Last Week, Attack on Capitol. This Week, Impeachment. What Next?

|

Last week, the Capitol was attacked.

This week, Nancy Pelosi will move to impeach the president (again!)

But then what?

What’s really happening to our country?

What impact will it have on your money and income?

What should you do about it?

According to a just-released ABC/Ipsos poll, 56% of Americans think President Trump should be removed from office. But 43% think he should not be removed.

Behind the numbers, however, are some other, very serious concerns.

First, without pointing fingers, no one can deny that what has happened ...

This cascade of events began in the 1970s — with a new cycle of division unlike any other in American history.

As I explained here months ago, what we see in America today is not just the rich squeezing out the poor or America’s millionaires squeezing out the middle class. We also see billionaires squeezing out America’s millionaires.

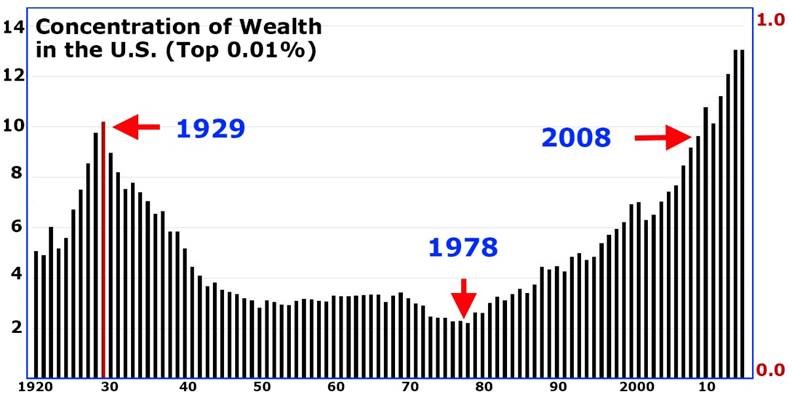

It’s obvious from the chart below showing the wealth share of the top 0.01%, the richest one in ten thousand American households.

|

In 1978, the concentration of wealth hit an all-time low. But since then, it has been rising steadily, reaching extremes never before seen in American history.

The end result is the great social and cultural divide we have today, with all its powerful emotions — pride and shame … greed and envy … fear and anger — all ingredients for mass protests, riots or worse.

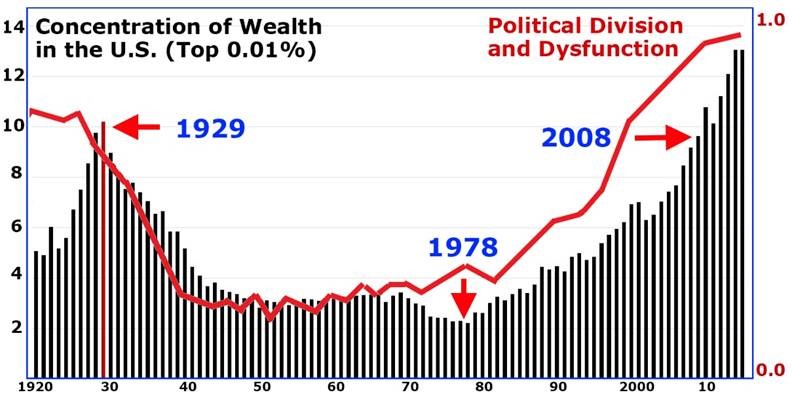

So, it should come as no surprise that political division and dysfunction in America (red line in chart below) have also mushroomed in last half century:

|

When the red line is low, it means that Republicans and Democrats in Congress are crossing party lines and drafting legislation together, based on the issues.

When the red line is high, it means that they’re voting strictly along party lines, throwing bricks at each other, or worse.

And now, the political division and dysfunction are at the most extreme level of our lifetime.

Two months ago, these forces reached a climax of sorts when 160 million Americans voted for president.

And it’s been mostly downhill from there ...

|

On Tuesday, the president gave a speech at the Save America Rally on the Ellipse across from the White House. He told the crowd to fight for him in his final battle for the White House.

The majority in the crowd were ordinary citizens, demanding that Congress oppose certification of the election.

But there was also a not-so-small minority, vowing to do much more.

They burst through the barricades. They overwhelmed the police. They invaded the Capitol. And they embarked on a rampage that shocked the nation to its core.

Less than 48 hours later, Nancy Pelosi demanded that Vice-President Pence invoke the 25th Amendment. And she promised to impeach.

Joe Biden was torn. How will impeachment disrupt his promise to vaccinate 100 million Americans in his first 100 days?

How will it impact his agenda to rescue the economy?

Over the weekend, House Majority Whip James Clyburn (D., Ga.) suggested that the House vote on articles to impeachment this week, but then postpone sending them to trial in the Senate until at least the end of April.

But no one — not even the president-elect — seems to have the will or the power to turn back the rising tide of attack and counter attack.

The Washington (and Wall Street) we once knew will never be the same again.

Only one institution in the nation remains undivided; only one institution is gaining more power and influence ...

The U.S. Federal Reserve.

And only one agenda is rising above the fray; only one prevailing unopposed ...

Wholesale money printing, gutting the safe yields of retirees and, ultimately, the savings of average Americans.

Right now, for example, according Bankrate.com’s most recent survey of banks and thrifts, the average rate one-year CD rate is a meager 0.21%. If you have $10,000, all you get is meager $21.

Want the ultimate safety and liquidity of a three-month U.S. Treasury bill? Then you’ll get 0.09% or a virtually invisible $9 per year:

|

That’s not just the lowest in American history (see chart).

It’s pretty much the lowest in the known history of interest rates.

Want a half-decent yield on your savings? Then, you’d have to do at least two things ...

1. Lock up your money for at least 10 years, AND ...

2. Lend it to high-risk borrowers with “junk” ratings or no ratings at all.

This helps explain why investors are rushing into stocks and even Bitcoin.

Trouble is, it does not offer risk-adverse investors a viable alternative.

In our Weiss Ratings publications, we do. So be sure to stick with them.

Good luck and God bless!

Martin