Emerging Market, IPO Meltdowns Show Risk of Chasing Easy-Money-Fueled Moves

Exactly one week from today, I’ll be flying out west to speak with hundreds of investors just like you at the MoneyShow San Francisco. I hope you’ll have the chance to join me. The conference runs from Aug. 23 to 25, and you can register to attend for free here.

Given the recent market turmoil, I have a TON to talk about. But it all revolves around a central theme: the unwinding of the easy-money-fueled “Everything Bubble” that's clearly getting underway.

Look at the recent upheaval in emerging markets like Turkey. It stems from the fact that emerging market (EM) countries and companies went wild the last few years. They issued hundreds of billions of dollars of cheap debt at rock-bottom yields as part of a gigantic central-bank-fueled bubble.

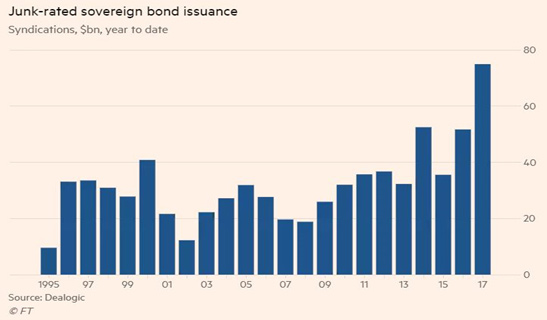

Here’s just one chart showing how nuts things got …

|

It shows annual government bond issuance by “junk”-rated sovereign nations. You can see that, in 2017, more high-risk foreign countries sold more high-risk debt than in any year in world history!

And it wasn’t just a little more. It was almost DOUBLE the level issued at the peak of the last credit bubble in the mid-2000s.

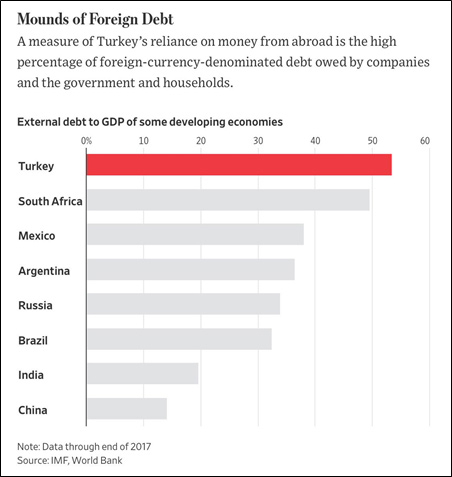

Moreover, many foreign countries issued a large chunk of that debt in dollars (and other foreign currencies, including the euro).

That’s all well and good when your currency is rising against the greenback. But when it tanks, the real cost of your debt skyrockets in local terms.

As you can see in this table, Turkey has among the highest percentages of external debt to GDP. But it’s far from alone. Other countries like South Africa, Mexico and Argentina are heavily exposed, too.

No wonder their stock and debt markets are getting hammered.

|

No single transaction illustrates the central-banker-fueled mania better than Argentina’s sale of a 100-year, dollar-denominated “Century” bond last June.

The country has defaulted on its debts over and over in the last several decades. Yet it was able to sell $2.75 billion of the 2117 bonds at a discount to face value (a price of 90 cents on the dollar).

Aftermarket demand ultimately pushed the high-risk bonds up to 104-and-change, as you can see in the chart here. But they’re plunging now, and just sank to less than 80 cents on the dollar. Oops!

|

While the collapse in foreign markets has not (yet) caused broad-based weakness in the U.S., that’s very similar to what happened in 1997-'98. A debt and currency crisis that began in Southeast Asia back then stayed “bottled up” for a while.

But eventually when Russia collapsed, the center couldn’t hold … and the Dow Industrials plunged 20% in just a few weeks!

Bottom line: More and more stocks, markets and even entire asset classes are succumbing to the draining of central bank liquidity I warned about many months ago. I’m not surprised one bit by what we're seeing now. And it’s why I’ve been saying all year to lower your stock exposure overall and invest your remaining funds much more conservatively.

I’m happy to report that this “Safe Money” approach is now performing even better vis-à-vis the riskier, tech-centric investment style that pundits keep pushing in the financial press.

In fact, I just issued two fresh recommendations in the August issue of my Weiss Ratings’ Safe Money Report. If you aren’t on board yet, you can sign up here to get them.

Rest assured they aren’t Tesla (TSLA, Rated “D”), Facebook (FB, Rated “A-”), or any of the other overhyped names everyone has been obsessing over. Nor are they any of those money-torching IPOs like Bilibili (BILI, Rated “C-”), iQIYI (IQ, Rated “C-”), Pinduoduo (PDD, Unrated), etc. that are giving up gobs of points almost every day now.

Until next time,

Mike Larson

P.S. Reader questions have flooded in all week about investing in gold, oil, the dollar and more. And Dr. Martin Weiss and Sean Brodrick are busy right this very moment, researching the answers you are looking for about the best ways to profit amid the current market cycles, trade wars, the upcoming U.S. elections and upheaval all over the globe. But don't worry — they will be ready for today's Q&A webinar, which kicks off promptly at 2 p.m. Eastern. Be sure to click this link about 10 minutes before the clock strikes 2, so you don't miss a single opportunity that they discuss!