|

Is bigger better? When it comes to the business of bombs and bullets, it sure seems so.

Two companies that are far from household names, L3 Technologies (LLL, Rated "B") and Harris Corp. (HRS, Rated "B"), agreed to a merger of equals that will create the sixth-largest defense contractor in the U.S. with annual sales of around $16 billion.

While both sell to the Pentagon, they aren't the traditional bombs-and-bullets types of military contractors. Instead, they provide the high-tech equipment that the new, modern military needs today.

Harris makes highly secure communications systems for battlefield management, while L3 makes communications equipment such as surveillance gear, cockpit electronics, night-vision devices, sensor systems and satellite communications.

The new company, to be called L3 Harris Technologies, will be worth some $33.5 billion. L3 shareholders will get 1.3 shares of Harris for each share outstanding when the deal, pending a review by the Defense Department, closes sometime next year.

|

The have been a number of defense industry mergers recently. In the last 18 months:

- United Technologies (UTX, Rated "B") acquired Rockwell Collins for $30 billion.

- Aircraft-parts maker TransDigm Group (TDG, Rated "B") bought Extant Components Group for $525 million.

- Boeing (BA, Rated "B") bought aircraft components distributor KLX Inc.

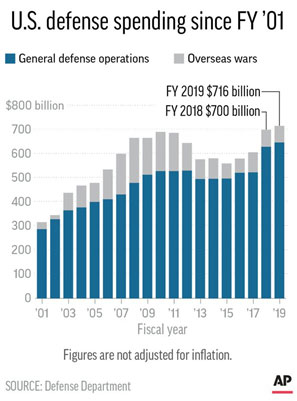

Part of that stems from the fact that defense spending under Donald Trump is rising. Congress passed a $674 billion military budget last month, including the largest pay increase to service members in 10 years.

That bigger budget will certainly translate into more business for the military industrial complex. But the most important change is the elimination of the cap on defense spending.

Under the "Budget Control Act of 2011," U.S. military spending was capped at $550 billion a year. But President Trump signed the "National Defense Authorization Act" into law in last December, and now the floodgates for future military spending are essentially wide open.

|

The U.S. isn't the only country spending record amounts on their military. Globally, military spending is at record levels.

That expectation of more and more military spending is behind this merger flurry, and I expect defense stock prices to go higher and higher.

Large-caps stocks like Lockheed Martin (LMT, Rated "C+"), Northrup Grumman (NOC, Rated "B"), Raytheon (RTN, Rated "A-"), Leidos (LDOS, Rated "B+"), General Dynamics (GD, Rated "B"), and Boeing are worthy of your consideration.

However, there are several small-cap defense contractors that look ripe for takeover and that also get solid Weiss Ratings. They include:

- Carpenter Technology (CRS, Rated "B"),

- Huntington Ingalls Industries (HII, Rated "B"), and

- Curtiss-Wright (CW, Rated "B").

If you're more of an ETF investor, takes a look at the iShares U.S. Aerospace & Defense ETF (ITA, Rated "B"), SPDR S&P Aerospace & Defense ETF (XAR, Rated "B") and Invesco Aerospace & Defense ETF (PPA, Rated "B").

Defense stocks have been on a roll ever since 9/11, and that terror attack redefined the priority that our country has placed on military strength. Heck, neither Republicans nor Democrats can afford to appear anti-military and I haven't heard a whisper (except from Bernie Sanders) about cutting military spending.

That means more military spending for as far as the eye can see, and bigger profits for the defense food chain — especially for the military technology segment.

Best wishes,

Tony