How to Separate the Disruptors and the Dominators from the Dodos

|

I’m more of a college football fan than an NFL guy. I’m particularly passionate about my University of Washington Huskies. But I always watch the Super Bowl.

I especially enjoy the commercials.

|

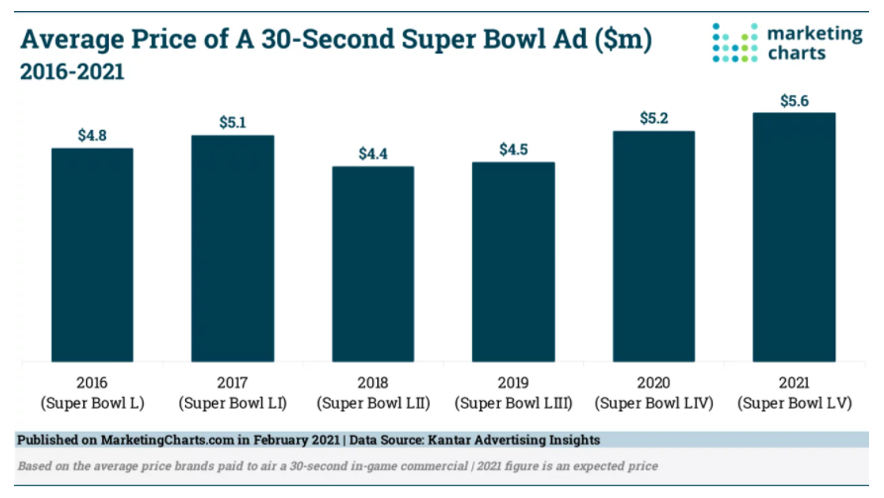

A 30-second Super Bowl commercial went for $5.6 million this year. That’s a lot of money.

And, more often than you might think, this sort of expenditure is an early warning sign of a company with more spending power than brains.

Consider this: Tom Brady played in (and won) his first Super Bowl in 2002. A 30-second spot during that broadcast cost advertisers $2.2 million.

Anheuser-Busch InBev SA/NV (NYSE: BUD) was one of those 2002 advertisers, with its famous tribute to those lost in the Sept. 11, 2001, terrorist attacks featuring an unforgettable bow from the Budweiser Clydesdales.

|

| Source: YouTube |

The rest of the 2002 advertising roster reads like a list of technology has-beens: AOL ... Blockbuster ... Radio Shack ... Circuit City ... CompUSA ... Sears ... HotJobs ... VoiceStream Wireless ... Gateway Computer ...

Those erstwhile titans were pulling in money hand over fist back then, and they were eager to spend millions for just half a minute’s worth of eyeballs.’

Blockbuster, for example, was one of the fastest-growing companies on the planet. In 2002, it had almost 10,000 stores and was pulling $6 billion a year in revenue.

I don’t mean to pick on those companies. Powerful, profitable businesses have fallen victim to new, disruptive technologies for centuries.

Steam engines, internal combustion engines, telephones, automobiles, airplanes, personal computers, fax machines, the internet, semiconductors and mobile phones have all enriched our lives.

But they’ve also left entire industries destroyed in their wake.

‘Revolution’ Vs. ‘Evolution’

There are two type of disruptive innovation: revolutionary and evolutionary. It’s important to understand the distinction.

Revolutionary disruption is fast and dramatic — think of the aforementioned mobile phones, computers and semiconductors.

Evolutionary disruption, however, tends to be gradual, incremental, even boring. It’s about gradually changing existing fundamentals, products and business practices.

Examples of evolutionary innovators who became fabulously wealthy are many: Sam Walton, Jeff Bezos, Michael Bloomberg, Phil Knight, Michael Dell and Charles Schwab, to name just a few.

None of them invented anything; all they did was build a better mousetrap and deliver it faster, better and/or cheaper than anybody else.

The reality is that most successful companies simply out-execute the competition with a new twist on an existing product or service.

Apple Inc. (Nasdaq: AAPL), by general consensus one of the most innovative technology companies in the world, could be considered more of an evolutionary innovator than a revolutionary innovator.

MP3 music players had been around for years before Apple came out with its fabulously successful iPod. It simply built a better one.

The same is true of the iPhone. Did you know that the original iPhone was launched in January 2007? But Motorola had launched the first cell phone way back in 1973.

So, Apple came very late to the mobile phone party. But it captured the market with slicker packaging and improved functionality.

Today, the iPhone is one of the most valuable technology franchises humankind has ever seen.

And it established dominance through evolutionary improvement over previous designs.

Now,

take a very close look at your portfolio. Is it full of disruptors that will tend to dominate?

Or is it full of dodos about to be disrupted out of business?

You might want to check it against the list of this year’s Super Bowl advertisers.

And then you’ll want to click here to learn more about my new service, Disruptors & Dominators, where we’ll separate the flashes-in-the-pan from the hall-of-famers ...

Best,

Tony