Overhyped Growth Turkeys Get Plucked ... While 'Safe Money' Stocks Surge!

|

It's Thanksgiving week, my favorite of all 52. That's because our family always gets together for holiday meals and good conversation, and I'm lucky enough to have my birthday to celebrate during the week, too.

So first, let me take a moment to wish you a wonderful Thanksgiving! Then, let me pivot to the markets because something very, very important is happening. Overhyped, over-owned, over-loved growth “turkeys” are getting plucked ... while “Safe Money”-style stocks are surging!

Just call up a chart of Facebook (FB, Rated “C+”). Or Amazon.com (AMZN, Rated “B-”). Or Netflix (NFLX, Rated “C+”). The “FAANG” stocks have now lost a stunning $945 BILLION in market capitalization from their recent highs. Amazon and Facebook are down around 15% in just the last month, while Netflix has dropped almost 18%.

And it's not just those companies taking it on the chin. It's a whole host of formerly red-hot growth stocks.

|

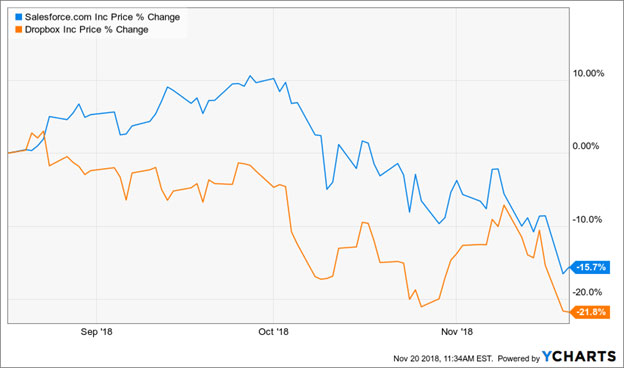

Look at some of the cloud computing names like Salesforce.com (CRM, Rated “C”), or the highly touted tech IPO Dropbox (DBX, Rated “D-”). They've plunged below 16% and 22%, respectively, in the last three months.

Or how about biotechnology? Money-losing, high-risk biotechs have been flooding the public markets with IPOs lately. Now they're dropping like rocks.

A few examples:

- Xeris Pharmaceuticals (XERS, Rated “E”), down 19% in three months ...

- Eidos Therapeutics (EIDX, Rated “E-”), down 25% ...

- And Magenta Therapeutics (MGTA, Rated “E-”), down 42%.

On the flip side, lower-volatility, higher-yielding stocks in safer, defensive sectors like utilities, healthcare and consumer staples are on fire. Several that I've recommended in my Safe Money Report are either already setting new multi-month or multi-year highs, or within a smidge of doing so.

|

You can get precise names and BUY and SELL targets by subscribing here. Or you can at least look at ETFs such as the Consumer Staples SPDR (XLP, Rated “C+”) or the Utilities SPDR (XLU, Rated “B-”). It's no surprise they're both up about 15% in the last six months.

In other words, the market is getting more challenging. It's getting more tumultuous. It's getting more volatile. Growth is getting dumped, while value is getting bought, and I expect that powerful rotation to continue for the rest of 2018 AND 2019.

Fortunately, I have something else to be incredibly thankful for: Our readers were 100% prepared for this! That's because you received advanced warning of these developments right here in your market updates.

For instance, I wrote on July 11 that “Today's IPO Mania Will End in Tears” and offered up this advice:

“Do NOT get sucked in by breathless IPO-related hype! When Wall Street is peddling this kind of sludge, your best bet is to run away as fast as you can.”

Then I wrote on Aug. 1 that FB's almost-$120 billion, one-day wipeout was a canary in the coalmine for tech and growth stocks. My warning:

“There are a lot of companies that are doing some pretty amazing things in the technology world. Many of them, including Facebook, sell products and services we all use in our daily lives. But that doesn't mean their shares are always and forever good investments.

“Valuations matter. Sentiment matters. Price matters. And concentration risk matters.

“When investors are dogpiling into a smaller and smaller group of overhyped stocks ... with little regard to their valuations or risks ... And when that is accompanied by a surge in IPOs from scores of 'Me Too' companies taking advantage of the easy money mania ... It's a recipe for trouble.”

And of course, all the way back on March 14, I said I was slashing my own 401(k) equity exposure to its lowest level in many years. The reason?

“Now, I'm starting to see signs of market exhaustion. It's not just the explosion in stock market volatility we experienced in February, with a pair of 'Down-1,000 Days' in a very short span of time. It's also an increasingly troublesome series of moves I'm seeing in various out-of-the-way corners of the interest rate and currency markets.

"Throw in the near-record age of this bull market ... the deflation of the global QE bubble ... and the multiple interest rate hikes we're seeing here and abroad ... and you've got the makings of a potentially major market shift ...

“I don't think you should ignore the change in character we're seeing in the markets. Nor do I think you should underestimate the rising potential for a real shakeout, something much more dangerous to your wealth than we've seen in many years.”

So, I trust that you already pulled money out of higher-risk growth stocks and rotated into lower-risk value ones ... dumped any SELL-rated dreck ... avoided getting suckered into junky IPOs ... raised your cash levels substantially ... and added hedges against downside risk, including select inverse ETFs.

But if not, I urge you not to wait much longer. The markets clearly aren't. They're looking more and more bearish, and that requires prudent, deliberate, protective action in your portfolio.

Until next time,

Mike Larson

P.S. If you didn't see the news already, I'm participating in the 2019 Money, Metals & Mining Cruise. The Ft. Lauderdale-to-San Juan cruise runs from Dec. 6-14, 2019, on board the Crystal Serenity.

Our host will be Brien Lundin, President & CEO of Jefferson Companies. He's an expert on the gold markets and junior miners. We'll also be joined by other, selected investment experts who are eager to share their knowledge and insights with you.

Interested? Then click here for more details. Or call 800-797-9519 for everything you need to know about pricing, itinerary and more. I hope to see you aboard!