|

I’m writing to you from gorgeous Auckland, New Zealand. Why the change of scenery?

Because I got word of a stock that sounds too good to be true. This has to be one of the most interesting stocks I’ve ever run into — at least on paper, that is. So, I couldn’t help but jump on a plane to check it out.

But before I get to this stock, I want to disclose some research I did when I got to New Zealand. It all started when I ran across this memorial to the Kiwis who died during the 1918 influenza pandemic.

|

Auckland was struck hard by the outbreak. People were dying faster than the 35 gravediggers could dig new graves. There wasn’t enough room for the victims, so Victoria Park in central Auckland was used as an open-air morgue.

A total of 8,573 people died from 1918 influenza epidemic out of a population of 1.15 million or out 7/10th of 1%.

Globally, the 1918 Spanish Flu infected 500 million people worldwide and killed between upwards of 100 million people — about was 3% to 5% of the world population at the time. The Spanish Flu’s mortality rate is estimated to have been between 10% and 20%.

This brought me back to the coronavirus outbreak. While numbers are not as severe as the 1918 Spanish Flu epidemic, it is deadly.

As of this writing, over 40,000 people have been infected and more than 900 people killed by the coronavirus in China alone. And the numbers have been growing.

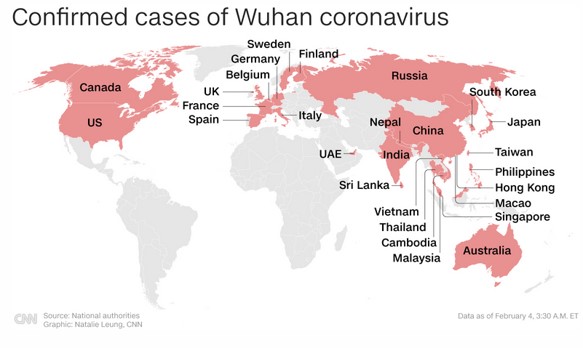

Worse, the infections aren’t limited to just China. More than a dozen countries have confirmed corona infections, including Australia, France, the U.K., Spain, Canada and the United States.

|

|

Source: CNN |

In fact, the coronavirus has killed more people than SARS in 2002-2003. The respiratory virus killed 774 people, mostly in mainland China and Hong Kong.

There’s no way to predict how much more the coronavirus will spread, or how governments around the world will respond.

And how governments respond can impact your portfolio severely. The economics of the coronavirus could be significant. Because of globalization, companies have built supply chains that cross national borders. This makes the world’s economies intimately interconnected. And China accounts for roughly 16% of global GDP.

It also means that human elements of these supply chains interact at much higher rates than previously. This makes containing the virus that much more difficult.

But there is some good news in all of this.

First, the global scientific community has been very successful at limiting the human loss.

|

|

Source: Dow Jones Market Data / TalkMarkets |

And second, that success is why the stock market has been so resilient to recent pandemic scares — SARS, ebola, ZIKA and the avian flu.

The key lesson you as an investor should take away from this is the stock market didn’t suffer major damage from those previous outbreaks. It stands to reason it’ll stand strong against the coronavirus, too.

That is why I am still looking for new opportunities instead of places to hide my money. Which brings me back to the stock that brought me to New Zealand.

Now, I haven’t finished my research on this stock, so you’ll have to wait a little longer for my verdict. But New Zealand itself has caught my attention. Particularly, its vibrant, growing, prosperous economy.

How prosperous? The iShares MSCI New Zealand ETF (ENZL) has averaged a 14% annual compounded return since its inception in

September 2010. That’s excellent.

|

|

Source: iShares |

Most investors wouldn’t recognize any of the ENZL’s top holdings — Fisher & Paykel Healthcare, A2 Milk Company, Spark New Zealand, Auckland International Airport, Meridian Energy, Ryman Healthcare and Contact Energy.

But don’t let that discourage you from considering ENZL for your portfolio.

Lastly, it may be my Montana roots and love for mountains, but New Zealand is one of the most beautiful countries I have ever, ever seen. And the Kiwis are some of the friendliest people in the world.

Even if you don’t put ENZL in your portfolio, you should put New Zealand on your bucket list.

Best wishes,

Tony Sagami