Reconciling the Epic Split Between Financial Markets and the Real World

|

There’s a great divide in America today. And I’m not talking about politics. I’m talking about the rift between the “real” economy and the “asset” economy.

Suppose you hadn’t been watching the financial markets closely, and I told you that unemployment is skyrocketing to almost 23% …

Economic deflation is the highest since the Great Recession …

Real estate prices are plummeting, along with public pension funds …

And S&P 500 company earnings are expected to plunge a whopping 19.7% in 2020.

Where would you guess that S&P would be? 2,500? 2,000? Lower?

Or how about the Dow Industrials? 20,000? 18,000? Maybe 15,000?

It sounds reasonable, no?

Especially given the dismal fundamentals, the ongoing virus fallout AND the unwinding of the massive corporate debt bubble.

But of course, those levels aren’t where the S&P or Dow are trading. The former was recently going for around 2,900, while the latter has been hovering around 24,000.

So, what accounts for the widest gulf between the “real economy” and the “asset economy” we’ve ever seen?

Faith.

Faith in the Federal Reserve.

Faith in Congress.

Faith in the president.

A faith ingrained in the hearts of a generation of investors that policy can “fix” anything that ails markets.

It’s understandable, at least on some level.

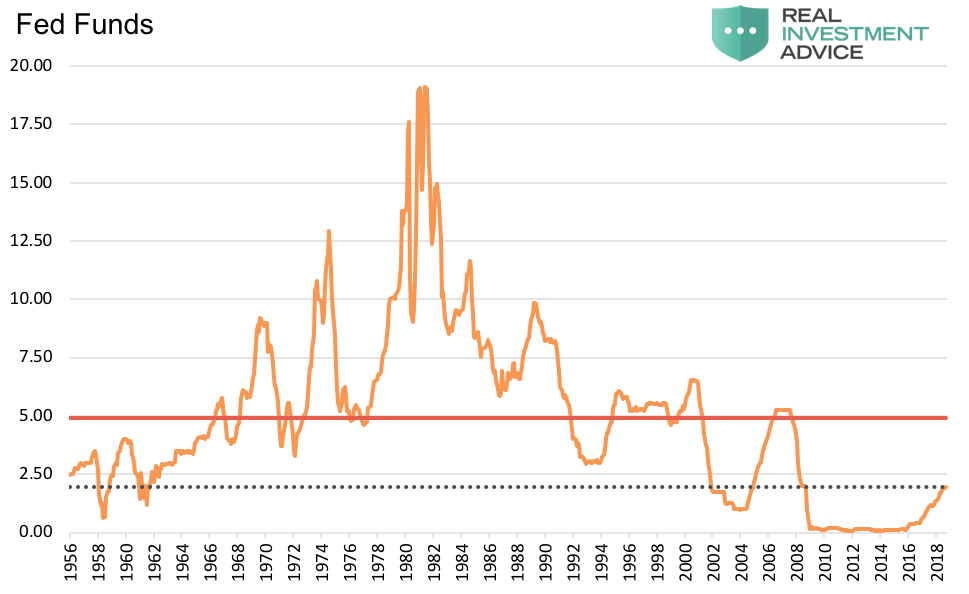

Every time markets have stumbled since the long bull run began in 2009, the Fed was there for investors: Round after round of QE. Ending its interest rate hiking cycle prematurely. Then cutting interest rates back to zero.

|

We saw it all in the last 11 years. And it appeared to work. After all, it “fixed” the market. But it didn’t. Not really. Instead of fueling strong growth in the real economy, it simply “propped up asset prices”.

And this “band-aid” approach hasn’t worked in the past, either.

The Fed acted aggressively to prevent the market downturns that began in 2000 and 2007 from turning into something worse. But it failed.

Two bear markets unfolded, ultimately lopping 50% and 57% off the S&P 500, respectively. It’s just that many investors have forgotten their market history ... or just chosen faith over facts.

Me? I like facts. I like data. I like learning from the past rather than ignoring it. So, I’m sticking with my time-tested, practical (and yes, very rewarding) “Safe Money” approach to this market.

I’m recommending a handful of top-notch, highly rated stocks and ETFs that have outperformed the market and should continue to do so.

I’m telling my subscribers to allocate a much greater amount of money to precious metals and related investments. I’m advocating prudent hedges and higher cash levels.

And most importantly, I’m urging them to be practical and realistic about what government and Fed policies can and will accomplish. If you would like to see the recommendations my subscribers are getting, including specific “Buy”/“Sell” recommendations, click here.

There’s nothing wrong with having hope and being optimistic about the much longer-term outlook for our nation — economically and otherwise.

It’s getting from here to there that will likely be very rocky — and potentially very dangerous to your wealth!

So, stick with this old adage to find the balance needed to cross this great economic divide: Hope for the best, but prepare for the worst.

Until next time,

Mike Larson