A growing number of pundits are clanging the bear-market alarm bell. There are plenty of good reasons why.

Pick your poison: trade wars, geopolitical instability, excessive interest-rate tightening, sky-high stock valuations, a Trump impeachment, or the long-overdue demise of a very old bull market.

You know the good times in the markets won’t last forever. But will the next big market drop happen next month? Next year? Next week?

Nobody knows for sure, but that doesn’t mean you shouldn’t prepare for trouble now.

America's Most Popular Investment

Strategy is Also the Most Dangerous

Recently we talked about how the worst thing you can do in a bear market is nothing. And I gave you four strategies — to reduce your stock exposure, pick some sell targets, get ready to buy stocks on sale and consider adding some bearish exposure to your portfolio — to help you get ready for a major downturn.

|

|

Click image to read full recession article. |

Since then, many stocks have gone on to rally to all-time highs. But think about those months that led up to the 2009-'09 financial crisis … and all the markets that told us something big was about to happen. In other words, you and your portfolio need to prepare for trouble now.

• From January 2007 to December 2011, some 4 million homes were foreclosed on. Plus, there were another 8.2 million uncompleted foreclosures.

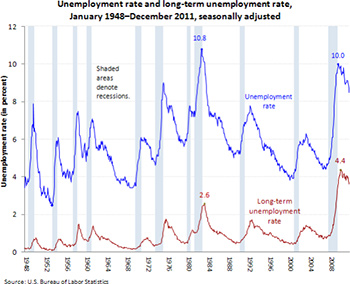

• 6 million jobs disappeared and the unemployment rate surged to 10%.

• The Dow Jones Industrial Average, the S&P 500 and the Nasdaq all lost more than 50% of their respective value.

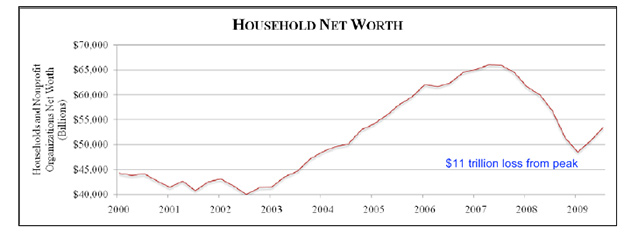

The average American household saw its net worth drop by 19% between 2007 and 2009. This was the largest drop in the post-World War II era.

|

Were you prepared back then? Are you prepared today? Here is what you should be doing.

Survival Tool #1: Diversification of Assets. Everybody knows that you need to spread our risk across different types of assets, but diversification is more than investing in number of different assets. You need to spread your wealth over different markets and economies as well as asset classes.

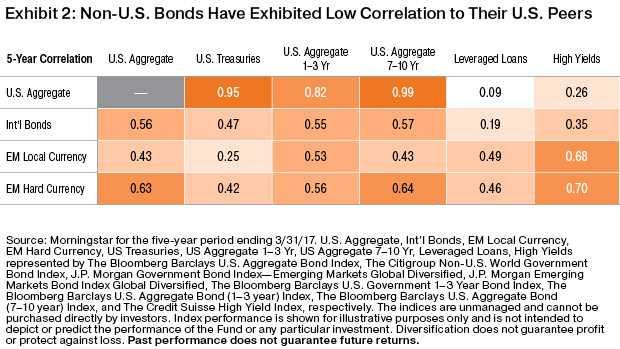

In short, include a healthy dose of non-U.S. assets and I highly recommend non-U.S. bonds for their diversification value. I personally own a significant position in the DFA Five-Year Global Fixed Income Portfolio (DFGBX). This mutual fund has a standard deviation of 1.8% compared to 10.2% for the S&P 500.

|

|

Click image for a larger view. |

For a list of the top-rated global bond funds at Weiss Ratings, you can go to https://weissratings.com/en/search?q=global+bond+fund

|

|

Click image for larger view. |

Survival Tool #2: Diversification of Currency. It shocks, shocks, shocks me that somewhere around 90%-plus of the investors I talk to have ALL their money denominated in one country's currency — the U.S. dollar. If the greenback tanks, so will your purchasing power. So, keep a meaningful portion (at least 25%) of your stocks, bonds or cash invested in non-dollar-denominated assets.

Moreover, I think every investor should keep a part of their money outside of the U.S. That could be someplace nearby like Canada or a country that you regularly visit.

Survival Tool #3: Diversification of Income. Most people only have one source of income — their job — and that is a giant mistake. Remember that 10% unemployment rate in 2008-'09?

What you should build is a portfolio of passive-income assets, one that pays you whether you work or not. This could be a portfolio of dividend-paying stocks, rental real estate or a business you can run in the evenings or weekends.

Survival Tool #4: Cash. Cash doesn’t pay much and it's boring … until you really need it. Plus, cash won’t drop in value when the stock market falls. Think of cash as an option to buy stocks when they get cheap. And a bargain isn’t a bargain unless you have the cash to take care of it.

Survival Tool #5: Physical Gold. Gold thrives in many environments, most of which are unfriendly to everything else you own. Think inflation, geopolitical uncertainly, weakness of the U.S. dollar and a total collapse of confidence in paper currencies. Plus, nothing beats gold as a reliable storehouse of value.

There are many ways to invest in it, and the person who I think knows more about gold investing than anybody on the planet is Sean Brodrick. His free weekly e-letter is invaluable, mandatory reading.

|

|

Click image to read full article. |

Survival Tool #6: Digital Gold. Digital gold? I’m talking about cryptocurrencies like Bitcoin. Digital gold has several advantages over physical gold, and it should be part of your financial survival kit. Unlike physical gold, cryptocurrencies are secure, private, can’t be confiscated by governments, and can be transported over international borders.

Go to https://weisscryptocurrencyratings.com/ to access our free library of informative articles and the world’s only cryptocurrency ratings.

Best wishes,

Tony Sagami

P.S. Every day, the Weiss Ratings system assigns letter grades to stocks, ETFs, mutual funds and more. These can help you decide whether to sell or stock up on the names on your radar. Remember that mutual fund I mentioned, the Five-Year Global Fixed Income Portfolio? It currently merits a "C" ("Hold") grade. Our ratings offer a great way to help you keep your risk in check at all times. Click here to gain access to this powerful investing tool today.Click here to gain access to this powerful investing tool today