I don't know about you. But the "Poltergeist" movies scared the you-know-what out of me when I was younger. Especially that scene in the sequel where Carol Anne's toy phone starts ringing, she picks it up, all heck breaks loose, and then she says those fateful words: "They're BBBAACCKKKK."

Turns out you could say the same thing about the housing speculators. Or, more accurately, I should say their policymaking enablers. That's because, against all odds, they've managed to push housing markets to the limit again as part of the broader "Everything Bubble" I've been telling you about.

I could just talk about the facts. Like how the average price of a U.S. home surged almost 7% year-over-year in February 2018. That was the biggest rise in four years.

Prices have now topped the 2006 Bubble-Era peak by around 8%.

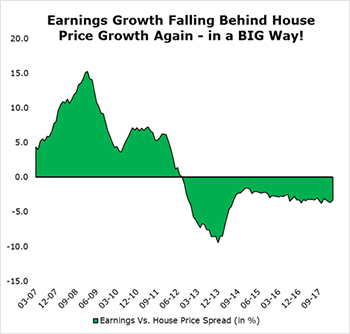

Or I could just present a chart like this, which shows the spread between the year-over-year change in average weekly earnings for U.S. workers and the YOY change in the S&P/Case-Shiller National Home Price Index.

|

|

Click image for a larger view. |

You can see that when house prices were plunging sharply as we headed into the Great Recession ... and then rising relatively slowly as we were coming out of it ... this differential was working strongly in favor of homebuyers.

But then earnings growth began to level off — even as house prices began to soar (again) thanks to the easy-money plague.

Result: Wages have risen more slowly than prices every single month since September 2012! That's putting housing further and further out of reach for average buyers.

Allow me to present to you the example of 1375 Bird Ave., a 1,066-square-foot, 42-year-old "house" in San Jose, Calif.

I put the word house in quotation marks because the building is technically unlivable. It was burned out in a fire two years ago. But that didn't stop this ... er ... "fixer upper" from hitting the market in April with an asking price of $799,000. Said Holly Barr, the listing agent from the Sereno Group:

"It's a great location. It's an easy commute. There's a great downtown, walkability, people with their dogs and tree-lined streets. It's where people want to be."

Personally, where I'd "want to be" is in a house with honest-to-goodness windows rather than plywood-covered openings ... a roof that wasn't a quarter of the way burned off ... and a lawn with actual grass rather than a bunch of overgrown weeds. But maybe that's just me.

In any event, the property didn't just sell for its listing value ...

|

It went for $938,000 — that's 17% above asking price — only 25 days later! That's a cool $880 per square foot.

True, it's cheaper than the $18,750-per-square-foot price that a 32-SF plot of empty land in Tokyo's Ginza shopping hub changed hands for at the peak of Japan's real estate bubble in the late-'80s/early-'90s, according to The New York Times. But should it really be our "goal" to strive for that as a nation?

I know all the excuses that are going to come my way ...

• This is the heart of Silicon Valley and real estate is local.

• The value was in the land, and they aren't making any more of it.

• Just like the value of those "FAANG" stocks we keep hearing about 732 times a day on financial TV, housing in the region is going to infinity and beyond.

But you know what? This isn't my first rodeo. My track record on the last housing bubble and bust is a matter of public record, and that's why this kind of action makes me both worried and angry at the same time.

Too much easy money is chasing too many dumb deals, and it isn't going to end well ... again.

Until next time,

Mike Larson

P.S. Want to invest in something "real" rather than pie-in-the-sky real estate like this? Then focus on the high-quality, fundamentally strong stocks my colleague Tony Sagami recommends in his Weiss Ultimate Portfolio service.

They've been vetted by our Weiss Ratings system, and are some of the strongest, most promising ones you'll find anywhere. Just last week, Tony led his subscribers to a 41.3% gain in two months' time. Click this link here to see how you can get high-profit-potential trades like these delivered to your inbox every week.