From the Worst of Times to the Best – in Just One Year

I’ve seen some pretty crazy moves during my two decades of following the markets closely. The Long-Term Capital Management debacle. The dot-com boom and bust. The mortgage mania ... and meltdown.

It has truly been the best -- and worst -- of times. But I can’t recall ever seeing both in the same year like we did in 2016.

Think about it: On the very first trading day of the year, the Dow tanked 276 points to 17,149. Then it proceeded to melt down all the way to the 15,500 area. That represented the worst annual start for the average in its 120-year history. Concerns over China’s economy, collapsing banks in Europe, and weakness here at home all helped spark the chaos.

Yet only a few weeks later, stocks began to rally sharply. The Dow climbed right back to 18,000 in April, then quickly righted itself after the temporary shock caused by June’s Brexit vote.

Then after plunging more than 800 points in the wee hours of election day, the Dow reversed course and exploded to the upside. Ever since then, hopes that Donald Trump would usher in a period of lower regulation, lower taxes, and a large increase in infrastructure spending have been powering stocks higher – so much so that the Dow is within spitting distance of 20,000!

So what do our Weiss Ratings suggest is coming next? Can we expect healthy gains in the New Year?

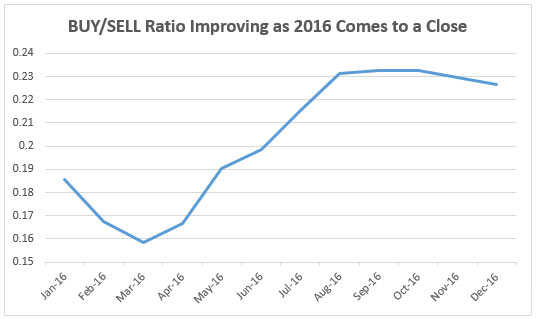

No one has a crystal ball, of course. But take a look at this chart, which shows the change in the BUY/SELL ratio for our overall universe of rated stocks:

You can see that it has been steadily improving since the early spring, suggesting this move is based on a solid foundation. We’ve also seen the percentage of SELL rated stocks in each of the major averages decline steadily. Our Weiss Ratings model graded 13.5% of the S&P 500 stocks as SELLS last December. That’s down to 11.2% now. In the Russell 2000, SELLS have dropped from 41.7% to 36.3%.

What’s more, the recent breakout to new highs is occurring on heavy volume – the kind of technical confirmation you want to see if you’re a bull. And as I showed last week, higher-risk, more economically sensitive sectors like financials and industrials have taken the lead from more conservative ones like utilities and real estate.

Of course, the markets tend to calm down around the holidays. So I wouldn’t be surprised to see trading volume ebb and stocks take a breather. But if you want to put this quiet period to good use -- and get a head start on making 2017 a profitable year for your portfolio -- give our Weiss Ratings Platinum service a try.

It allows you to screen the entire universe of stocks, ETFs, and mutual funds we rate in order to find the best-rated, most fundamentally sound investments available. You can find more details online here.