Fed’s Print-A-Palooza Fuels Speculative Activity Everywhere

|

The COVID-19 outbreak may have put the kibosh on this year’s summer concert season. But it sure didn’t stop the Federal Reserve from launching its own “Print-A-Palooza” fest!

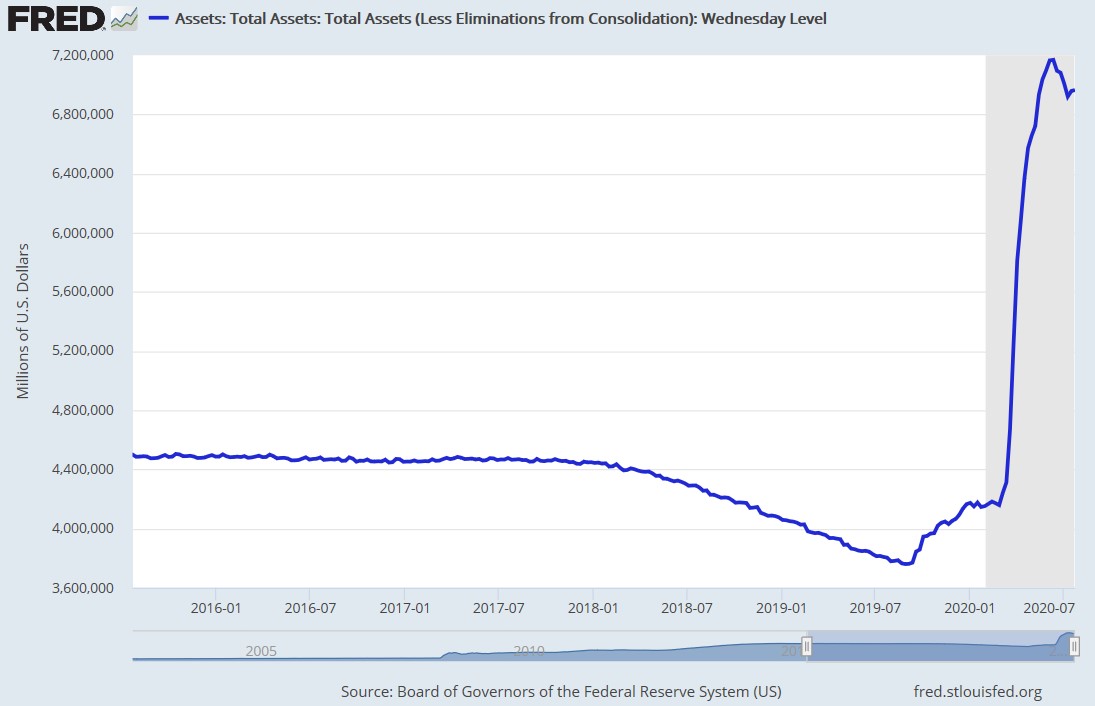

Its balance sheet has exploded 70% in the last few months. Last week it hit around $7 TRILLION! That’s up from $4.1 trillion in late February.

Alongside all that money-printing, it’s been buying or backstopping an ever-longer list of markets and assets.

Heck, there are so many acronyms and credit programs in the Fed’s weekly balance sheet reports I can hardly keep track anymore! The market has responded ...

1. The U.S. Dollar collapsed! The euro, the pound, the Canadian dollar … they’re all ganging up on the buck. The broad dollar index that tracks the greenback against six major world currencies just tanked to its lowest since June 2018.

2. Gold and silver soared! Precious metals are experiencing the strongest bull market in a decade. Gold just hit an ALL-TIME high of $1,974 per ounce early Tuesday. Silver surged above $26, its highest since April 2013.

3. Interest rates sank further! Remember that whole “V”-shaped recovery? Neither does the bond market. Treasury prices completely have reversed their May and June losses, while intermediate-term and long-term yields have tumbled to multi-month lows amid mounting economic and policy concerns.

The Fed’s aggressive approach has Wall Street in a tizzy. Speculative appetite and risk-taking is near an all-time record.

One Morgan Stanley speculation index just swung to an extreme +2.2 reading from -3.8 in just a few months. And it’s not hard to see why. Just look at this chart of the Fed’s balance sheet ...

|

The Fed is wrapping up its latest policy-setting meeting today.

Policymakers will announce the results of their deliberations, then Chairman Jay Powell will step before the podium microphone for his customary press conference.

It’s clear from recent market behavior that analysts want, need and expect more Fed rocket fuel.

They want to hear it’s being delivered today or get a strong hint it’s coming as soon as the next Fed meeting in September.

Among the options on the table, the Fed could increase the rate at which it’s buying Treasuries and mortgage bonds. It could implement Yield Curve Control, a policy that involves fixing interest rates on longer-term bonds rather than just targeting the very short-term federal funds rate. Or it could sink its teeth even deeper into the corporate debt market, the municipal bond market, the market for esoteric structures like Collateralized Loan Obligations (CLOs) and so on.

We know from experience that none of this “monetary spaghetti” being thrown against the wall will do much for the real economy. After all, years and years of QE and ultra-low rates haven’t pushed inflation or growth notably higher.

But it will make the rich 1% crowd that owns the most assets even richer. It will make the Wall Street speculators speculate even more aggressively. And it will amplify and accelerate the trends already underway.

In other words, IF the Fed gives Wall Street what it wants, you can bet the dollar and interest rates will drop even lower while metals and miners see big gains.

We will also see even-stronger outperformance by high-dividend, highly rated stocks.

This environment has been a gold mine for my Safe Money Report subscribers. They’ve been positioned to profit from surging metals, miners and income-oriented stocks. They’ve been cleaning up as a result.

If you want to join us, all you have to do is click here or call my team at 1-877-934-7778.

Or at least spend some time researching stocks, ETFs and mutual funds that invest in those sectors at our Weiss Ratings website. You can obtain proprietary Ratings on thousands of them and make sure you’re only holding the higher-graded ones.

What about the unlikely scenario the Fed signals a course change today? Perhaps in an effort to tamp down egregiously reckless Wall Street behavior and speculative frenzy?

No doubt that would lead to a correction in certain assets, including metals.

But the Fed has shown us through its actions ... repeatedly ... that it doesn’t care about long-term negative consequences of policies that fuel bubbles. All you get is occasional lip service to the contrary.

So, unless and until we see a REAL change in approach, those pullbacks should be viewed for what they are: great opportunities to buy great assets at even-greater prices.

Until next time,

Mike Larson