How to Get More ‘Mailbox Money’ No P.O. Box Needed!

|

I was a retail stockbroker at Merrill Lynch in the 1980s, and I’ll never forget one of the conversations I had with one of my wealthiest clients.

He said, “There’s nothing I like better than to open my mailbox to find a dividend check.”

Back in those days, dividend-paying companies sent their shareholders an actual check every quarter.

Today, you don’t have to wait for that “mailbox money” to hit your doorstep. Dividends are instantly credited to your brokerage account.

You can even set up your account to automatically reinvest them, or you can save that income and tap it when you need to.

2020: The Worst Year for Dividend Cuts Led to the Best Year for Dividend Payouts

However, last year was a challenging one for many income investors. Some 27% of dividend-paying companies reduced or eliminated their payouts.

This made 2020 the worst year for dividends in a decade. Despite that, American companies paid out a record amount of cash to those who stayed loyal by continuing to own their shares.

The companies that make up the S&P 500 Index paid out a total of $480 billion last year, the ninth-straight year of record dividend payments.

Dividend payouts are more common than you may think; 385 out of the S&P 500 currently pay a dividend, and a whole slew of them just announced dividend increases. Companies like:

• Morgan Stanley (NYSE: MS), which doubled its quarterly dividend to 70 cents per share.

• Marsh & McLennan Companies Inc. (NYSE: MMC), which operates in the insurance, investments and other professional services, increased its dividend to 53.5 cents from 46.5 cents, a 15% increase.

• And Conagra Brands Inc. (NYSE: CAG), which raised its dividend by a 14% increase, from 27.5 cents to 31.25 per share.

That’s just a small sampling of the big firms that have announced bigger payouts this year.

And with the record-high number of S&P 500 companies that issued positive revenue guidance in the second quarter, this is a trend that looks likely to continue.

But, as we saw last year, not every dividend-payer will boost their payouts. And there’s no guarantee that even the ones who maintain their current levels will continue paying one at all.

So, how do you avoid those dividend dogs?

Focus on Firms That Consistently Boost Their Yield

In these days of huge gains in r/WallStreetBets stocks like AMC Entertainment Holdings Inc. (NYSE: AMC) and cryptocurrency moonshots like Dogecoin (DOGE), you get excited about a 1%, 2% or 3% dividend.

|

| Figure 1. For a full-size chart, click on the image above. |

That’s shortsighted, though. Last year, the S&P 500 was up 15.7%. Including dividends, the total return was 17.8%.

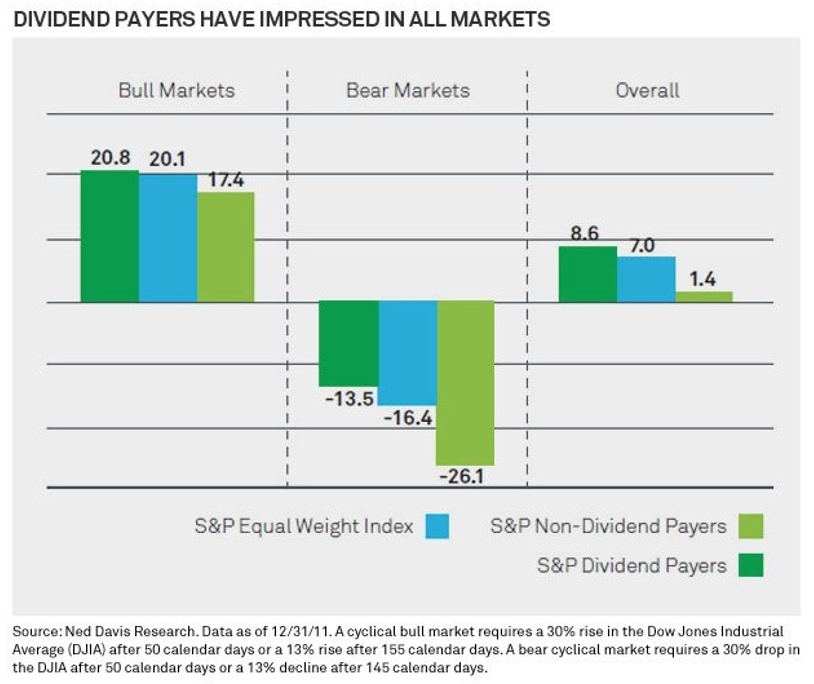

Higher returns aren’t the only benefit of dividend-paying stocks. They’ll also deliver significant downside protection during bear markets.

For example, in 2008, the S&P 500 dropped by 37%. At the same time, the S&P 500 Dividend Aristocrats — an index of large companies that have raised their dividends every year for the past 25 years — lost only 22%.

In fact, dividend-paying stocks have outperformed the overall stock market in both good times and bad, a hard-to-beat combination of all-weather performance.

That’s especially true today with the stock market at dizzying valuations and runaway government spending and borrowing threatening future stability.

Indeed, lots of my smart money manager friends expect the stock market to run into an overvalued wall and sink lower eventually.

If you’re looking for ways to reduce your risk and portfolio volatility, I recommend you take a long, serious look at dividend-paying stocks.

As my colleague Mike Larson writes in his Safe Money Report issue that will hit subscribers’ inboxes later today:

If you put $10,000 in a 1-year bank CD paying the national average rate of 0.17%, you’ll earn $17 in interest.

But if you assume June’s 5.4% inflation rate holds constant for a year, guess what? Your $10,017 would only be equivalent to $9,476 in real, inflation-adjusted dollars.

In other words, holding cash not only doesn’t pay … but it actually costs you.

Mike knows how to spot safe and growing dividends from a country mile away. And to see what he’s recommending to his subscribers right now, join him at Safe Money Report and read the “Actions to Take” column in the issue that comes out later today.

Best,

Tony Sagami