How the Top 5 U.S. Banks Reacted to Brexit

With the post Brexit economic turmoil unfolding around the globe, we look in our own backyard to see what’s going on with U.S. bank stocks.

Our stock analysis shows that three out of the top five largest U.S. banks have regained some of their strength since the steep drop in value after the U.K.’s vote to leave the European Union.

Although the vote took place on Thursday, June 23, the chaos in the markets didn’t completely unfold until the following Monday. Banks suffered most of their losses over the intervening business days.

The analysis below shows how the top five reacted to Brexit and how have they performed since.

Federal National Mortgage Association (FNMA) lost 7.6 percent of its value over the two days, continuing to drop by another 2.1 percent as of last Friday. It holds a D+ investment rating.

JPMorgan Chase & Co (JPM) dropped 10.1 percent on Monday, June 27, following the Brexit vote, but it regained 7.3 percent of its value as of Friday, July 8. It currently holds a B investment rating from Weiss.

Bank of America Corporation (BAC) stock lost 13.2 percent from June 23 to June 27 regaining 8.1 percent as of last Friday. Bank of America Corporation stock currently holds a C rating from Weiss.

Federal Home Loan Mortgage Corporation (FMCC) lost 7.4 percent of its stock value on June 27; it dropped another 0.6 percent as of last Friday. The company holds a D+ rating from Weiss.

Wells Fargo & Company (WFC) stock dropped 6.1 percent from June 23 to June 27, but had gained back 6.2 percent of its value as of last Friday. The company holds a C+ investment rating.

The table below shows the percent change in value for the top five U.S. banks two days after Brexit vote, and then the percent change since those initial Brexit losses. Three banks show recovery, while the other two indicate a further decline.

Company Name |

Assets in Trillions $ |

Ticker | 2 Days After Brexit % Change |

Since Brexit Loss % Change |

Investment Rating (as of 07/11/16) |

| Federal National Mortgage Assoc. | 3.22 | FNMA | -7.6 | -2.1 | D+ |

| JPMorgan Chase & Co | 2.42 | JPM | -10.1 | 7.3 | B |

| Bank of America Corporation | 2.19 | BAC | -13.2 | 8.1 | C |

| Federal Home Loan Mortgage Corp. | 1.97 | FMCC | -7.4 | -0.6 | D+ |

| Wells Fargo & Company | 1.85 | WFC | -6.1 | 6.2 | C+ |

For a complete list of all U.S. bank stocks, click here.

JPMorgan, Bank of America, and Wells Fargo stock values reacted in a similar pattern, losing a good chunk at first and then gaining back some value over the last two weeks.

Federal National Mortgage Association and Federal Home Loan Mortgage Corporation are having a difficult time recovering their losses, possibly due to their narrow focus on U.S. mortgages.

To see all Weiss rated stocks, click here. To narrow down to a group of stocks, use our Stocks Screener--and if you need any assistance in doing so, click here for help.

Stocks

Pepsico (PEP) reported better than expected second quarter earnings last Thursday, sending its shares to a 52-week high of $109. It finished the week up 1.7 percent, trading at $108.27 a share. The second quarter success was driven by higher demand for Frito-Lay snacks, new products and healthier beverage options.

Pepsico currently holds a B+ rating from Weiss after an upgrade from B.

Coca-Cola (KO) and Dr Pepper Snapple Group (DPS) are expected to announce their second quarter earnings results on July 27.

ETFs

One hundred and three Weiss rated ETFs receive an A or a B investment rating meriting inclusion in the BUY universe, there are 741 funds in the HOLD universe and 817 in SELL. The number of funds in each universe changes when investment ratings get upgraded or downgraded.

Click here to see all Weiss rated ETFs.

Mutual Funds

Weiss Ratings gives you access to ratings and analysis on over 27,000 mutual funds. We empower you to slice and dice them all using the Mutual Funds Screener where you can find exactly what you’re looking for.

Arm yourself with the tools necessary to make better financial decisions. Click on any mutual fund to see its top holdings, similar funds, price and NAV history along with individual and industry comparison reports.

Banks

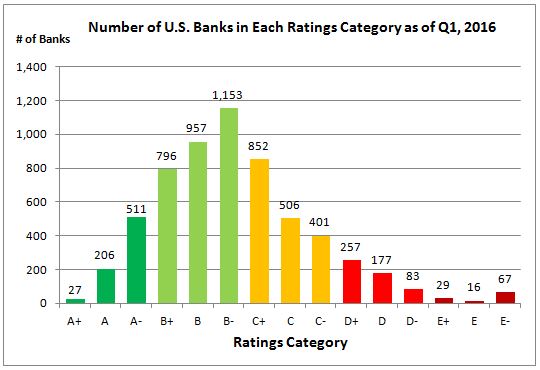

Based on Q1, 2016 bank data analysis, there were 2,906 U.S. banks meriting a B (Good) rating representing 48.1 percent, or nearly half of the entire banking industry. 1,759 C (Fair) rated banks represented 29.1 percent, the second most issued bank safety rating in Q1, 2016. A’s and D’s with 744 and 517 banks represented 12.3 and 8.6 percent, respectively. There were only 112 (or 1.9 percent) E rated banks.

The graph below further breaks down each letter grade using the plus and minus signs. The plus sign indicates that the institution is in the upper third of the letter grade and the minus sign indicates that it is in the lower third.

Credit Unions

First quarter 2016 credit union data analysis showed a continuing decrease in the overall U.S. credit union non-performing loans as a percentage of total loans. This indicates that a large number of borrowers are making their loan payments on time. This may also indicate that credit unions have stricter underwriting policies than banks that saw an increase in delinquent loans in Q1, 2016.

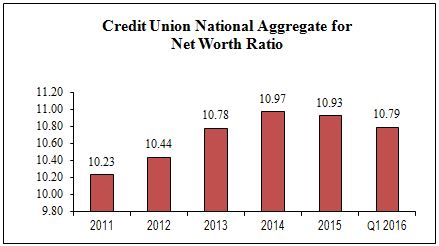

The credit union net worth ratio dropped to 10.79 percent in Q1, 2016. Although lower than in the prior two years, 10.97 percent in 2014 and 10.93 percent in 2015, the ratio is well above the NCUA’s (National Credit Unions Administration) set 7 percent for a well-capitalized credit union.

Insurance

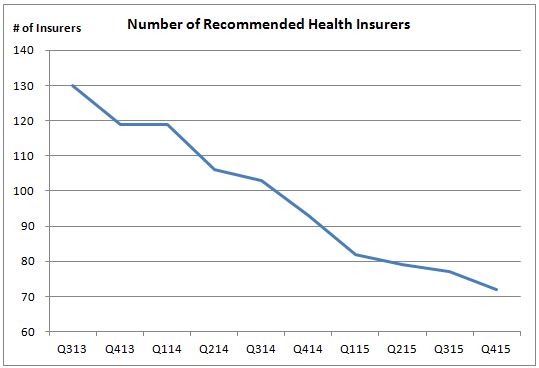

Weiss Ratings health insurance data analysis indicated there were 72 recommended health insurers in Q4, 2015. This number has declined by 39.5 percent (or 47 insurers) from 119 companies in Q4, 2013.

You can search for all recommended insurance companies in your state that write health business. This list includes all insurers that issue health policies so you will see life and property & casualty insurers as well.

Select your state first and then pick the type of insurance that you’re looking for.

Insurance Company Failures

Institution Name |

Industry |

State |

Total Assets in Millions $ |

| HealthyCT Inc | Health | CT | 112.3 |