How Our Weiss Ratings Can Help Take the Emotion Out of These Markets

|

If you are overloaded with stocks, you probably got pretty worried when the Dow Industrials plunged roughly 2,000 points in May. You probably also breathed a big sigh of relief when the Dow surged 1,500 points in the first few days of June.

There's a way to get off this emotional, market-driven roller coaster. And if you are reading this, you have access to it!

The Weiss Ratings are designed to help you evaluate the relative health (or lack thereof) and fundamental underpinnings of stock market rallies. Our objective, time-tested, investment analysis model evaluates a multitude of fundamental and technical indicators. It does this for tens of thousands of stocks, ETFs and mutual funds.

The goal? To help you figure out which are (and aren't) worthy of your hard-earned capital.

But my team and I have gone even further. We've taken the core data and devised tools and methodologies based off it that help determine whether moves like those we've just seen are likely to last or not. I use these to help guide the investment recommendations and strategies in my Safe Money Report, and they've proved extremely valuable for the last few years.

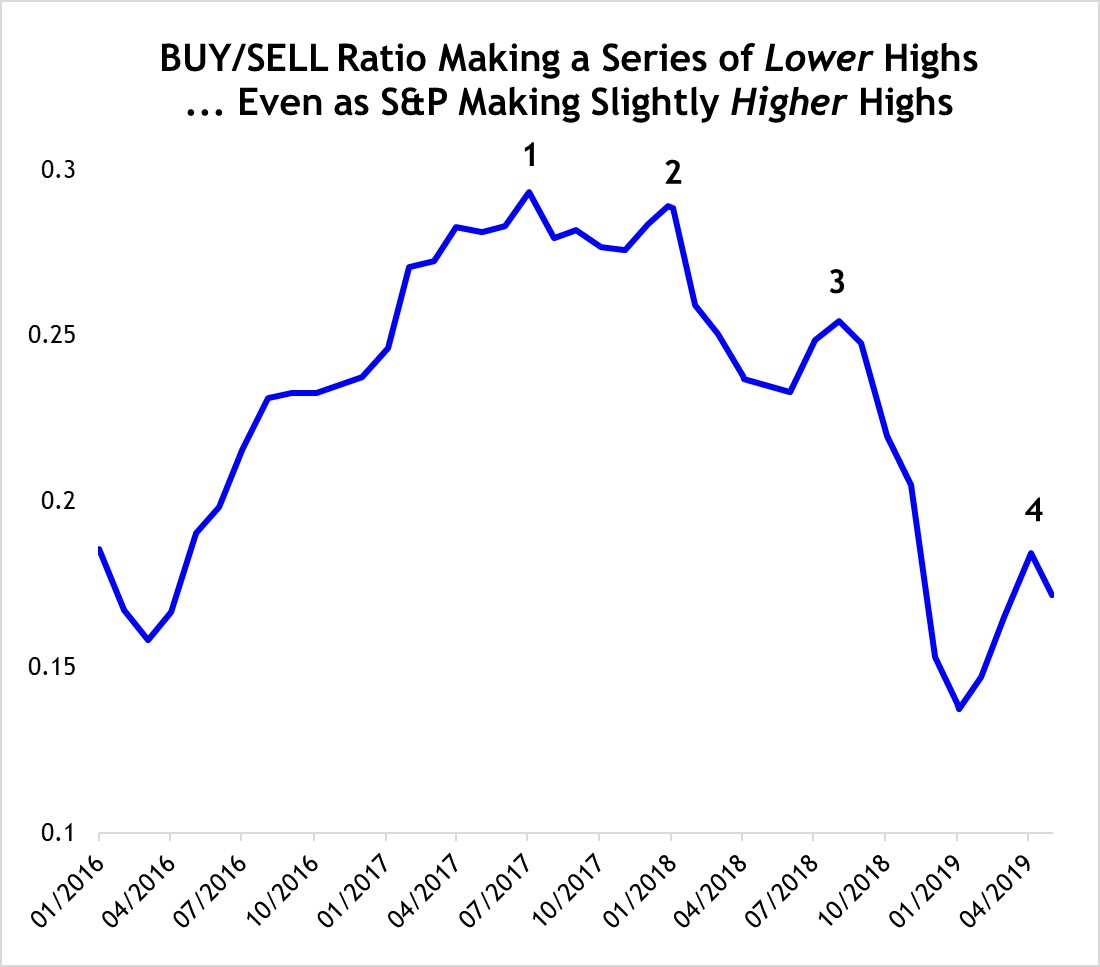

Consider the Weiss Ratings BUY/SELL ratio. I track changes in the relative number of Ratings upgrades vs. downgrades because it speaks to the broadness (or lack thereof) in stock market rallies.

During the fantastic stock market run that followed the November 2016 election, both stocks and our BUY/SELL ratio rose in tandem. That meant the rally was being "confirmed" by underlying breadth and participation.

But look at this recent chart showing the evolution of the BUY/SELL ratio for common stocks over the past few years. It has been making a series of lower highs even as the S&P 500 has been making a series of (slightly) higher highs since early 2018.

|

Forget my opinion ... or anyone else's opinion, for that matter. The DATA tells us that market advances have lacked broad participation for a year and a half now.

I also rely on another indicator — known as the Weiss Ratings Market Barometer — to determine how aggressive or conservative my investing strategy should be. The Barometer distills signals coming from five separate financial indicators, three credit market indicators, and 15 economic indicators over multiple time frames.

When most indicators are pointing in a positive direction, I get more "offensive" with my strategy. When most indicators are pointing in a neutral or negative direction, I play "defense." Just like the ratio I mentioned earlier, the Barometer has been more conservative for some time now.

So, what does this mean for YOU? I'll go into much more detail this weekend during my events at the MoneyShow Seattle. There's still time to register here so you can catch my presentations Saturday and Sunday at the Hyatt Regency Seattle hotel.

Or if that's too last-minute for you, I'm also going to be in Vancouver later this summer for the Sprott Resource Symposium. It runs from July 29 through Aug. 2 at the Fairmont Hotel Vancouver downtown. You can find more information and register to attend by clicking here. If you do so by July 5, you'll qualify for the "early bird" savings rate of $599. Just enter the discount code "GENL19" at the site.

But if you're not ready to make one or both of those trips, suffice it to say I STILL haven't seen the underlying market trends or indicators change. They caused me to get more cautious back in the first quarter of 2018. And since then, the broad averages have essentially gone nowhere ... plain-vanilla Treasury bonds have trounced equities when it comes to total returns ... and defensive, recession-resistant, dividend-focused stocks have outperformed offensive ones.

Or in other words, my "Safe Money" approach has worked best for 17 months and counting. Rather than succumb to my emotions, I'll let the objective data tell me when (or if) it's time to change course!

Until next time,

Mike Larson