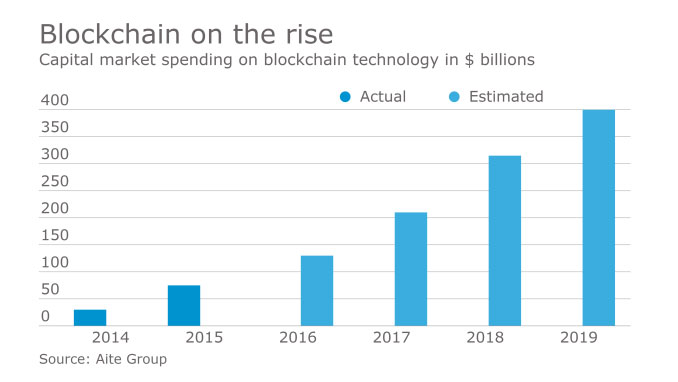

That opportunity is blockchain technology, the technological lynchpin behind Bitcoin and other cryptocurrencies.

Crypto What?

I have never bought any Bitcoin as much as I wish I would have. Old-timers like me, and maybe you, are very skeptical about the cryptocurrency mania.

Instead of investing in some of the most-talked-about cryptocurrencies, like Bitcoin, Ethereum, Dash, Ripple, Litecoin or Lisk, just to name a few, or any of the silly-sounding cryptos like Bananacoin and Dogecoin, I am instead talking about the underlying technology that makes cryptocurrencies work.

The technology that anchors Bitcoin, known as blockchain, was the revolutionary technological development that made Bitcoin possible.

|

Sure, Bitcoin was a groundbreaking development. But more important was the underlying algorithm that made the cryptocurrency work.

And it is the offshoots of those hyper-secure algorithms, the infrastructure providers of the cryptocurrency food chain, where big money is to be made.

There are some publicly traded stocks that I think have the potential to triple, quintuple or even increase by tenfold over the next few years. But the easiest way to get started investing in the cryptocurrency food chain is with ETFs.

There are four ETFs that focus on companies involved with the transformation of business applications though development and use of blockchain technology:

• Amplify Transformational Data Sharing ETF (BLOK)

• Reality Shares Nasdaq NexGen Economy ETF (BLCN)

• First Trust Indxx Innovative Transaction & Process ETF (LEGR)

• Innovation Shares NextGen Protocol ETF (KOIN)

Warning: None of these four blockchain ETFs are very large. The two largest — Amplify Transformational Data Sharing ETF (BLOK) and Reality Shares Nasdaq NexGen Economy ETF (BLCN) — both have less than $200 million in assets under management and often trade less than 100,000 shares a day.

What kind of stocks do these ETFs own? Amplify Transformational Data Sharing ETF’s top 10 holdings include Amazon (AMZN, Rated “B-”), Visa (V, Rated “B+”), Microsoft (MSFT, Rated “A”), Tencent Holdings, Taiwan Semiconductor Manufacturing (TSM, Rated “B”), Intel (INTC, Rated “B”), Oracle (ORCL, Rated “C”), Mastercard (MA, Rated “B-”), Cisco Systems (CSCO, Rated “C”), and Nvidia (NVDA, Rated “A-”).

Frankly, while each of the above stocks have dipped their toes into the cryptocurrency/blockchain world, those efforts are dwarfed by their legacy businesses. So, I consider them an ineffective way to participate in the crypto revolution.

There are many other, lesser-known stocks where life-changing fortunes can be made. Remember: The biggest profits are made by investing in things that have never happened before.

That’s been true of railroads, cars, telephones, computers, and the internet. And the next thing in line is blockchain technology.

I hope you jump on board.

Best wishes,

Tony Sagami