|

First things first. Weiss Ratings founder Martin Weiss just shared a very timely update about three major overseas crises converging right here, in real time.

These are causing flight capital to flood in to safe-money investments — dollar-based assets and precious metals. They're also making certain sectors and investments look wildly attractive. So, make sure you click here to catch Martin's briefing and get more details.

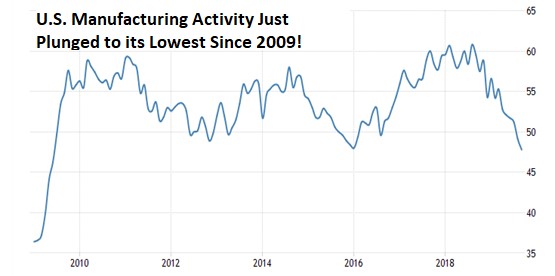

Meanwhile, on this side of the world, the Institute for Supply Management just said its key factory index plunged to 47.8 in September from 49.1 in August.

Not only did that miss forecasts for an increase to 50.2, it was also the worst reading in any month since June 2009 ... more than 10 years ago!

|

|

Source: TradingEconomics.com |

If you look behind the headline reading to the various sub-indexes, you see that ...

- Employment activity fell to its lowest level since January 2016.

- New orders were stagnant.

- And a measure of export activity fell to its lowest since March 2009.

The weakness stems in part from the global trade war. But as I've been saying for a long time now, the BIGGER issue is that the credit and economic cycle is turning.

We just experienced the longest, most extreme boom in easy, cheap money in U.S. history ... and now, it's petering out. It's inevitable the economy will weaken as a result.

It's also inevitable the stock market will reflect that kind of trouble.

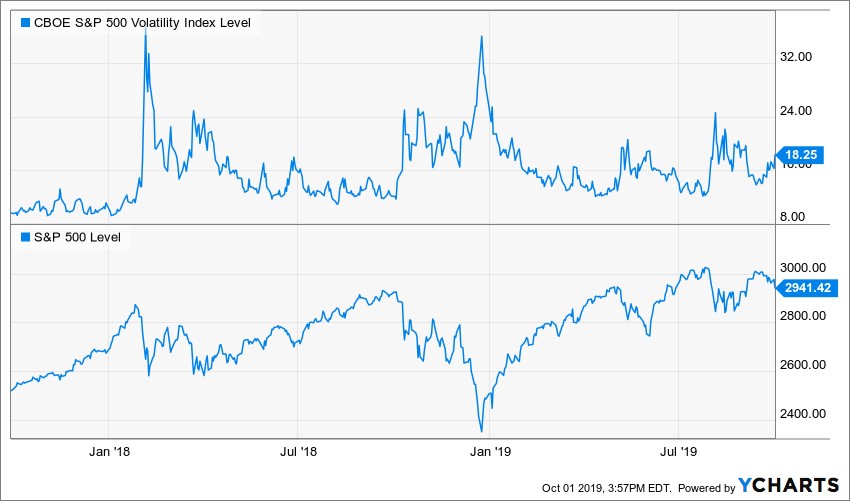

Consider this: The S&P 500 made three attempts to hit — and HOLD — new all-time highs through July of this year. But unlike all the pre-January 2018 moves, they were accompanied by divergences all over the place. And not surprisingly, all of them failed.

At the same time, sectors like materials, financials, industrials and energy have lagged badly. They're all trading well off their highs. The same goes for the Russell 2000 Index of smaller-capitalization stocks and the economically sensitive Dow Jones Transportation Average.

The CBOE Volatility Index, or VIX, has diverged from the S&P 500 as well. It's making a series of higher lows rather than lower lows like it did before January 2018.

|

The same is true for credit spreads — the extra yield investors demand as compensation for assuming the default risk inherent in high-yield or investment-grade corporate bonds vs. underlying Treasuries.

That brings us to the present day. The S&P 500 is — once again — attempting to put this resistance zone around 2,900-3,000 behind it once and for all.

