Declare Your Independence ... From Lousy Yields and Lousy Investments!

|

I love the Fourth of July holiday almost as much as I love Thanksgiving.

It’s a time to get together and celebrate America, shoot off fireworks, eat as much grilled food as possible and, most importantly, enjoy some quality time with family.

The latter is especially important in 2020, considering how things have gone off the rails so far this year!

Think about it: We’re in an environment where bank Certificates of Deposit (CDs) are barely paying 1% in annual interest — and that’s only if you agree to lock your money up for a half decade! The yield on the five-year U.S. Treasury just hit a fresh all-time low of 27 basis points (0.27%) yesterday, while yields on other maturities are also falling.

The Federal Reserve’s de facto takeover of the corporate and municipal bond markets is also driving yields down sharply there. This is happening despite the risk you’re taking as an investor. You should be earning more yield to compensate for the risk in buying those kinds of securities.

All of this means you have to take steps to fight back — against lousy investment options that suffer in a “Ultra-Low/Zero Percent Forever” interest rate environment.

For starters, you want to avoid almost all banks and financial stocks. Their profit margins come under intense pressure in this kind of rate environment and they’re underperforming radically as a result.

Instead, you want to add even more exposure to precious metals and mining shares. They’re among the biggest beneficiaries in a zero-rates-forever, money-printing-forever environment.

Sure enough, gold blasted through long-term resistance at $1,800 an ounce earlier this week. Silver and mining shares are also surging, with the latter handily beating the S&P 500 — and utterly trouncing financial stocks.

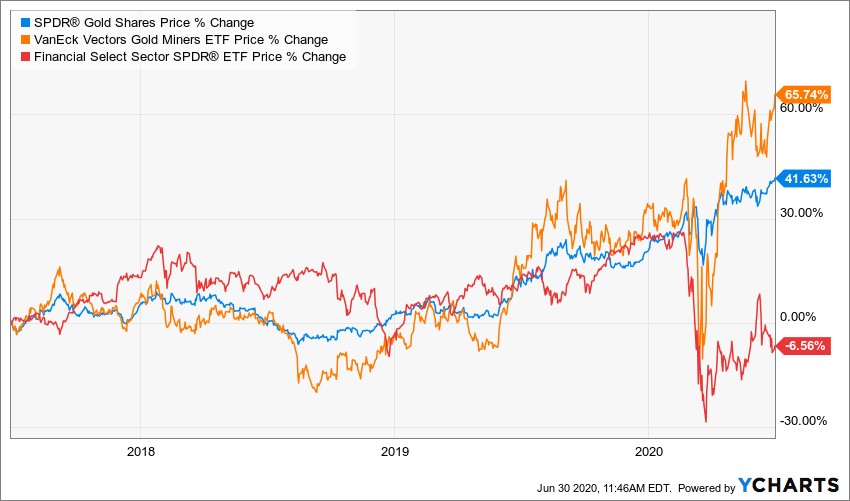

Just look at this chart: You can see that simply owning the SPDR Gold Shares (NYSE: GLD, Rated “B”) would’ve returned more than 41% in the past three years. Owning the VanEck Vectors Gold Miners ETF (NYSE: GDX, Rated “C+”) has performed even better, with a return of more than 65%! During that same time, you would’ve LOST more than 6% with the Financial Select Sector SPDR Fund (NYSE: XLF, Rated “D+”).

|

What else should you do? Focus on high-quality, higher-yield, higher-rated income stocks. I’m talking about those that are in the “sweet spot” when it comes to yield — more than the S&P 500 but not TOO MUCH more — and that pass rigorous dividend sustainability tests.

That’s what I do in my Safe Money Report, and you can find out more about the strategies I use (plus get specific recommendations) by clicking here.

Finally, there’s one last way to fight back: Consider alternative, unique, high-success-rate strategies that are tailor-made for generating “windfall” income in this kind of environment.

I’m talking about an approach that generates significant payouts week after week, month after month.

Weiss Ratings has spared no expense in developing this strategy. We’ll explain how it works in a FREE webinar, Instant Income, TODAY at 2 p.m. Eastern. Be sure to click here to save your spot.

I think it’s well worth your time to check it out!

Above all, I hope you have a safe, enjoyable holiday — and that you enjoy the feeling you get from declaring independence from lousy yields!

Until next time,

Mike Larson