Policy Choices Create a ‘Prosper Now, Pay Later’ Market

|

“Buy now, pay later!”

It’s a familiar lure deployed by automobile salespeople across multiple media, through the ages.

I’m sure you’ve seen it and/or heard it ... so often it probably doesn’t even strike you anymore.

The idea is you just sign on the dotted line, put no money down, then drive away in a nice new ride.

Of course, the nice new ride isn’t costless.

Anyone who puts no money down has to finance the purchase with a bigger loan. They typically need a longer loan term to keep the monthly payments lower. Altogether, it drives up the total interest paid.

In other words, short-sighted buyers ultimately pay a long-term price.

Well, today, the federal government and Corporate America are falling for a similar come-on. They’re focusing only on policies and actions that fuel short-term gains.

All the while, they’re ignoring the long-term pain sure to follow from their present largesse.

That, in turn, has created a “prosper now, pay later!” market environment. It’s one that creates enormous opportunities for investors in the here and now. But it also threatens your wealth with enormous future risks.

Think about the dollar amounts President Trump committed the federal government to spending in the waning days of his administration. Now, consider President Biden’s follow-up since he occupied the Oval Office:

• A late December COVID-19-related package worth $900 billion;

• An early March COVID-19 relief package worth $1.9 trillion;

• A late March infrastructure proposal worth $2.3 trillion; and

• A late April social spending and tax proposal worth $1.8 trillion.

All told, we’re talking about almost $7 trillion in fiscal stimulus and other proposed tax and spending programs in just five months.

It’s unprecedented in our nation’s history. The idea is to buy more growth now, funded by enormous debt issuance, but worry about paying for it later via higher interest costs and reduced financial flexibility.

And Corporate America is following the same game plan.

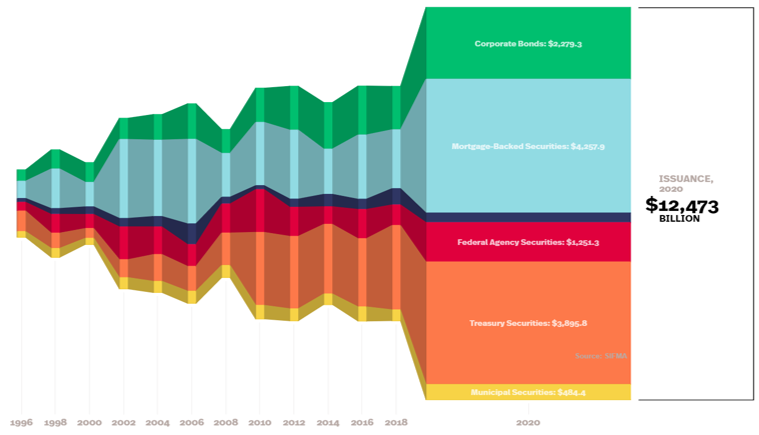

Just look at this chart showing U.S. debt issuance in 2020. You can see that it wasn’t just U.S. Treasury sales that ballooned last year. Corporate bond issuance exploded as well. So did sales of mortgage-backed and federal agency bonds.

|

| Source: SIFMA |

A lot of this borrowed money will find its way into the economy. A significant chunk will also flood into the markets. This will fuel near-term growth in corporate revenue and earnings and fund rampant speculation by individuals and institutions alike.

I saw this coming last year, which is why I’ve been recommending vehicles to help my subscribers prosper from it. I’m pleased to report the results have been great.

But I am not losing sight of the long-term costs to all this. Nor should you. Eventually, we’ll have to pay for this glorious ride.

And those costs will be much steeper than if the federal government and Corporate America chose the path of fiscal prudence.

In terms of an investing strategy, do what you can to rake in “Safe Money” profits now.

But be ready to take profits and to flip to a much more defensive posture. It’s going to happen, sooner or later.

Until next time,

Mike Larson