|

The Fed is printing money with reckless abandon.

Congress just passed a $1.9-trillion stimulus package on top of trillions spent last year.

Another $2-trillion infrastructure behemoth is now on the way.

The national debt just hit $28.118 trillion.

What’s more, inflation is raising its ugly head for the first time in years.

So, it doesn’t take rocket science to figure out that the next giant wave of flight capital will be from those who have the most to lose into the asset class that has the most to gain.

The Biggest Source of Flight Capital Is

BOND INVESTORS

Invariably and inevitably, the first victims of inflation are bond investors.

After subtracting inflation, their fixed yields plummet to zero and far BELOW zero.

The market value of their bonds sinks.

Bondholders panic, dump their bonds and drive bond prices into an even deeper death spiral.

Traditionally, they’d move some percentage of their money to gold, and they will probably do the same again. But this time …

The Most Popular Destination

of Flight Capital Is

BITCOIN AND DEFI

This is not just a forecast. It’s already happening.

While gold bullion is down 9.5% this year, Bitcoin, a kind of “digital gold,” is up 101% in the same period.

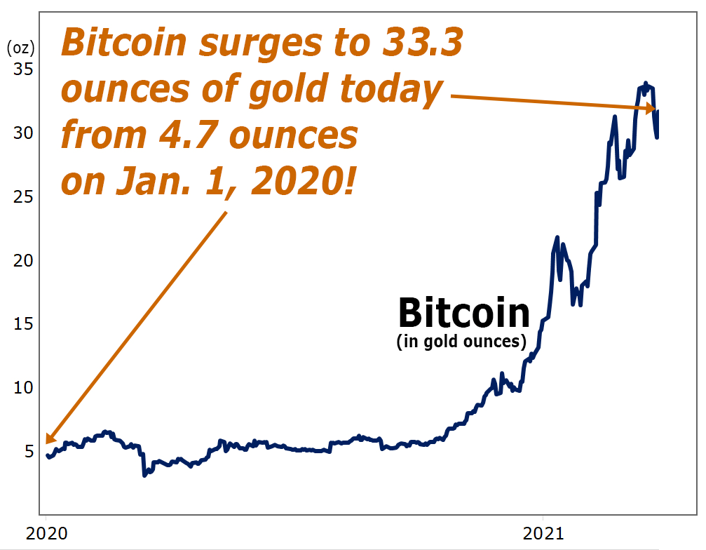

And since Jan. 1, 2020, Bitcoin has risen nearly SEVEN times more than gold. Just look at this chart …

|

On Jan. 1, 2020, Bitcoin was worth 4.7 ounces of gold.

Now, it’s worth 33.3 ounces!

You could still make a lot of money in gold, to be sure. But more so than ever before, inflation-fearing investors prefer Bitcoin over bullion.

It’s easier to buy. It costs nothing to store. It’s a heck of a lot easier to “transport.” And its supplies are irrevocably capped.

So let’s look at the numbers …

All of the world’s bonds add up to $100 trillion.

All of the world’s gold is worth about $10 trillion.

And the total market cap of Bitcoin is about $1 trillion.

So …

If just 1% of the capital now sitting in bonds moves to gold, we will see $1 trillion in new gold demand chasing $10 trillion in existing gold supply. That could certainly drive gold prices substantially higher.

But if we see $1 trillion in new Bitcoin demand chasing the much smaller $1 trillion in existing Bitcoin supplies, it could up Bitcoin prices 10 times more.

And if bond investors PREFER Bitcoin over gold, even this estimate could be understated.

Our recommendations:

First, if you own long-term bonds, head for the exits before the crowd.

Second, if you like gold, continue to hold and accumulate.

Third, to go for gains that could be many times greater than gold’s, seriously consider Bitcoin.

Fourth, best of all, take a close look at the fastest-growing sector of the crypto world — decentralized finance (DeFi).

Just in the last 12 months, it has grown more than 4,000%. And one of our favorite DeFi cryptos has risen as much as 125,000%.

So hold your hat. This could be one heck of a ride.

Good luck and God bless!

Martin