How to Build Your Next Egg Amid America's Retirement Crisis

Egad. How did I get so old?

In one more month, I turn 62 years old. And if I were so inclined, I could start collecting a monthly Social Security check.

Of course, I am still productive and expect to work for another couple decades, so I don't need a Social Security check.

Yes, I enjoy what I do so much that I hope to keep at it until my 80s — but I do wonder whether Social Security will still be around when I hit that age.

According to the 2018 annual Social Security report, the people running the Social Security fund estimate that it will run out of money by 2034. Zilch! Nada! Zero!

My guess is that our politicians will figure out some way to kick the can down the road for another couple decades with some combination of means testing, higher payroll taxes and raising the retirement age. But the sad truth is that it's not wise to rely on Social Security as the primary source of your retirement income.

|

The days of enjoying a monthly retirement pension check are long gone. Unless you have a government job, you are unlikely to receive a traditional retirement pension.

They've been replaced by 401(k)s and profit-sharing plans, which means that YOU have to take personal responsibility for your financial well-being.

I am sad to say that the early results show many Americans are doing a lousy job of it! The median retiree household has a mere $60,600 in savings, and a disturbing 25% of households only have $3,260 of savings.

|

Sadly, that lack of a financial cushion is pushing a growing number of retirees to the brink of poverty.

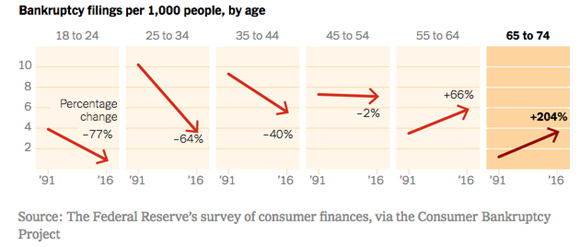

Get this: The rate of people 65 and older filing for bankruptcy is three times what it was in 1991. Seniors now account for the largest share of bankruptcy filings in the U.S.

• There were 3.6 bankruptcy filers per 1,000 people 65 to 74; in 1991, there were 1.2 per thousand.

• 2% of filers are now 65 or older, up from 2.1% in 1991.

Many Americans (three out of five) cited large medical expenses, while three-quarters cited too large of a debt load, for their financial woes.

|

The solution is simple: Save more and avoid debt. Yet that is a lot easier said than done — even though the cost of not doing so is — as the above graphic shows — just too dehumanizing to consider.

Your first step should be to shovel as much money as possible into a retirement plan.

• You can sock away as much as $18,500 a year into a 401(k), but as much as $24,500 if you are over 50 years old.

• For individual IRAs, the numbers are $5,500 and $6,500 for 50-plus workers.

Hint: If you're self-employed, you can put away as much as $61,000 a year into a "solo" 401(k).

As far as debt, you need to pay off as much as you can, as fast as you can. Perhaps that means fewer restaurant meals, more stay-at-home vacations, or keeping your car until you drive it into the ground.

Lastly, like me, you should consider delaying retirement. A lot of Americans are choosing to "downshift" into retirement by working longer than they had planned or by working part-time.

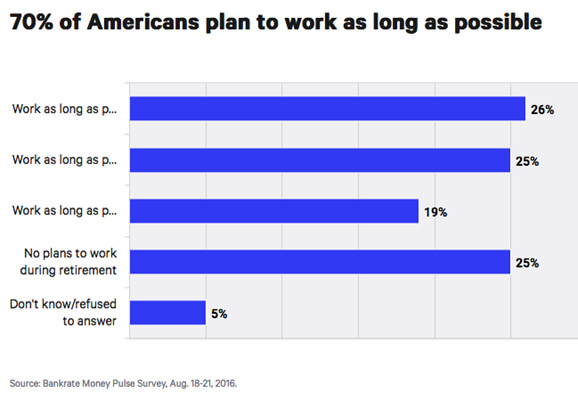

A survey from Bankrate found that 70% of Americans plan to "work as long as possible." Their rationale?

|

* 26% because they like the work

* 25% because they need the money

* 19% because they like the work and need the money

Delaying retirement doesn't just mean more wages; it also increases the size of your Social Security check.

If you wait until you're 67 years old to collect, you'll get 108% of the monthly benefit because you delayed getting benefits for 12 months.

If you wait until age 70, you'll get 132% of the monthly benefit because you delayed getting benefits for 48 months.

Moreover, a larger Social Security check will also help you spend less of your savings each year. And that will make your nest egg last even longer.

And to help you grow that nest egg faster and safer, I highly recommend you consider subscribing to Mike Larson's Safe Money Report, which offers the perfect combination of growth and safety. You can find out more by clicking here.

Best wishes,

Tony Sagami