|

Grandparents are notorious for spoiling their grandchildren.

Now that I am a grandfather, I'd like to give my one grandchild, a beautiful granddaughter, something more meaningful than a Barbie doll and Cinderella dress as a gift. I'd rather give her a head start on her retirement.

|

I'm talking about something that will help secure her financial future. Specifically, I'm talking about a Roth IRA.

Roth IRAs are like traditional IRAs in that (a) your contribution is NOT tax-deductible like a traditional IRA, and (b) your money grows without taxation.

The key difference is that there is ZERO tax when you take money out of your Roth IRA. In short, zero tax while it grows and zero tax when you take it out!

Most minors, like my granddaughter, don't have regular jobs. But many do work odd jobs like mowing lawns, babysitting, raking leaves, shoveling snow, etc.

Of course, most children would sooner spend their money than save it. But as long as the child has an income, any parent, grandparent, aunt, uncle or any other adult who wants to give that child a financial head start can open and fund a Roth IRA.

Like a traditional IRA, the contribution amount cannot exceed the earnings in a given year. For example, if your child earned $1,000 mowing lawns last year, then they are eligible to contribute a maximum of $1,000 that year.

For 2019, the maximum contribution is $6,000.

|

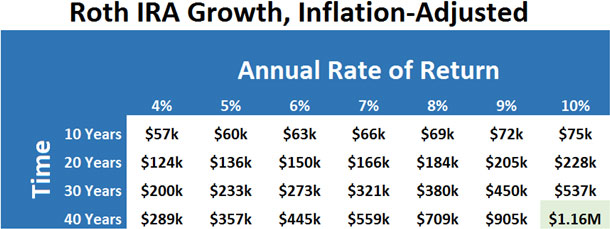

If you funded a Roth IRA for an 18-year-old for four years (and four years only) at the maximum $6,000, they could end up with more than $500,000 at 65 years of age. (That's assuming a 7% growth rate.)

What if the child needs the money before he or she turns 65, to pay for college or make a down payment on a house? Roth IRA works for that, too.

If you're younger than 59½ and you've owned a Roth IRA for less than five years ...

You'll owe income taxes and a 10% penalty if you withdraw earnings from your account unless you meet one of the following exceptions.

- You're withdrawing up to $10,000 to buy your first home.

- The withdrawal is for qualified education expenses (college).

- The withdrawal is for unreimbursed medical expenses in excess of 10% of your adjusted gross income for the year.

- The withdrawal is for health insurance premiums while you're unemployed.

- The withdrawal is due to disability.

To open a Roth IRA for a child or grandchild, you will need his or her name, address, date of birth and Social Security number, as well as the amount of their earned income.

Best wishes,

Tony