The Building Backlash of America’s Economically Forgotten

I was raised on a vegetable farm near Tacoma, Wash., and attended the University of Washington. And even though I moved to Asia years ago, my brother, sister, daughter and my precious 8-month-old granddaughter live in Seattle, so I still feel a close connection with the Pacific Northwest.

Seattle, like most of America, has changed since my childhood. I have to say that Seattle has transformed itself to one of the most liberal (or progressive, if you prefer that term) cities in America.

How liberal? The city of Seattle elected Kshama Sawant, an open Socialist, to its already very progressive City Council.

That City Council just passed a controversial “head” tax on big businesses — like Amazon.com (AMZN, Rated “B-”) and Starbucks (SBUX, Rated “B”) — to pay for the city’s growing homelessness and fund affordable housing programs.

|

The tax, which passed unanimously, will cost all Seattle-based businesses with more than $20 million in annual revenues an extra $275 per employee. The tax is projected to bring the city about $45 million of new annual revenue.

The plan proposes spending about two-thirds of the new revenue on affordable housing and the remaining on emergency shelter, sanitation, services for people living in their cars, medical services, and wage stabilization (whatever that is) for homelessness service providers.

Now, $45 million a year (of which Amazon is expected to pay about $10 million) is a lot of money. But a City Council-appointed task force puts the annual costs at $164 million to $214 million a year.

Note: Washington state does not have an income tax. In fact, its constitution prohibits taxing income or wealth, so this head tax is a clever way to bypass the income/wealth tax prohibition.

Opinions vary on the wisdom of this tax, but I see several negative consequences:

• Some people believe that large businesses should help pay for serious social problems, like homelessness. But that’s not what big corporations are accustomed to. Heck, big corporations are accustomed to sticking their hands out for tax breaks, not extra taxes.

• A goal of government should be to encourage, not penalize, employment. Tax policy is pretty simple: Tax things you want to discourage and don’t tax things that you want to encourage.

• Entry-level jobs will be the most affected. That $275 is peanuts compared to the salary of, say, a software programmer. But it’s more meaningful for a janitor or clerical worker. I forecast that big Seattle companies will outsource entry-level jobs to small, outside contractors who aren’t subject to the head tax.

• One of the roots of the homelessness problem is overly restrictive zoning policy. I used to be a member of a zoning board in Montana and every time a high-density, affordable housing project was submitted, the anti-growth crowd would flood the zoning meetings to protest the project. My experience was that anything other than million-dollar, luxury log homes with 5-plus acres was met with fierce opposition.

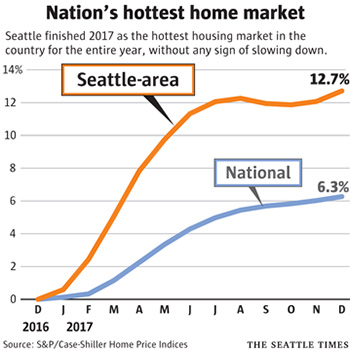

|

|

Click image for a larger view. |

Overall, Seattle real estate is getting so expensive that the average family — let alone the poor and working poor — are getting priced out of the market.

In Seattle’s King County, the annual household survival budget for a family of four in 2016 was nearly $85,000, which would require an hourly wage of $42.46. However, only 14% of jobs pay more than $40 an hour in Washington state.

And that is against a backdrop of extremely strong job growth. The national unemployment rate dropped to a prosperous 3.9% last month. But it dropped even lower in Washington — to only 2.9%.

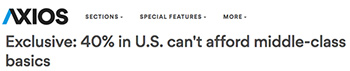

Despite those extremely strong jobs numbers, the American dream is slipping away for millions of Americans. A new study from the United Way found that more than 40% of U.S. households — 34.7 million households — cannot afford the basics of a middle-class lifestyle: Rent, transportation, child care and food.

|

|

Click image for full article. |

The number of what United Way calls the “economically forgotten” is growing despite the improving economy. This group lies between poverty and the middle class, and has been dubbed “ALICE” families, for “Asset-Limited, Income-Constrained, Employed”.

When you add those 34.7 million “ALICE” households with people living in poverty, you get 51 million households. It's a magnitude of financial hardship that we haven't been able to capture until now.

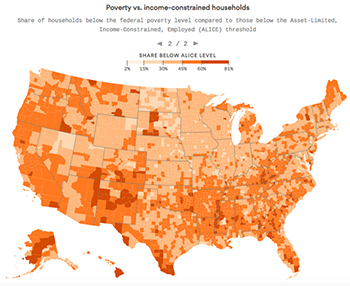

Guess where the economically forgotten people live? The majority of these “ALICE” households live in America’s largest cities.

|

|

Click image for a larger view. |

North Dakota has the smallest population of combined poor and ALICE families, at 32% of its households. The largest is 49%, in California, Hawaii and New Mexico. Frankly, 49% is shocking. That's almost half their population!

And this is happening at a time when corporate profits are soaring — up by a staggering 26% on a year-over-year basis in the first quarter of this year — and when the stock market has been enjoying a nine-year bull market run.

What does all this mean for investors? Social angst and economic frustration is getting worse and worse. That’s not a healthy situation for our country and paper assets.

Last week, I urged you to consider adding both physical gold and digital gold (cryptocurrencies) to your portfolio. When things go haywire, those two assets and cash will be your most valuable assets. Make sure you own all three.

Best wishes,

Tony Sagami

P.S. How do you feel about this alarming new environment? What worries you most right now? What are your greatest wealth-building challenges today? Click this link and leave a comment with your answer on the Weiss Ratings blog.