|

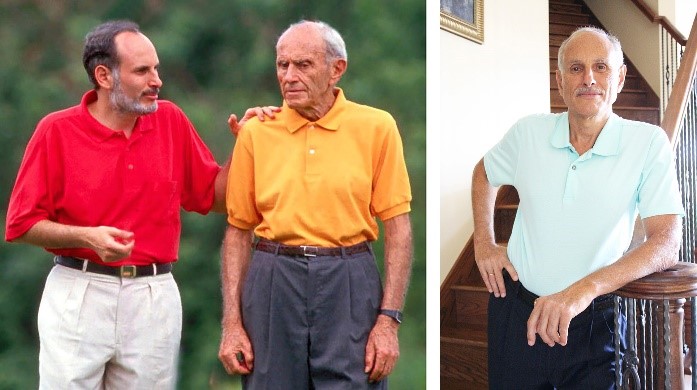

| Martin and Irving Weiss in 1980s. Right: Martin Weiss today. |

When I was in my 40s, my father and I used to talk frequently about America’s retirement crisis and the utter urgency of doing something about it.

Now, I’m almost as old as he was then.

Nothing has been done to fix the crisis.

And America’s retirement dream is now America’s retirement nightmare.

Every day of the year, approximately 10,000 baby boomers turn 65. And for the first time since Harry Truman was president, they’re in worse shape financially than the previous generation.

More than 19 million Americans can’t afford to retire at all.

Nearly half are nearing retirement age with less than $25,000 in savings.

One in four doesn’t even have $1,000.

And, one in five has nothing saved for retirement.

Corporate Pension Plans Deep in the Red

What about the millions of Americans who worked hard all their life and relied on defined-benefit pension plans provided by their employers?

They’re also in grave jeopardy.

U.S. pension funds now owe their members $2 trillion more than they can pay.

All over the country, they’re slashing payouts or even going bankrupt, as hundreds of thousands of retirees lose most or all their benefits.

And, adding insult to injury the government’s Pension Benefits Guarantee Corporation (PBGC), responsible for bailing out bankrupt pension plans, is itself deep in the red.

Its deficit is $51 billion.

Its exposure to future losses from underfunded plans is $185 billion.

And its progress toward fixing its problems is virtually zero, according to the latest report from the U.S. Government Accountability Office.

401(k) Disaster

The magic-bullet solution to this pension fund crisis was supposed to be 401(k) plans.

The idea was to do two things -- reduce employers’ responsibility for retirement savings and shift it to the employees themselves.

But it backfired.

Sure, the first part of the plan seems to have worked; participation in corporate pension plans has plunged by more than half. But the second part has been an abject failure …

For every dollar that Americans will need for their retirement, they have no more than 4 cents stashed away in their 401(k) plans.

Social Security:

Insolvent in 15 Years

Social Security was never more insecure.

Social Security Trustees themselves project that the trust funds will run out by 2035.

According to Committee for a Responsible Federal Budget, “That means the program will be insolvent when today’s 51-year-olds reach the retirement age and today’s youngest retirees turn 78. At that point, all beneficiaries will face a 20 percent across-the-board benefit cut, which will grow to 25 percent over time.”

And it’s not just a future problem. Right here in the 2020s, the Social Security program will run cash deficits of nearly $1.8 trillion.

What would it take to restore solvency?

If Congress acted today, they’d have to raise payroll taxes by 22 percent, slash benefits of new retirees by 20 percent, or some combination of both.

If Congress does nothing until 2035, it will be much worse. Then, it will be impossible to save Social Security without gutting the benefits of existing retirees.

The scariest part: All this is happening in what appears to be the best of times -- no debt crisis … no bank failures … unemployment at its lowest level in three generations … stocks making new all-time highs.

What will happen to America’s 74 million baby boomers in the next recession? What if it’s as bad as the Great Recession of 2008-'09? What if it’s worse?

What will happen to America’s 74 million baby boomers?

What about their children and grandchildren?

What about you?

And what should you do about it?

I will dedicate this year to helping you answer these questions.

And for starters, we have just announced the biggest income investing breakthrough of our 48 years in business.

Dad would be proud.

Good luck and God bless!

Martin