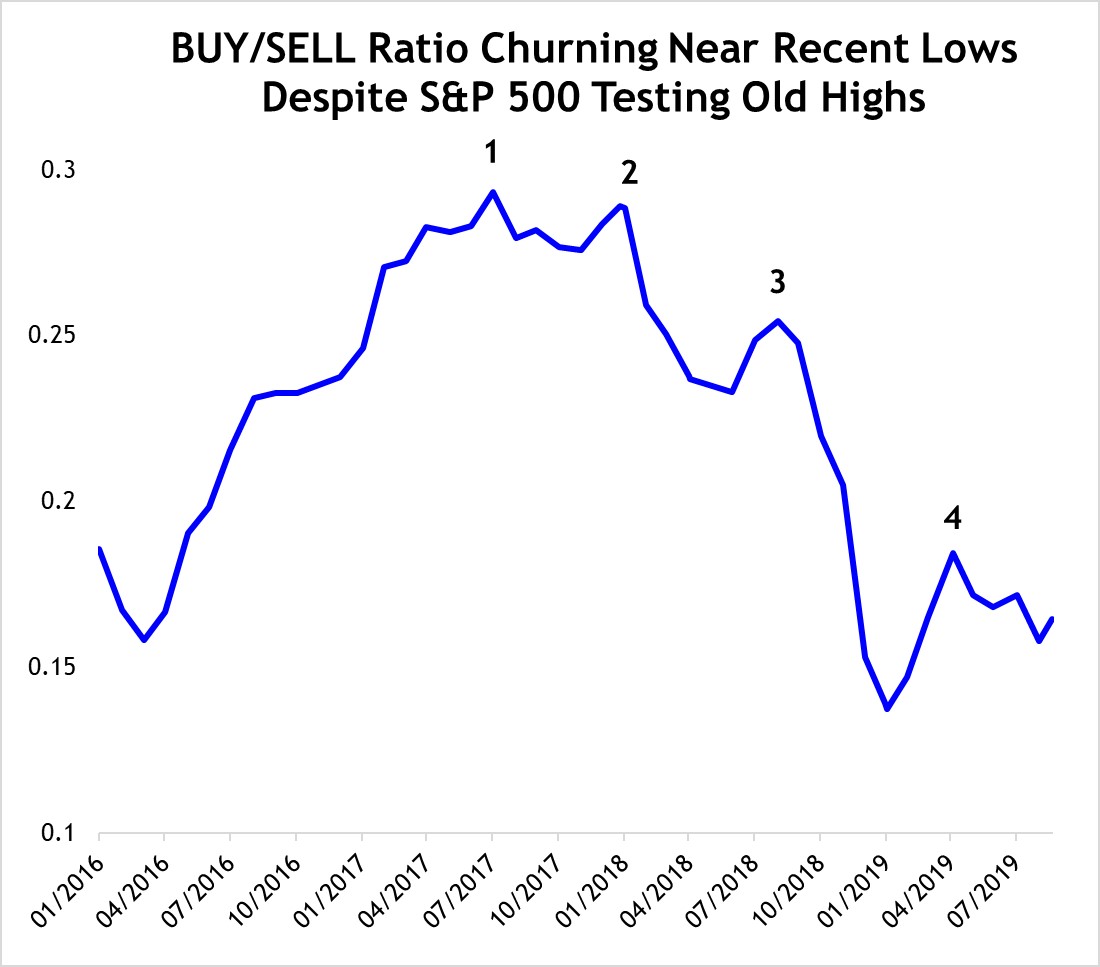

But as you can see in this freshly updated Weiss Ratings "BUY"/"SELL" ratio chart, the move is still lacking broad participation.

|

|

Source: Weiss Ratings, Data Date 9/18/19 |

So, whether or not you agree with my opinion — or anyone else's for that matter — about the market, one thing is clear:

Our unbiased, data-driven, back-tested Ratings model is still suggesting that many stocks are struggling and that the rally isn't as healthy as those we saw pre-January 2018.

The bottom line?

Your best approach here is to stay defensive, stay alert, stay focused on the kinds of recommendations Martin is discussing and otherwise avoid taking outsized risks.

This isn't the same rampant, wild-running bull market we had before January 2018. You shouldn't invest as if that's the case.

Until next time,

Mike Larson