Like a monster from an old creature feature, an ugly beast once again looms over Wall Street.

I’m talking about inflation.

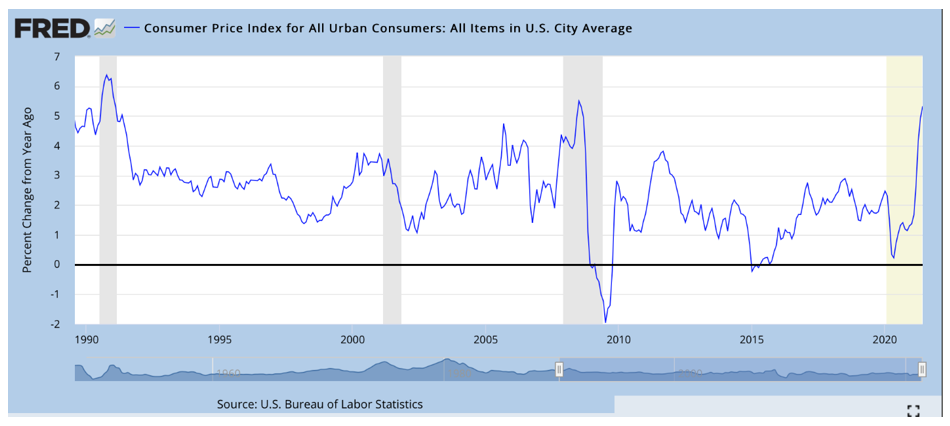

And if I needed any more confirmation, this week’s consumer price index (CPI) data from the Bureau of Labor Statistics was it.

U.S. inflation continued to accelerate in June at the fastest pace since 2008.

Headline CPI for May was estimated to have increased 5.4% from last year and 0.9% when compared to the prior month.

And when you take a closer look using “core inflation,” which excludes food and energy prices, CPI increased 4.5% on the year, the highest since the early 1990’s.

|

Now, if you’re a regular Weiss Ratings reader, you know that inflation at these levels is attention worthy, but not overly concerning at the moment.

As Weiss Ratings Senior Analyst Tony Sagami pointed out in last week’s interview with Jessica, these high inflation readings aren’t “transitory” as the Fed repeatedly harps.

Rather, they’re being caused by rapid economic growth as we continue to rebound from the pandemic and rising wages certainly are a major contributor.

So, it’s safe to put recession worries to bed.

Aside from the major negatives of inflation — like decreased purchasing power — investors need to realize the opportunity at hand.

There are many areas that tremendously benefit in inflationary environments like real estate, commodities, bonds and stocks as they help preserve portfolio worth and maintain income buying power.

Today, I want to narrow this broad spectrum of options to stocks because I want to use the Weiss Ratings as my main investment compass to help pick the winners in sectors that tend to benefit from inflation.

And to narrow it down further, I want to target three industries: energy, real estate and materials.

On the Weiss Ratings stock screener, I was looking for companies with a “buy” rating of “B” or higher.

In the energy sector, there were two companies with “B” ratings or higher.

The first was Sunoco LP (NYSE: SUN). The company is a dividend raiser and is trending in the right direction with its rating. In the past five years, the company has most commonly been in the “hold,” or “C” range, but it’s now locked in two consecutive “buy” ratings.

Next up is Flex LNG Ltd. (NYSE: FLNG) with a “B” rating. In the past five years, this pick was actually most commonly listed as a “sell” but recently got the “buy” upgrade due to a significant increase in the valuation, efficiency and growth indexes. EPS increased, net income increased 82% from $25.82 million to $47.23 million and EBIT also increased.

These are key metric that the ratings use to gauge their ratings, so it’s not very surprising to see this upgrade.

Turning our attention to real estate, they’re actually 42 listed with a “buy” rating.

I highly suggest you take a look for yourself, but I personally wanted to look at one of the top “B” rated picks: Alexandria Real Estate Equities, Inc. (NYSE: ARE).

This real estate investment trust (REIT) has a large market cap of $28.06 billion and say its ratings increase over the past year due to things like having their debt-to-equity declining (0.8 to 0.73) and seeing increased earnings per share (EPS). Aside from two short stints with a “C+” rating, this company has been listed as a “buy” since May 2018.

Lastly, let’s look at the materials sector.

Over the past year, we’ve seen a boom in construction, a sizzling housing market and a historical boom in commodity prices, so I wasn’t surprised to see 64 companies with a “buy” rating.

One of the top rated “buys” is Rio Tinto Group (NYSE: RIO), and it’s a pick that Tony Sagami recently targeted to help his Weiss Ultimate Portfolio subscribers bank gains of around 13% in under two months on that single position.

Even as one of the largest exploring, mining and processing companies of precious metals in the world, the company could still be seen as undervalued. It’s P/E ratio is 6.3, compared to an industry average of 10.97.

The company has primarily been listed as a “buy” since August 2017 and it’s certainly a pick that investors who are targeting precious metals should keep on their radar.

I won’t be sitting idling watching inflation erode my money. I will be utilizing the amazing tools I have at my disposal to my advantage.

I hope you do, too.

Best,

Peter Amirata