|

The only topic that generates more hate mail than Donald Trump is whenever I say anything critical about Tesla (TSLA).

My guess is that people that own shares of Tesla, or a Tesla car, are the most affluent members of the climate change worrywart crew. So, any criticism of Tesla — in their minds — is the same as denying climate change.

How dare I!

Well, this column isn’t about climate change or lack thereof, but about the investment merits of Tesla. And I am absolutely positive that Tesla shares are about to get hammered. And hammered hard.

Reason #1: Investors Underestimate the Competition. Tesla was the first to come out with high performance, sexy-looking electric cars. But everybody, including BMW, Fiat, General Motors, Honda, Hyundai, Nissan, Toyota, Mercedes, and Volkswagen, now offer electric vehicles.

|

Volkswagen, the largest automaker in the world, has a new electric SUV that has gotten rave reviews.

The biggest competition, however, will come from China with its cheaper labor and friendly government treatment.

|

China-based Geely has unveiled its latest electric car, the Geometry, which starts at just 210,000 yuan, or $31,250, before government subsidies. The after-subsidy costs drops to only $22,321. Tesla can’t touch that.

By the way, Consumer Reports recently pulled its recommendation for the Tesla Model 3 in February. Why? Reliability concerns.

Reason #2: Persistent Manufacturing Hiccups. Running a global manufacturing business is pretty darn complex and harder than most people realize ... something Tesla is discovering.

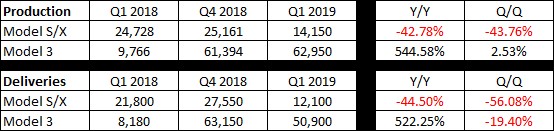

Tesla announced that it delivered 63,000 cars in the first quarter of 2019, well below the 76,000 that it had previously promised.

|

Whatever the reasons for the production shortfalls, the results are very negative to the bottom line. Tesla admitted that its Q1 revenue will “be negatively impacted” because of “lower than expected delivery volumes and several pricing adjustments.”

The one bright spot was the 50,900 of Model 3 cars that Tesla delivered. But remember: The base price of the Model 3 is only $35,000, so the one “bright spot” was for the cheapest cars that make the least amount of profit. Not good.

Reason #3: Tough Life Without Subsidies. The electric auto industry is addicted to government subsidies. Demand has dropped like a rock whenever tax incentives are reduced/eliminated.

Until recently, our government offered a $7,500 tax credit for electric cars. But that was chopped in half to $3,750 at the start of this year.

Reason #4: Heavy Millstone of Debt. Tesla is in debt up to its eyeballs. Not only does it have $9 billion of debt, but it’s also burning through cash so fast that that number will surely grow. Plus, it owes $18 billion in purchase obligations for battery cells produced by Panasonic.

|

Reason #5: Weed, Ego, and Elon Musk. While I believe a person should be able to put whatever they want into their body in the privacy of their own home, I am a redneck when it comes to marijuana.

The video of Elon Musk smoking weed on a widely watched Joe Rogan made me doubly question his ability to grow Tesla into a global automobile powerhouse.

Example: Two of the three vehicles Tesla currently sells are sedans, which have fallen out of favor with consumers who greatly prefer crossovers and SUVs.

I do think that electric vehicles are the wave of the future, but I think Tesla is the worst way to invest in it.

Best wishes,

Tony Sagami